By Ed McNamara, CEO of Cleveland-based port insurance broker Armada Risk Partners —

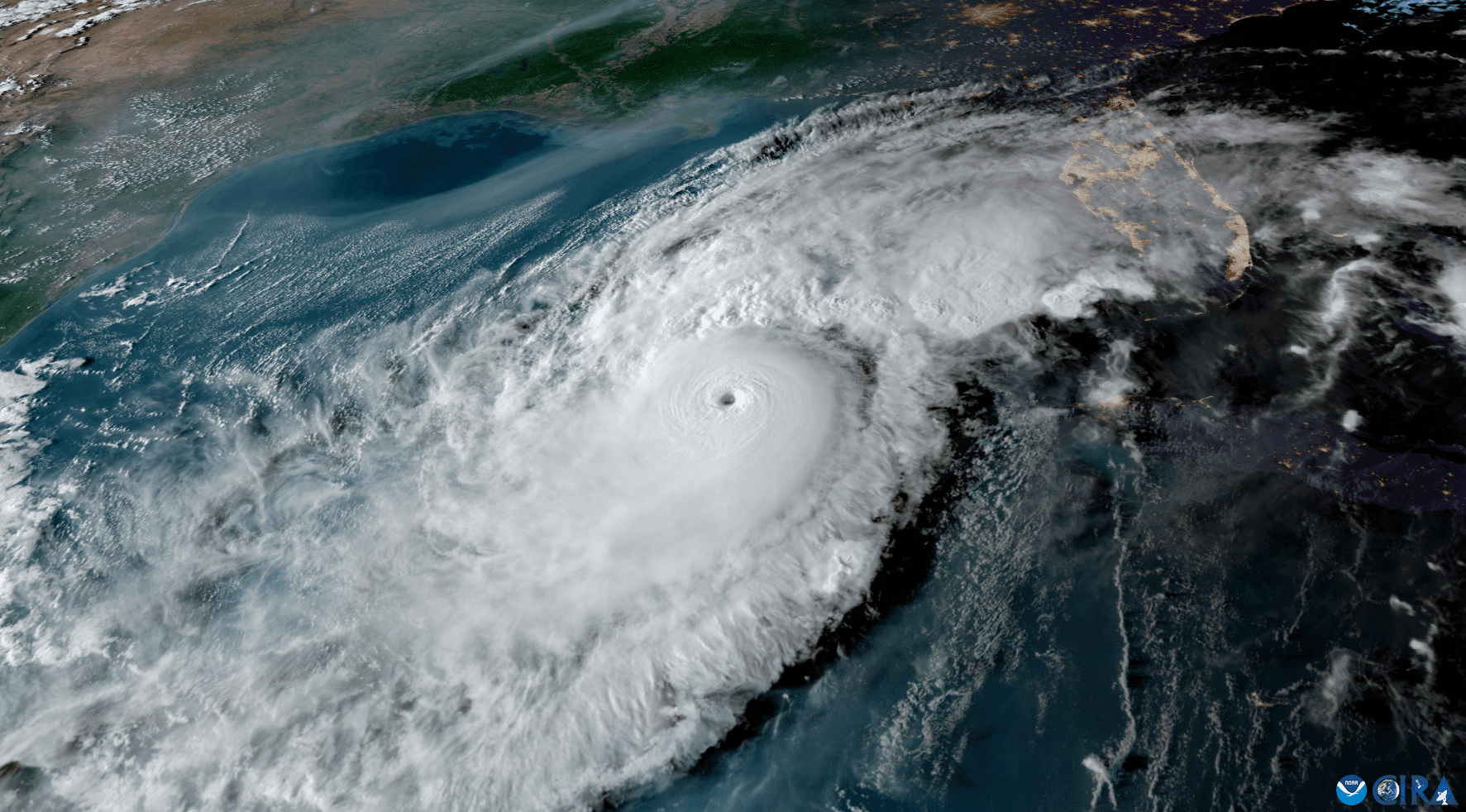

The 2025 Atlantic hurricane season is shaping up to pose increasingly serious threats to shipping, coastal ports, and surrounding areas.

With climate experts warning that extreme weather could surpass that of recent seasons which saw widespread damage from multiple high-intensity hurricanes, the resilience of ports and their ability to protect employees, assets, and operations will be sorely tested.

Ports in the Caribbean, Gulf Coast, and Eastern seaboard are on the frontline of risk, and comprehensive marine insurance coverage will be critical to ensuring they are not exposed to massive disruption from severe damage or prolonged port blockage.

When you look at the real and increasing risks from extreme weather because of climate change, ports need to ensure they have the proper insurance in place to be able to take immediate action and restore operations as quickly as possible

Read: NOAA Expects Busier-Than-Normal Hurricane Season

There is so much that can, and does, go wrong in ports when extreme weather hits. The lives of employees are at risk, assets can be severely damaged, and ports can end up with a total blockage. It is imperative that operators regularly – and rigorously – check their insurance coverage so that they are adequately protected and have control of the recovery operation.

The threats are real. Hurricane researchers at Colorado State University (CSU) have released projections that are among the highest they have ever issued prior to the annual season, which officially runs from June 1 to November 30.

CSU’s April outlook predicts 17 named storms with nine hurricanes, of which four are expected to become Category 3 or higher. This level of storm activity is about 125 percent above the average for the past 30 years. And there is a 51 percent chance that a major hurricane will strike the United States, compared to the historical average of 43 percent.

CSU’s projections are mirrored by AccuWeather, which is similarly forecasting 13 to 18 named storms with seven to 10 hurricanes. Both agree that climate conditions are favorable for the development of high-intensity cyclones, placing ports, commercial shipping, and offshore facilities at serious risk.

We saw in 2024 that the threat is widening as changing atmospheric patterns lead storms into historically lower-risk areas. And when a number of hurricanes hit in quick succession, response teams can be overwhelmed and rescue efforts hampered.

Hurricane Francine severely impacted Gulf Coast ports last September, leading to the shutdown of major energy ports, disrupting about 1.5 million barrels of oil production and sparking a 2 percent increase in crude oil prices.

Also in September, Hurricane Helene struck Florida. Port Condition Zulu was declared at several ports, including Tampa, Canaveral, and SeaPort Manatee. Vessel traffic and cruise operations were suspended, disrupting cargo operations and cruise schedules with substantial financial losses for both the ports and shipping companies.

Two months earlier, Hurricane Beryl closed numerous ports along the Texas coast, including Houston, Corpus Christi, and Brownsville, leading to disruption of logistics and supply chains that rippled across various industries.

All of this underscores the need to take control of the situation with the right insurance coverage. For example, relying on the government to come and unblock your port when they have no spare capacity to help is a dangerous strategy, as we saw in 2024.

In light of these escalating risks and the stark warnings from hurricane forecasters, I would strongly advise maritime operators, particularly port authorities and shipping companies, to proactively review their insurance coverage. Key areas of focus should include:

- Business Interruption Coverage: Ensure your policies adequately cover both revenue losses from port closures or operational disruptions and the cost of restoring operations as quickly as possible

- Port Blockage Insurance: Consider coverage for losses due to vessels being unable to access or leave ports

- Liability Coverage: Make sure that liability limits are sufficient to cover potential third-party claims for injury or property damage resulting from hurricane-related incidents

- Supply Chain Disruption Clauses: Shipping lines should examine their policies for clauses addressing disruptions to the wider supply chain caused by extreme weather

- Named Windstorm Deductibles: Understand the specific deductibles that apply to hurricane-related damage.

Only by taking a proactive and rigorous approach to insurance coverage, can everyone in the maritime industry better navigate the real and increasing threats from the Atlantic hurricane season and ensure greater resilience in the face of extreme weather.

Join The Club

Join The Club