HD Hyundai Sets Course for New India Shipyard in Tamil Nadu

HD Hyundai has signed a strategic partnership with the Tamil Nadu state government to establish a new shipyard in India, marking the latest move by the South Korean shipbuilding giant...

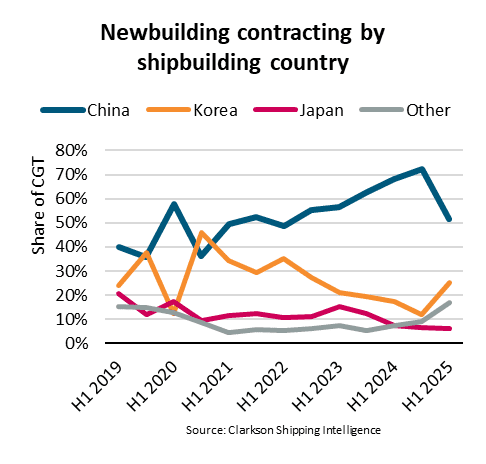

Chinese shipyards have seen their global market share drop dramatically from 72% to 52% in the first half of 2025, according to a new analysis from BIMCO.

“In the first half of 2025, China’s share of newbuilding contracting fell to 52% from 72% in the previous six months. Growing concerns over USTR port fees on Chinese ships in US ports likely contributed to a decrease in contracting in China. This trend was further amplified by a drop in global ship contracting and a shift in the types of ships being ordered,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

The upcoming USTR port fees, scheduled to take effect in October 2025, will affect both Chinese owners and operators, as well as ships built in China. The policy does include exemptions for smaller Chinese-built vessels based on sector-specific criteria and for short haul voyages.

According to BIMCO’s analysis, global newbuilding orders measured in Compensated Gross Tonnage (CGT) fell 54% year-over-year during the first half of 2025. The decline was most pronounced in bulkers, tankers, and gas carriers, sectors hit by weaker freight rates. Container and cruise ships were the only major segments showing expanded contracting activity.

While China continues to dominate global shipbuilding, South Korea has recently gained ground in key sectors. In 2024, South Korea led in gas carrier construction, and this year it has overtaken China in crude tanker shipbuilding as well.

Gouveia notes that alternative shipbuilding capacity remains limited: “Even if shipowners try to avoid ordering ships in China due to USTR fees, there is a limit to the capacity available outside of the country. Consequently, if global ship contracting had not significantly dropped during the start of the year, China’s share of contracting would have likely been larger.”

Industry constraints have created an extended orderbook with significant lead times, particularly for larger vessels and specialized ships like container carriers, gas carriers, and cruise ships. Of this year’s new orders, 31% are scheduled for delivery in 2027, 38% in 2028, and 23% in subsequent years.

South Korea and Japan, the second and third largest shipbuilding nations respectively, face challenges in expanding their production capacity due to labor shortages stemming from declining populations. These demographic challenges have increased labor costs, affecting their competitiveness in the global market.

Looking ahead, Gouveia believes China’s position remains strong despite recent setbacks: “China’s dominant position in shipbuilding is unlikely to significantly change soon, but the country could face increasing competition in the medium term. Countries like the Philippines and Vietnam, already small-scale producers of bulkers and tankers, may boost their output, benefiting from low labor costs. Meanwhile, although the US and India currently have limited shipbuilding capacity, both governments are actively working to strengthen their domestic industries. However, even if they succeed, it will take time for them to scale up production.”

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up