via Google

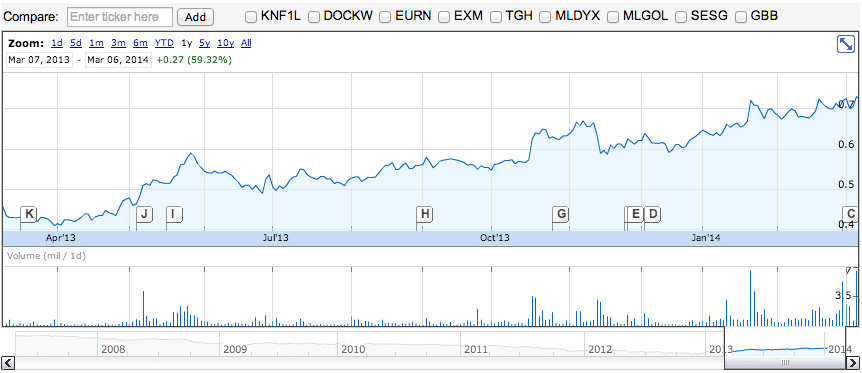

After a very successful year which has seen product tanker owner, d’Amico International Shipping S.A. (Borsa Italiana: DIS), shares rise over 59 percent, the company announced today it has sold off 42,195,531 shares, or 10 percent of the company, via a private placement to institutional investors at a rate of 0.695 euro per share.

d’Amico now holds 62.5 percent of the company’s shares.

In the company’s 2013 report, Giovanni Barberis, Chief Financial Officer of d’Amico commented:

“We are very satisfied of the financial results achieved in 2013 since we doubled our EBITDA margin on TCE, we generated a strong Cash Flow from operating activities of US$39.0 M and all the financial key ratios improved. In 2013, we have increased the value of the company and therefore for its shareholders by doubling the market capitalization of the Company, since the share capital increase launched at the end of 2012. We can proudly report that the financial community has strongly supported us in this year of transition.”

D’Amico’s net profit in 2013 reached US$ 18.9 million, a vast improvement compared to their 2012 net Loss of US$ 106.0 million. During the period, the company invested USD $383 million in a dozen newbuild MR product tankers. Four newbuild MR tankers have been delivered to D’Amico so far in 2014.

Sector Outlook – via D’Amico

Global oil demand growth appears to have gradually gained momentum in the last 18 months, driven by economic recovery in the developed world. Oil demand growth has been ramping up from a low point in 3Q12 to a recent high of 1.5 million barrels per day in 3Q13. Key to this change has been a trend reversal in OECD demand. This reversal in demand has been led by the Americas and Europe. Most OECD economies have by now largely exited the restraints of recession, with strong gains in some countries in the energy?intensive manufacturing and petrochemical sectors.

Indian oil demand growth is forecast to accelerate to 2.4% in 2014 as the underlying macroeconomic picture recovers, with GDP growth of above 5% forecast by the International Monetary Fund (IMF) in 2014.

Refinery maintenance has already started in the Middle East with Saudi Arabia featuring as an active buyer of distillate cargoes from the East. Available capacity in the Middle East will increase sharply in mid-March as refinery maintenance comes to an end and the second phase of the 400,000 barrels per day Jubail refinery comes on-line (+ 200,000 barrels per day).

China’s top refiners, Sinopec Corp and Petro China were granted export permits for the fourth quarter. It is expected with slowdown in domestic demand that there will be more licenses to export granted.

The U.S. West Coast market is seen engaging in strong gasoline and diesel exports in the first month of 2014, and the heavy push is extended into early February. In January, at least five cargos of gasoline and naphtha were booked for export to Asia, and another 2-3 cargos were fixed for the trans-pacific voyage

in February. Most of these cargos of conventional gasoline, aromatics and naphtha, are headed to Singapore, China and Japan.

Total OECD commercial oil inventories plummeted by 53.6 million barrels in November, their steepest monthly decline since December 2011. Crude oil and petroleum products such as Gasoil and Distillates led the plunge. At end on January, inventories lagged year?ago levels by 85.8 million barrels and five?year average levels by as much as 99.5 million barrels. With the looming spring refinery maintenance season we should see an improvement in product tanker demand to restock the low inventories.

The key drivers that should affect the product tanker freight markets and d’Amico International Shipping performance are:

- Global oil demand;

- worldwide GDP growth;

- the large modern fleet.

The factors that could mitigate and partially off-set the current scenario for the Product Tanker demand and supply in the longer term are disclosed in more details below:

Product Tanker Demand

- In 2013 there have been at least 170 time charter contracts concluded in the MR sector compared to 57 in the whole of 2012.

- The Jones Act, the cold weather in the US (helping demand and causing refinery problems) and fast declining distillate stocks in the US North East are driving the distillate flows in the Atlantic Basin. Excess volumes from the US Gulf have to be exported, with most of it ending up in Europe, while distillates from Europe and Russia have increasingly been heading to the US East Coast.

- There is currently 800,000 barrels per day of refinery capacity in Europe which is under strategic review. European refiners are suffering, due to slow domestic and United States product demand so we could see further closures.

- In Asia and Australia there is over 500,000 barrels per day of refinery capacity due to close and an additional 1,000,000 barrels per day under strategic review. This will only increase these countries reliance on imported product.

- Annual seaborne palm oil transportation is expected to rise from 6.5 million tonnes to 7.5 million tonnes by 2016. This would require an additional 31 ships (MR Tankers) annually.

Product Tanker supply

- There have been various reports of very strong ordering in the MR sector in 2013. There is considerable speculation of exactly how many orders have been placed and the reports range from 300 up to 400 for delivery in the next 3 years.

- The order book for delivery last year was around 125 ships of which 86 were delivered.

- Based on historical figures for the last couple of years we would expect the order book for 2014 to be around 90-100 ships and the same for the following year.

- Slippage and possible cancellations should still be considered a significant factor in the new buildings. The average slippage has been around 35 percent over the last 5 years.

Join The Club

Join The Club