(Bloomberg) — China is using the most supertankers in five months to meet record demand for oil imports, diminishing a glut of shipping capacity and returning John Fredriksen’s Frontline 2012 Ltd. to profit.

The number of carriers bound for Chinese ports rose 32 percent since August, according to ship-tracking data compiled by Bloomberg. Monthly imports averaged an all-time high of 22.26 million metric tons this year, customs data show. Shares of Frontline 2012, formed in December by the richest shipping investor, will gain 36 percent within 12 months, according to the average of six analyst estimates compiled by Bloomberg.

Rising oil shipments add to signs that China’s growth is accelerating, after slowing for seven quarters. Freight swaps used by traders to bet on future shipping costs indicate December will give owners the best returns since May. Rates have been unprofitable almost every day since June, according to data from the Baltic Exchange, the London-based publisher of freight prices on more than 50 maritime routes.

“It’s been a tough year, but Chinese crude demand is finally boosting rates,” said Simon Newman, the London-based head of tanker research at ICAP Shipping International Ltd., a unit of the world’s biggest broker of transactions between banks. “China is one of the few countries that can influence demand at short notice.”

Fuel Costs

Rates climbed yesterday to $28,265 a day, the highest level in almost six months. They were negative in all but 10 sessions starting July 5, according to the Baltic Exchange, which means owners have to contribute to fuel costs. Freight swaps anticipate returns will advance to $21,918 in December, the highest monthly average since May, data from Marex Spectron Group show.

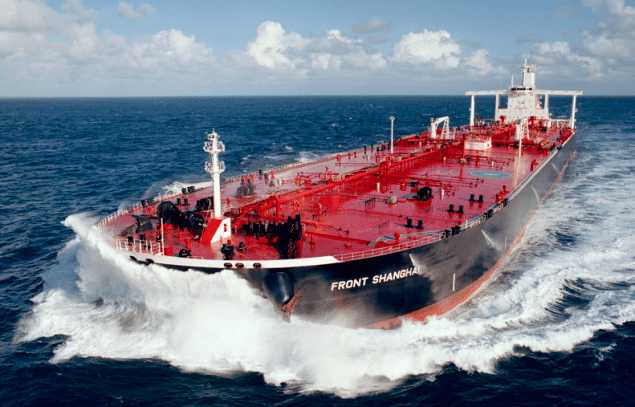

Shares of Frontline 2012 rose 40 percent to 25.25 kroner in Oslo this year and will reach 34.28 kroner within 12 months, the analysts’ estimates show. The Hamilton, Bermuda-based company’s six very large crude carriers, each holding 2 million barrels of oil, mostly compete for single-voyage charters and benefit when spot rates jump, said Bjorn Kristian Roed, an analyst at Danske Markets in Copenhagen.

Frontline 2012 was created with ships and orders for new vessels bought from Frontline Ltd., in which Fredriksen is also the largest shareholder. The billionaire split the company after it lost $529.6 million last year and said it risked running out of cash after the worst rout in rates in more than a decade. That’s allowing him to reap gains as rates rebound.

OSG Filing

Not all owners have endured the slump. Overseas Shipholding Group Inc., the New York-based tanker owner with 111 ships in its fleet, filed for Chapter 11 bankruptcy protection on Nov. 14. General Maritime Corp., the second-biggest U.S. owner, did the same a year ago. The VLCC fleet expanded three times faster than trade since 2008 and companies added the most new vessels since the 1980s, data from Clarkson Plc show.

Tankers trading on the Saudi Arabia-to-Japan route, the benchmark voyage for settling freight swaps, earned an average of $10,459 a day since the start of this year, Baltic Exchange data show. They need $10,670 to cover crew, insurance, repairs and other running costs, according to data from Moore Stephens LLP, a London-based consultant that tracks the industry’s expenses.

While shipments to China are growing, those to the U.S. are contracting because domestic oil production is running at its highest since 1998. The world’s largest crude buyer imported an average of 8.7 million barrels a day this year, the least since 1999, according to U.S. Energy Department data.

European Recession

Europe, which accounts for about 16 percent of oil demand, entered its second recession in four years as governments imposed tougher budget cuts. Gross domestic product in the 17- nation euro area will fall 0.1 percent in the fourth quarter after a 0.2 percent decline in the previous three months.

Other vessel classes are also contending with gluts. The Baltic Dry Index, a measure of costs across four types of vessels hauling coal and iron ore, fell 35 percent since the start of January. A gauge reflecting charges for six types of containers slid 16 percent in the past year, data from the Hamburg Shipbrokers’ Association show.

Frontline 2012 will report a net profit of 10.4 million kroner ($1.8 million) for the first three months of 2013, according to the mean of three analyst estimates compiled by Bloomberg. The company is expected to have a net loss of 4.56 million kroner in the current quarter.

Energy Consumption

Europe’s biggest VLCC owner is Antwerp, Belgium-based Euronav NV. Its shares advanced 19 percent to 4.50 euros since the start of this year and will gain another 24 percent to 5.60 euros in 12 months, according to the average of six analyst estimates.

Fredriksen-backed companies, which also include Ship Finance International Ltd., are the second-biggest owners of supertankers after Tokyo-based Mitsui O.S.K. Lines Ltd., according to data from Clarkson, the world’s biggest shipbroker.

China’s energy consumption climbed to the equivalent of 2.6 billion tons of oil last year from 1.1 billion tons in 2002, according to BP Plc data. Its economic growth will accelerate in this and the next three quarters, according to the median of 30 economist estimates compiled by Bloomberg.

The nation’s oil consumption will gain 4.3 percent to 9.6 million barrels a day in the current quarter from a year earlier, the International Energy Agency predicted last month. Demand will average 9.7 million barrels a day in 2013, 3.2 percent more than in 2012, the Paris-based group said. China is the biggest destination for laden VLCCs, with about 13 percent of the fleet heading to its ports at any time.

Persian Gulf

Tanker rates are also rising because traders booked at least 141 VLCCs to load crude in the Persian Gulf during November, the most since December 2011, according to Marex Spectron data. Surplus shipping capacity in the world’s largest oil-loading region dropped to 14 percent on Nov. 13, the least since June, according to data compiled by Bloomberg.

“Fewer vessels in the Middle East are a sign that demand for crude in China is increasing,” said Roed of Danske Markets, whose recommendations on the shares of shipping companies returned 9.6 percent in the past six months. “Ship owners will succeed in increasing rates.”

– Rob Sheridan, Copyright 2012 Bloomberg.

Join The Club

Join The Club