Flexport Grabs Top Amazon Executive

By Spencer Soper (Bloomberg) Dave Clark, who spent two decades climbing the ranks at Amazon.com Inc. to become its consumer chief, is joining logistics software startup Flexport. Clark will be co-chief...

By Gavin van Marle (TheLoadstar) US digital-first freight forwarder Flexport has secured “a truly outstanding” $1bn in a new funding round led by Japanese tech investment behemoth SoftBank.

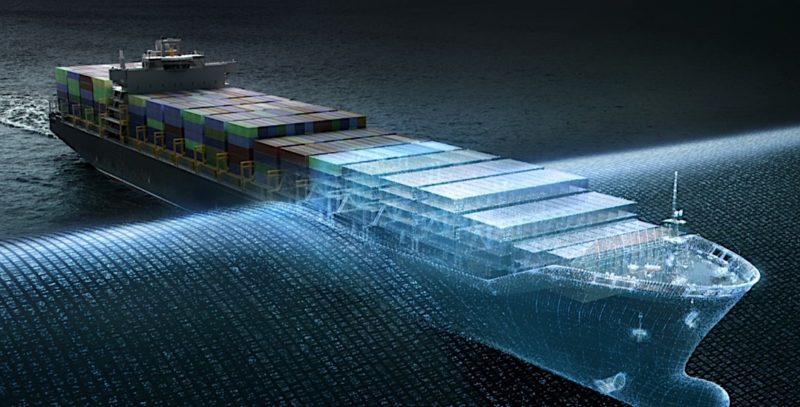

Flexport said the cash would be used to “deepen its technology and data capabilities, grow its global logistics infrastructure footprint and invest in industry expertise”.

SoftBank’s Vision Fund was joined by existing investors in Flexport, including Founders Fund, DST Global, Cherubic Ventures, Susa Ventures and emerging Chinese integrator SF Express.

The investment will see Michael Ronen, managing partner at SoftBank Investment Advisers (SBIA), join the Flexport board, while Ed Shrager, director at SBIA, will serve as a board observer.

“Logistics is a $7trn industry that is crucial for global trade, yet extraordinarily fragmented,” said Mr Ronen. “Even the largest companies only hold single-digit market share.”

Flexport said last year it doubled top-line revenue, generating close to $500m in sales and increasing staff to nearly 1,000, while expanding its geographic presence to 11 offices and warehouses around the world.

In September it claimed to be ranked the 11th largest freight forwarder by ocean volume on the core transpacific eastbound tradelane.

“Our vision is to unite the planet in a seamless web of commerce, unhindered by physical borders, boundaries or political agendas,” said Ryan Petersen, Flexport founder and chief executive.

“The Vision Fund shares our belief in using technology to create a better, more interconnected world and their support will propel us into that future, making global trade easier for everyone,” he added.

The Loadstar’s financial analyst, Alessandro Pasetti, who yesterday conducted an interview with Mr Petersen, said the funding could propel the company’s valuation “multiple times $3bn, in terms of net present value for its implied enterprise/equity value”.

He added: “Most of the feedback I have received from trade executives in the past 24 hours suggests, and rightly so, that $1bn in new financing is a truly outstanding achievement, particularly given the challenging, late-cycle market volume-led environment for 3PLs and 4PLs, which typically boast low capital expenditure (capex) needs as well as thin operating margins.

“To give you some context, $1bn equates to over four full years of maintenance and growth capex for Switzerland’s Kuehne + Nagel, the world’s largest ocean freight leader.”

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up