By Bloomberg News (Bloomberg) —

China’s exports surged to a new monthly record in September as strong demand ahead of year-end holidays and rising prices outweighed the effect of power shortages across the country.

Exports grew 28.1% in dollar terms in September from a year earlier to reach a high of $305.7 billion, data from the General Administration of Customs showed Wednesday. That beat economists’ expectations of a 21.5% gain. Import growth slowed to 17.6%, below the 20.9% forecast by economists, leaving a trade surplus of $66.8 billion.

China’s exports have been a driver for the economy’s rebound from the pandemic, helping to offset weak domestic spending. Demand for Chinese-made goods remained strong ahead of China’s weeklong National Day holiday at the beginning of October, and as buyers ramped up orders before the traditional year-end shopping season.

The trade figures reflect “the continued strength from global demand for Chinese goods, and on the other hand the domestic economy has slowed more than expected,” Jian Chang, chief China economist at Barclays Plc, said in an interview on Bloomberg TV.

Nomura Holdings Inc. economists also pointed to a pickup in prices as a reason for stronger export numbers. Higher industrial product prices may have contributed more than 5 percentage points to the jump in export growth, they estimated.

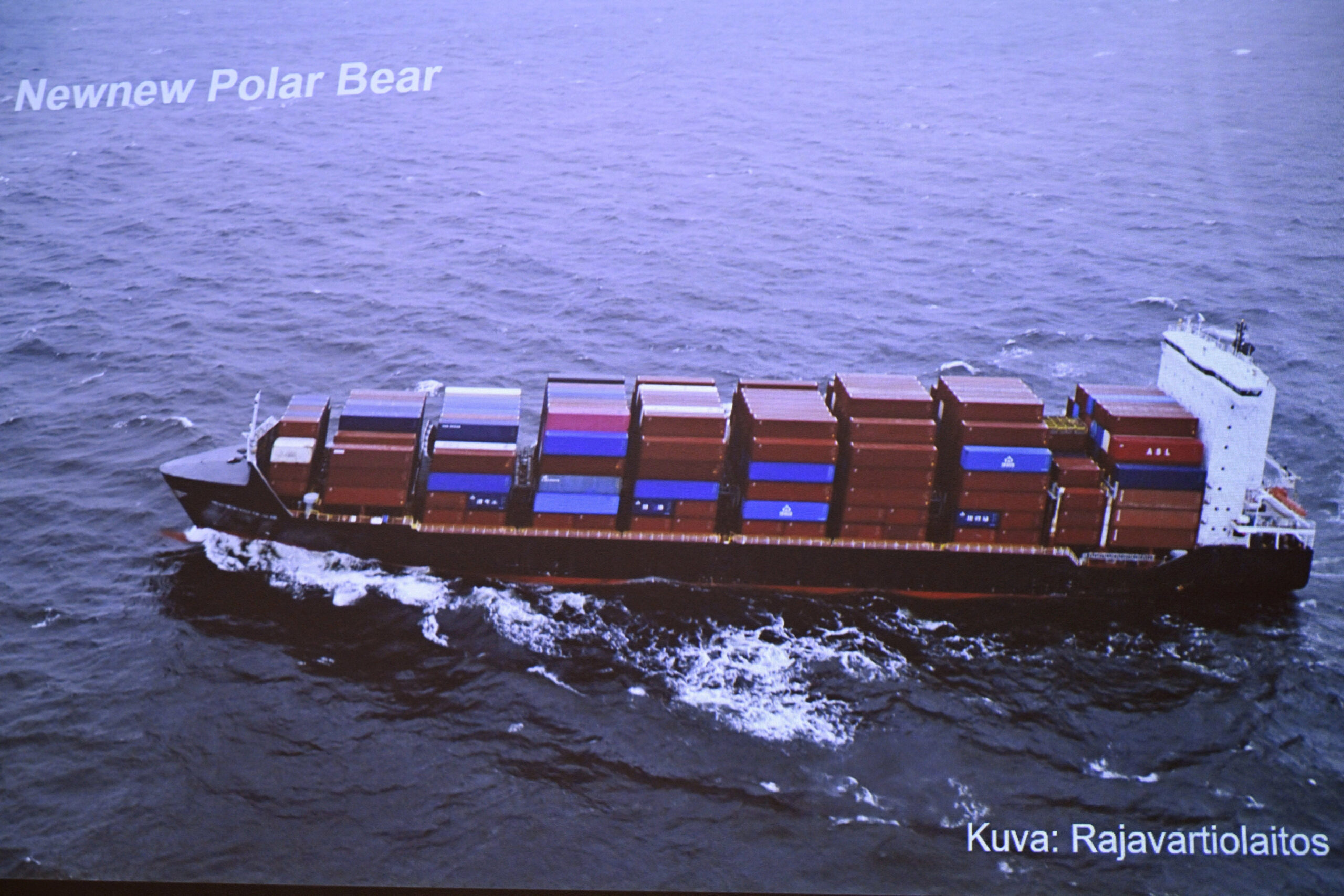

Exporters are facing multiple challenges though, including from high freight costs, raw material prices, electricity shortages and environmental curbs. Li Kuiwen, a spokesman for the customs department, said fourth-quarter trade growth may slow because of the higher base of comparison from a year ago and logistical problems.

“Some traffic routes suffered imbalanced supply and demand,” he said. “We are following the situation closely.”

What Bloomberg Economics Says…

A second straight month of upside surprises in China’s export growth in September shows external demand is providing support for the economy. But it’s unlikely to be enough to offset downward pressures caused by power shortages and strains in the property sector that are intensifying a slowdown in growth.

David Qu, China economist

Export growth was expected to slow last month after power outages forced factories in several provinces to shut. From aluminum smelters to textiles producers and soybean processing plants, factories were ordered to curb activity or shut altogether, partly due to a shortage of coal and soaring prices.

The customs department is closely monitoring the impact of rising raw material and energy product prices on trade, and will release its conclusions later, Li said.

Global appetite for Chinese goods could also start to ease after buyers frontloaded their Christmas orders. Indexes tracking new export orders in both the official purchasing managers’ index and Caixin PMI weakened further in September.

Import growth softened as domestic demand weakened, a property downturn weighed on the economy, and the prices of some commodities eased. The volume of iron ore imports dropped to 95.6 million tons from 97.5 million tons in the previous month, while imports of coal and gas rose in the month to counter the power shortages.

China Raises Coal and Gas Imports to Counter Energy Crisis

“The solid export figures could not offset the slowdown of the domestic economy,” Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. “The decline in imports is concerning. China will need to overcome supply constraints on several fronts, notably power shortage.”

Imports are set to drop further going forward, amid slowing property construction and a pullback in commodity prices, Julian Evans-Pritchard, senior China economist at Capital Economics Ltd., said in a note.

–With assistance from James Mayger, Ailing Tan and Myungshin Cho.

© 2021 Bloomberg L.P.

Join The Club

Join The Club