Major Cocaine Bust: UK Border Force Seizes Record Shipment at London Gateway

In one of the UK’s largest drug seizures of the past decade, UK Border Force officers have seized cocaine with an estimated street value of £96 million (USD 130 million)...

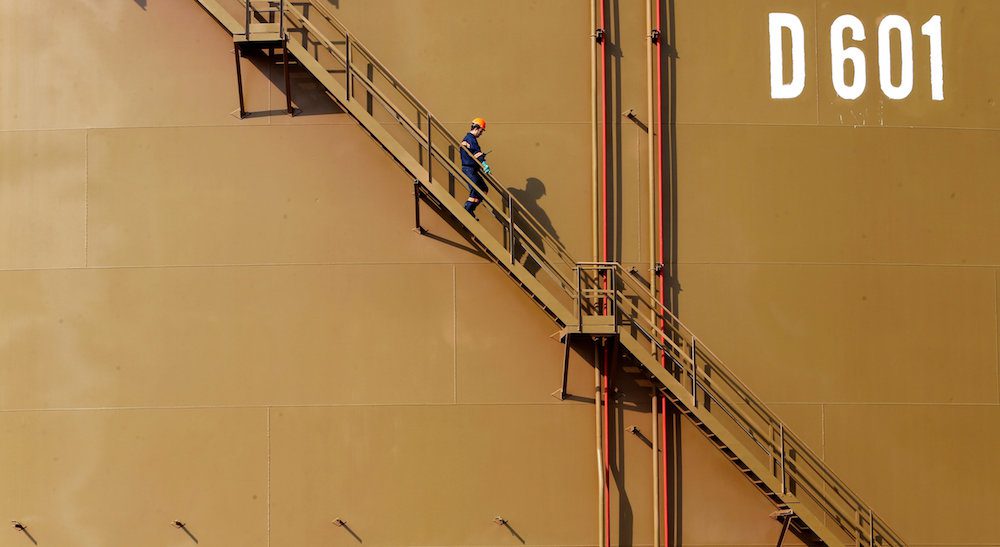

REUTERS/Umit Bektas/File Photo

![]() By Amanda Cooper

By Amanda Cooper

LONDON, Nov 10 (Reuters) – The oil market surplus may run into a third year in 2017 without an output cut from OPEC, while escalating production from exporters around the globe could lead to relentless supply growth, the International Energy Agency said on Thursday.

In its monthly oil market report, the group said global supply rose by 800,000 barrels per day in October to 97.8 million bpd, led by record OPEC output and rising production from non-OPEC members such as Russia, Brazil, Canada and Kazakhstan.

The Paris-based IEA kept its demand growth forecast for 2016 at 1.2 million bpd and expects consumption to increase at the same pace next year, having gradually slowed from a five-year peak of 1.8 million bpd in 2015.

The Organization of the Petroleum Exporting Countries meets at the end of November to discuss a proposed cut in production to a range of 32.5 to 33 million bpd, but discord among members over exemptions and production levels has raised doubt over OPEC’s ability to deliver a meaningful reduction.

“Whatever the outcome, the Vienna meeting will have a major impact on the eventual – and oft-postponed – rebalancing of the oil market,” the IEA said.

“If no agreement is reached and some individual members continue to expand their production then the market will remain in surplus throughout the year, with little prospect of oil prices rising significantly higher. Indeed, if the supply surplus persists in 2017 there must be some risk of prices falling back.”

Oil prices have risen to around $46 a barrel from near 13-year lows in January around $27, but are still 60 percent below where they were in mid-2014, when the extent of the surplus became apparent.

The IEA said it expects non-OPEC production to grow at a rate of 500,000 bpd next year, compared with a 900,000-bpd decline this year, meaning 2017 could see inventories building again if there is no cut from OPEC.

Supply outpaced demand by as much as 2 million bpd earlier this year and this excess appeared to have all but vanished during the third quarter of 2016.

However, OPEC pumping oil at a record rate of 33.83 million bpd last month, along with increases in production from non-OPEC rivals such as Russia, Canada and even the North Sea, threatens to reverse this rebalancing.

“This means that 2017 could be another year of relentless global supply growth similar to that seen in 2016,” the IEA said.

Furthermore, slower global economic growth and more modest demand in previous consumption hot spots such as India and China mean overall demand for oil will likely not pick up next year, the IEA said.

“There is currently little evidence to suggest that economic activity is sufficiently robust to deliver higher oil demand growth, and any stimulus that might have been provided at the end of 2015 and in the early part of 2016 when crude oil prices fell below $30 a barrel is now in the past,” the agency said. (Reporting by Amanda Cooper; Editing by Dale Hudson)

(c) Copyright Thomson Reuters 2016.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up