project in the North Sea. Image via Gassnova

by George Hay (Reuters) – If offshore wind and solar power are zero-carbon energy’s ESG golden boys, carbon capture is its problem child. Climate activists often see the process of removing the pollutant from fossil fuel emissions as an expensive and untested way for oil majors to stick to business as usual. That’s about to change, and in a way that will interest investors.

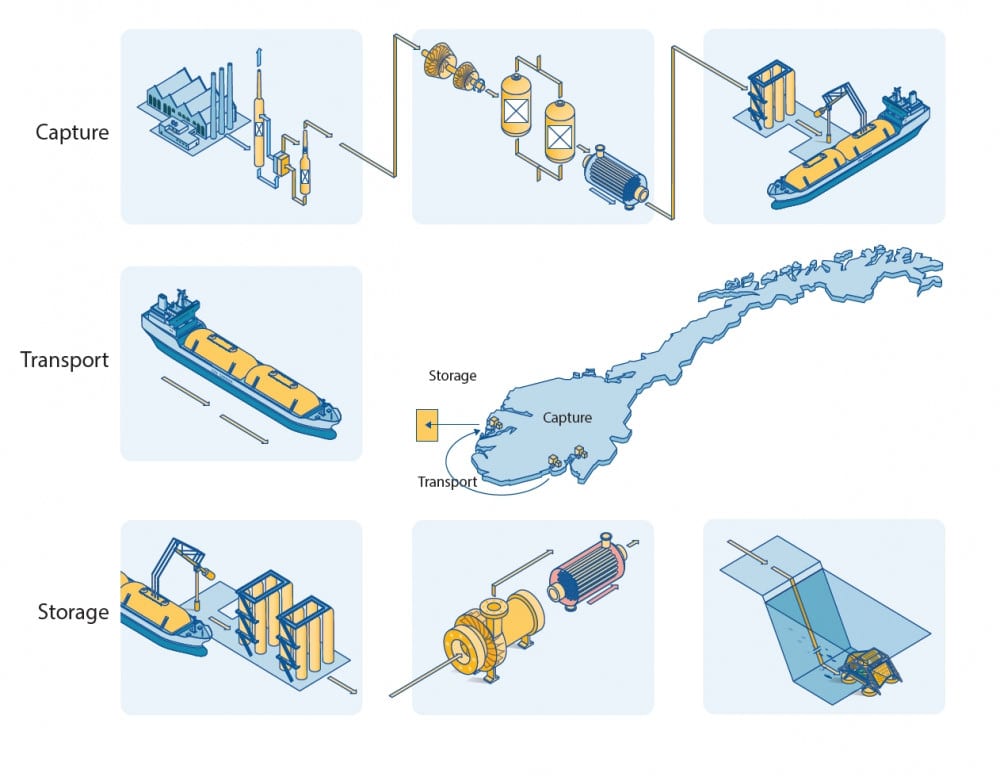

CCUS – carbon capture, utilization and storage – is a catch-all term for technologies that remove carbon dioxide produced when generating power, by heavy industries, or, less frequently, from the air itself. Once the CO2 is removed it can be used as an input to assist other industrial processes, or compressed and stored in a suitably secure venue. CCUS is increasingly seen as a way to help eliminate today’s 35 gigatonnes of global carbon emissions by 2050, thus creating a chance of limiting global warming to no more than 1.5 degrees Celsius above pre-industrial era temperatures.

Attention usually focuses on wind turbine and solar panel installation, rather than CCUS. That’s fair enough. A massive increase in capacity is needed if they are to generate the majority of global electricity by mid-century. But one-fifth of carbon emissions come from heavy industrial processes like steel and cement, which are much harder to decarbonise using wind or solar-powered electricity.

That’s why forecasters pencil in a massively expanded role for CCUS. To hit 2050 targets, the International Energy Agency estimates the volume of carbon captured every year will have to jump 200-fold, to 8 gigatonnes from 40 million tonnes currently. The Energy Transitions Commission, a think tank chaired by former UK financial regulator Adair Turner, estimates governments and companies need to spend $5 trillion by 2050 to create sufficient capacity for all this carbon removal.

The IEA identifies 16 big projects around the world representing $27 billion of investment which are at the advanced planning stage, and which could double carbon storage capacity to around 80 million tonnes. But it’s difficult to move faster. Major emitters still lack a strong enough economic incentive to capture carbon – few countries tax it yet, and the European emissions trading scheme’s carbon allowances trade at around $30 a tonne. That doesn’t cover the cost of the infrastructure to remove the carbon in the first place, nor the need to find suitable places to store it. Right now, that’s a deterrent for the private sector.

Norway’s $2.7 billion Longship project, which was unveiled in September, reflects that reality. The project will remove carbon from a domestic cement and potentially also a waste treatment plant, ship it in condensed form to Bergen on the country’s west coast, and then pipe it to a storage facility 2,600 metres beneath the North Sea seabed. The catch: according to Citi, the cost exceeds $100 per tonne of carbon stored, far above prevailing carbon prices. That’s one reason why Equinor, Total, and Royal Dutch Shell, are only putting up a third of the cost of the venture, while the government is financing the rest. Norway’s opposition Progress Party is trying to block the scheme.

Yet there are good reasons why Longship can and should happen. Oil major BP reckons developed market carbon prices will rise to $100 a tonne by 2030, which would start to make the projects commercially viable. The storage capacity of the Longship project could be 100 million tonnes, meaning plenty of room will be left over after catering for the 800,000 tonnes of annual emissions from the two Norwegian plants. That space could be used by selling it to carbon emitters from other sectors and countries, according to Nils Rokke, executive vice president for sustainability at SINTEF, Scandinavia’s largest research and development institute.

This presents a potential opportunity for the private sector. Canadian pension funds and Gulf sovereign wealth funds love industries that generate a steady stream of income. That’s why they own much of the UK’s current energy network infrastructure. If a carbon-capture plant charged heavy-emitting clients from around Europe a toll to deposit their carbon under the sea, such investors might have an interest in acquiring government stakes or supporting new projects.

The United States and European Union already offer incentives for CCUS development. But the United Kingdom, keen to flex its carbon-cutting credentials before it hosts the COP26 climate conference next year, could be the next to make a Norway-style move. It has a slew of depleted North Sea oil wells that could serve as carbon stores. Supporting projects such as the Acorn carbon capture plant would be a way to meet decarbonization targets and fashion a new export industry. If governments make the first move, a wall of green finance could follow.

by George Hay, Reuters

Join The Club

Join The Club