HOUSTON (Dow Jones)–ConocoPhillips’s (COP) $103.2 million offer for the Keathley Canyon Block 95 was the highest bid in the first U.S. Gulf of Mexico lease sale since last year’s Deepwater Horizon oil spill.

ConocoPhillips’s bid was higher than offers made for the same block by six other companies, including BP PLC (BP), Royal Dutch Shell (RDSA), and a subsidiary of A.P. Moller-Maersk A/S (MAERSK-B.KO), according to results released Wednesday by U.S. Bureau of Ocean Energy Management in New Orleans.

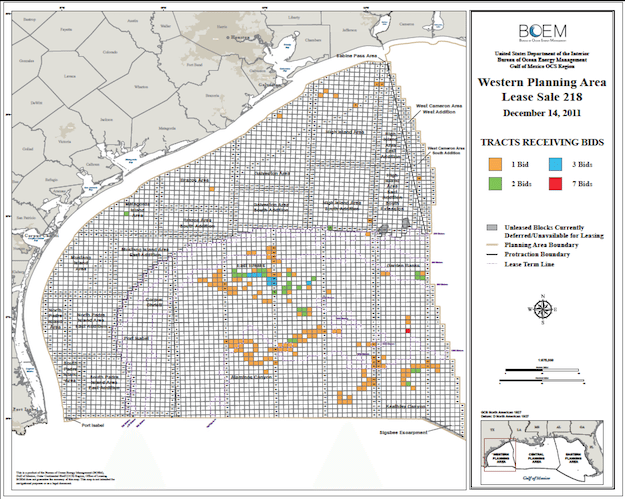

The agency is set to report the winning bids for the sale, known as Sale 218, which offered 191 tracts located in the western Gulf, later Wednesday.

Block 95 is located in the Gulf’s deepwater and it has yielded in the past massive discoveries such as Chevron Corp.’s (CVX) Buckskin and BP’s Kaskida.

Exxon Mobil Corp. (XOM) and Anadarko Petroleum Corp. (APC) were also among active bidders for other blocks offered in the sale, according to the agency.

The results are expected to show the level of interest oil companies have in the Gulf. The federal government strengthened regulations in the area after BP’s Macondo well blew out as drilling was completed in April 2010, killing 11 workers and unleashing the largest offshore spill in U.S. history.

–By Isabel Ordonez, Dow Jones Newswires

Join The Club

Join The Club