Image (c) Rob Almeida/gCaptain

By Rujun Shen

By Rujun Shen

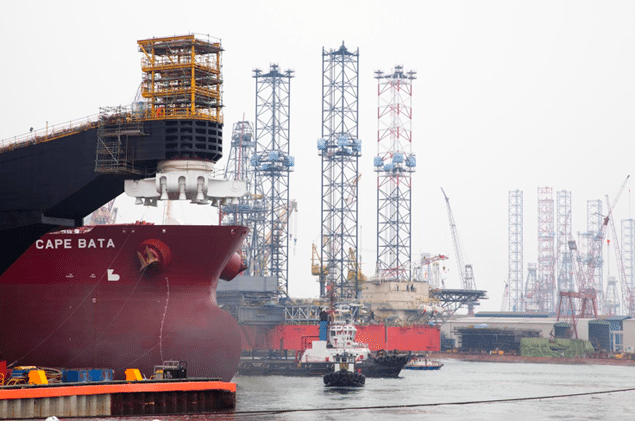

SINGAPORE, Jan 23 (Reuters) – Singapore’s Keppel Corp Ltd , the world’s top offshore drilling rig builder, boasts an $11 billion order book that will likely lift profits this year as those rigs start to take shape.

There is one order that isn’t on the books: the company’s first drillship – designed to probe for oil and gas in deep water – which Keppel is building before even landing a customer. With a likely price tag above $500 million, it’s a big bet that demand is hot enough to warrant the speculative risk, and a challenge to South Korean rivals who dominate this segment.

Keppel’s forte is jackup rigs – mobile platforms on extendable legs – which are made for shallower water up to about 500 feet (152 meters). Drillships can operate in water as deep as 12,000 feet.

Deepwater projects accounted for 44 percent of global spending on offshore oil and gas field development last year, and that’s expected to rise to more than 54 percent by 2018, according to Infield Systems, an energy research firm.

Consultancy Douglas Westwood forecasts global spending on offshore oil and gas exploration and production will grow 15 percent this year to $135 billion, and hit $164 billion in 2016.

Two of Keppel’s big South Korean rivals, Samsung Heavy Industries Co Ltd and Daewoo Shipbuilding & Marine Engineering Co Ltd, have started building jackup rigs, prompting Keppel to test out deeper waters.

“After Samsung and Daewoo broke into the jackup market, Keppel is trying to hit back and show they can break into the drillship market and have the ability to compete with the South Korean yards,” said James Hearn, an Infield analyst.

An official at a Korean shipbuilder that also makes drillships said: “Keppel has long experience in rigs and semis (semi-submersible rigs) and has good relationships with drilling firms. It has no track record yet, but could make its mark in drillships over time.” The official didn’t want to be named as he was not authorised to speak to the media.

IMPROVING MARGINS

Keppel took home orders worth about S$7 billion ($5.5 billion) in 2013 – primarily for jackup rigs – pushing its total outstanding orders to a record S$13.6 billion at end-September, and raising hopes that profits will rebound this year. Booked orders start earning revenue once they are one fifth completed.

Full-year results from Keppel, more than a fifth owned by state investor Temasek Holdings, are expected to show net profit dropped 21 percent last year to S$1.51 billion from a record S$1.91 billion in 2012, when it reported a surge in sales in its property division. The results are due later on Thursday.

But 2014 earnings will likely rebound as some of the rigs on the order book start to contribute profit. Also, margins are expected to improve as Keppel gets more efficient in building rigs of its own design. A Reuters poll shows analysts expect 2014 net profit to rise 6 percent to S$1.6 billion.

“In Keppel’s case, the backlog is impressive because a large majority of the contracts are repeat orders of its proprietary design, which we can expect them to deliver a good margin on,” said Clement Chen, a Barclays analyst. “Given the strong contract momentum in 2013, it should translate into good margins and profitability in 2014-16, as these contracts are delivered.”

SOMETHING NEW

South Korea’s rig builders are known for aggressively pursuing orders, even at the expense of lower profit margins.

For the 2013 third quarter, Samsung Heavy, which generates almost all its revenue from shipbuilding, posted an operating margin of 5.8 percent, compared with the 16.5 percent operating margin at Keppel’s offshore and marine division.

Keppel declined to comment on its drillship ambition and referred to a press release issued last month in which Chow Yew Yuen, head of Keppel Offshore & Marine, said Keppel was offering a differentiated design. “Since the launch of our design earlier this year, we have received a very encouraging response from the market, and we have decided to start constructing the first drillship to this design,” he said then.

Keppel hopes that enhancements such as the integration of high-capacity blowout preventers (BOPs) – safety valves designed to avert deepwater disasters like the 2010 Gulf of Mexico oil spill – will appeal to customers looking beyond the standard drillships that Korean yards offer, brokers said.

Keppel’s drillship can handle BOPs designed to withstand pressure of up to 20,000 pounds per square inch, which is above the 15,000 psi of BOPs installed on new drillships today and double the capacity on the majority of units in operation now.

AND THEN THERE’S CHINA

In recent years, Keppel and crosstown rival Sembcorp Marine Ltd have seen their dominance in the jackup market chipped away by mainly Chinese shipyards, who have turned to rig building as demand for container ships, dry bulk carriers and oil tankers remains depressed.

As of mid-December, Chinese yards had won 38 of the 78 jackup orders placed globally in 2013, ahead of Singapore’s 30. Among the 131 jackups under construction around the world, 61 were at Chinese yards and 47 in Singapore, data from IHS shows.

Even Korean yards that usually build drillships won 3 jackup rig orders in 2013, after exiting that segment decades ago.

Keppel isn’t alone in chasing the rising interest in deepwater rigs.

A number of Chinese yards, after some missteps in the early days of building jackups, are becoming more reputable contenders. Armed with an improving track record, low prices and appealing payment terms, they are eyeing the drillship market.

Last week, Yantai CIMC Raffles Ltd, one of China’s biggest rig builders, won an order from Norway’s Norshore Holdings AS to build a small-sized drillship. Norshore has the option to build three similar ones.

“Keppel has a reputation, and no one would worry about that,” said a Singapore-based offshore broker. “But the fact is they’ve got no one ordering a drillship yet. Buyers wouldn’t say that that’s because they don’t believe in the quality of Keppel. It would be because of commercial reasons.”

($1 = 1.2759 Singapore dollars) (Additional reporting by Joyce Lee in SEOUL; Editing by Emily Kaiser and Ian Geoghegan)

Join The Club

Join The Club