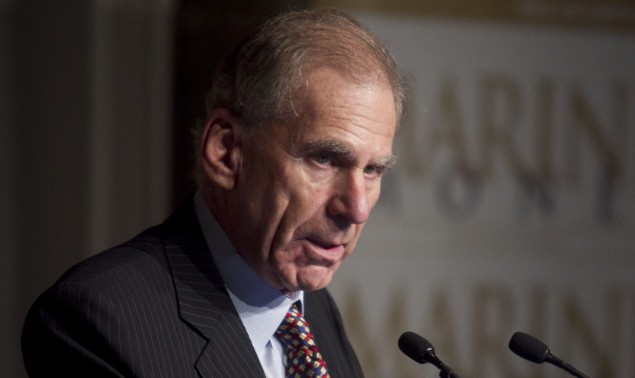

Charles Fabrikant, Executive Chairman, Seacor Holdings, image (c) Marine Money

NEW YORK, March 24 (Reuters) – Shares of cargo ship operator Seacor Holdings could climb as oil drilling in the Gulf of Mexico picks up, according to a report in Barron’s weekly financial newspaper.

NEW YORK, March 24 (Reuters) – Shares of cargo ship operator Seacor Holdings could climb as oil drilling in the Gulf of Mexico picks up, according to a report in Barron’s weekly financial newspaper.

Gulf drilling, which was sharply cut back after the BP 2010 spill, has been coming back, with exploration outfits deploying an increasing amount of rigs, the report in the March 25 edition said.

Seacor, which also operates work boats for oil rigs, could boost revenue from offshore marine business by 20 percent, resulting in a big boost to earnings, the article said.

What’s more, the stock often trades at a 25 percent premium to book value, but at its current price, the stock is about 20 percent below that value, which some investors see as a buy signal, the report said.

The stock closed at $71.83 on Friday.

(c) 2013 Thomson Reuters, Click For Restrictions

Join The Club

Join The Club