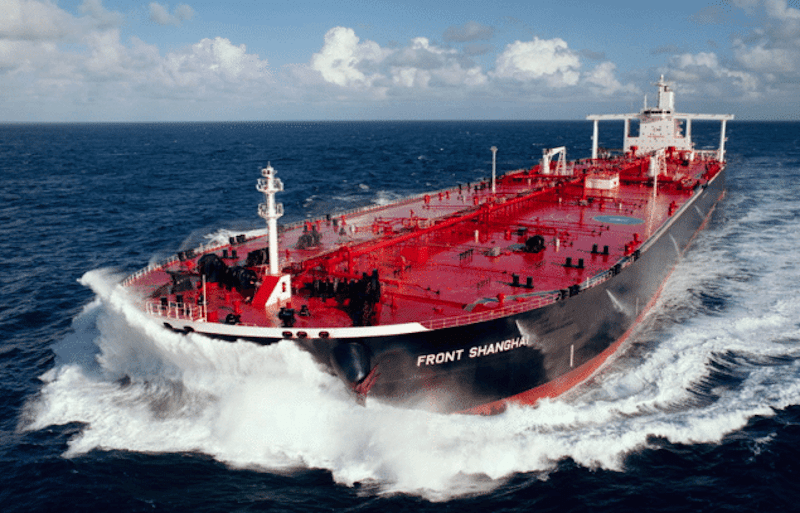

Photo: Frontline Ltd.

John Fredriksen’s Frontline Ltd made a non-binding proposal over the weekend where Frontline would acquire all outstanding shares of common stock of U.S.-listed crude oil tanker company DHT Holdings in a stock-for-stock transaction.

Frontline also announced Monday it has already bought 16 percent of DHT’s shares.

Frontline has offered a ratio of 0.725 Frontline shares for each DHT share. The company has also acquired 15,356,009 shares of DHT, representing approximately 16.4% of DHT’s outstanding common stock based upon 93,366,062 common stock outstanding. Share for share, Frontline’s offer represents an implied price of $5.09 per DHT share, representing a 20% premium compared to the closing (share) price.

A combination of Frontline and DHT would create the largest public tanker company by fleet size, market cap, and trading liquidity.

“Assuming significant cost synergies are achieved, as well as superior access to debt and equity capital markets, Frontline believes a combined entity would generate significant free cash flow and maximize value for both companies’ shareholders. However, no specific arrangement has been reached, and there can be no assurance as to the certainty or timing of any potential business combination,” Frontline said in a press release.

In response, DHT’s board said it had adopted a plan allowing it to issue more shares to existing owners if Frontline raises its stake or other investors buy stakes of more than 10 percent. The board will evaluate the proposal from Frontline and respond accordingly in due course, DHT said.

Analysts on Monday said the Frontline must raise its bit if it wants the takeover to succeed.

DHT’s fleet currently consists of 19 VLCCs and 2 Aframax tankers. Frontline Ltd’s fleet currently stands at 58, consisting of VLCCs, LR2 tankers, Aframax tankers, and medium-range tankers.

Join The Club

Join The Club