The traditional peak season for ocean container shipping between China and the United States could arrive earlier than usual this year following a significant reduction in tariffs between the world’s largest trading nations.

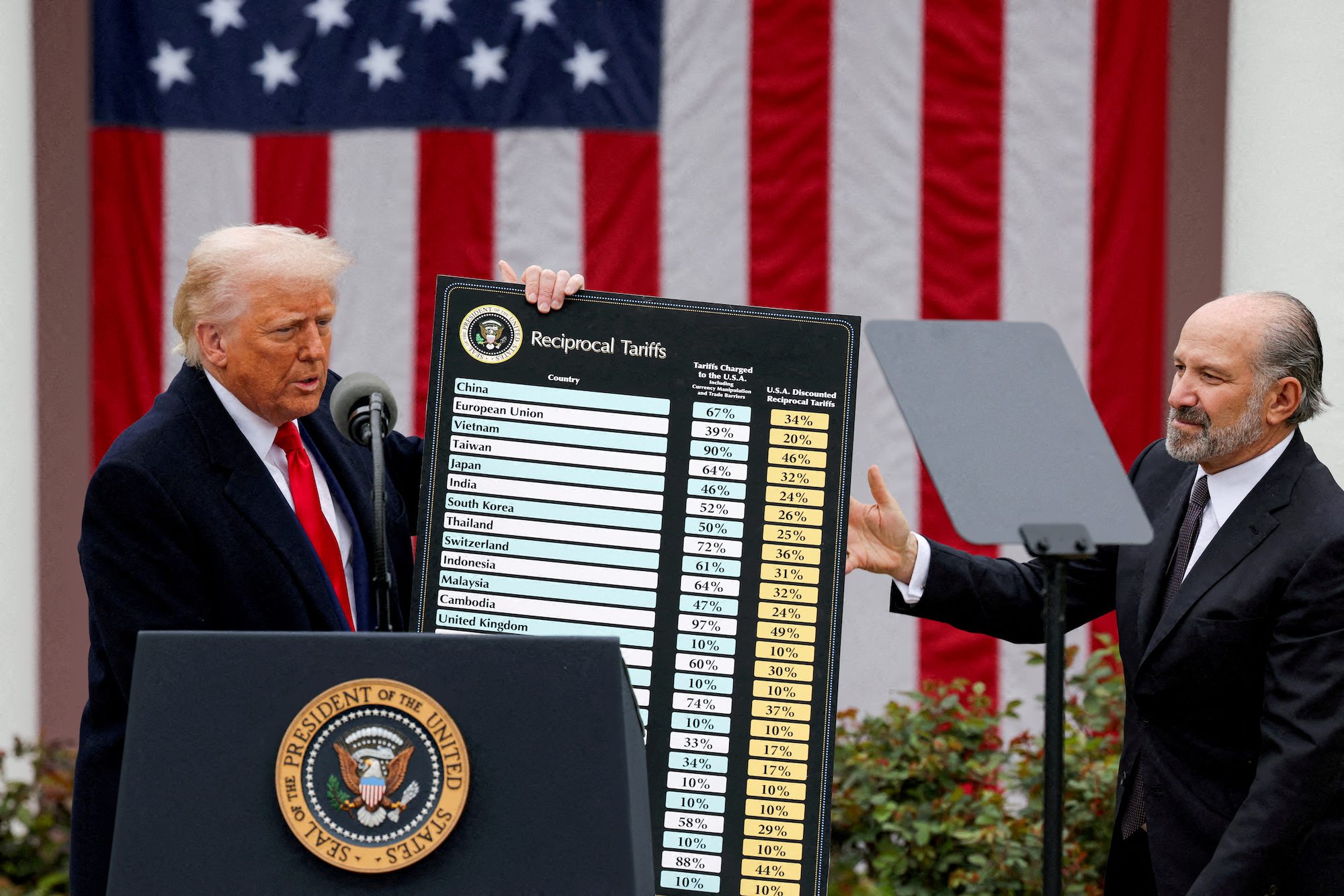

On Monday, the United States agreed to a 90-day cooling-off period, temporarily lowering tariffs on Chinese imports from 145% to 30%, while China responded by reducing its retaliatory tariffs on U.S. goods from 125% to 10%.

Peter Sand, Chief Analyst at Xeneta, notes that with an average transit time of 22 days on the Transpacific trade, shippers are likely to maximize this opportunity by moving as much cargo as possible during the 90-day period, creating upward pressure on freight rates.

“Q3 is traditionally the peak season for ocean container shipping, but that may arrive earlier in 2025 if there is now a rush to import goods into the US from China,” said Sand.

The situation is further complicated by capacity constraints, as carriers had redeployed vessels to other routes—such as the Far East to Europe trade—in response to declining China-US volumes when tariffs rose sharply in early April 2025. The time required to shift this capacity back could result in higher short-term costs for shippers.

Recent data from Xeneta’s platform reveals that capacity has already tightened significantly, with the four-week rolling average for offered capacity from Asia to North America dropping 17% since April 20, reaching 265,000 TEU as of May 12. Blanked sailings have increased by 86% during the same period, totaling 89,100 TEU.

However, Sand says the persistent 30% tariff on Chinese imports could still affect lower-margin goods, potentially dampening the demand surge. Additionally, some shippers may need time to restart their Chinese operations after scaling back in response to previous tariffs.

Spot rates have seen significant decreases since the beginning of the year, with rates to the US West Coast and East Coast falling by about half before a slight uptick in early April. “In the longer term, it is likely freight rates will continue the downward trend seen in the market during Q1 prior to the ‘Liberation Day’ announcement by Trump,” added Sand.

Industry experts warn that while the tariff reduction brings welcome relief, supply chain stakeholders should remain cautious. The geopolitical landscape continues to pose risks, and businesses are increasingly focused on diversifying their supply chains to better manage future disruptions.

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club