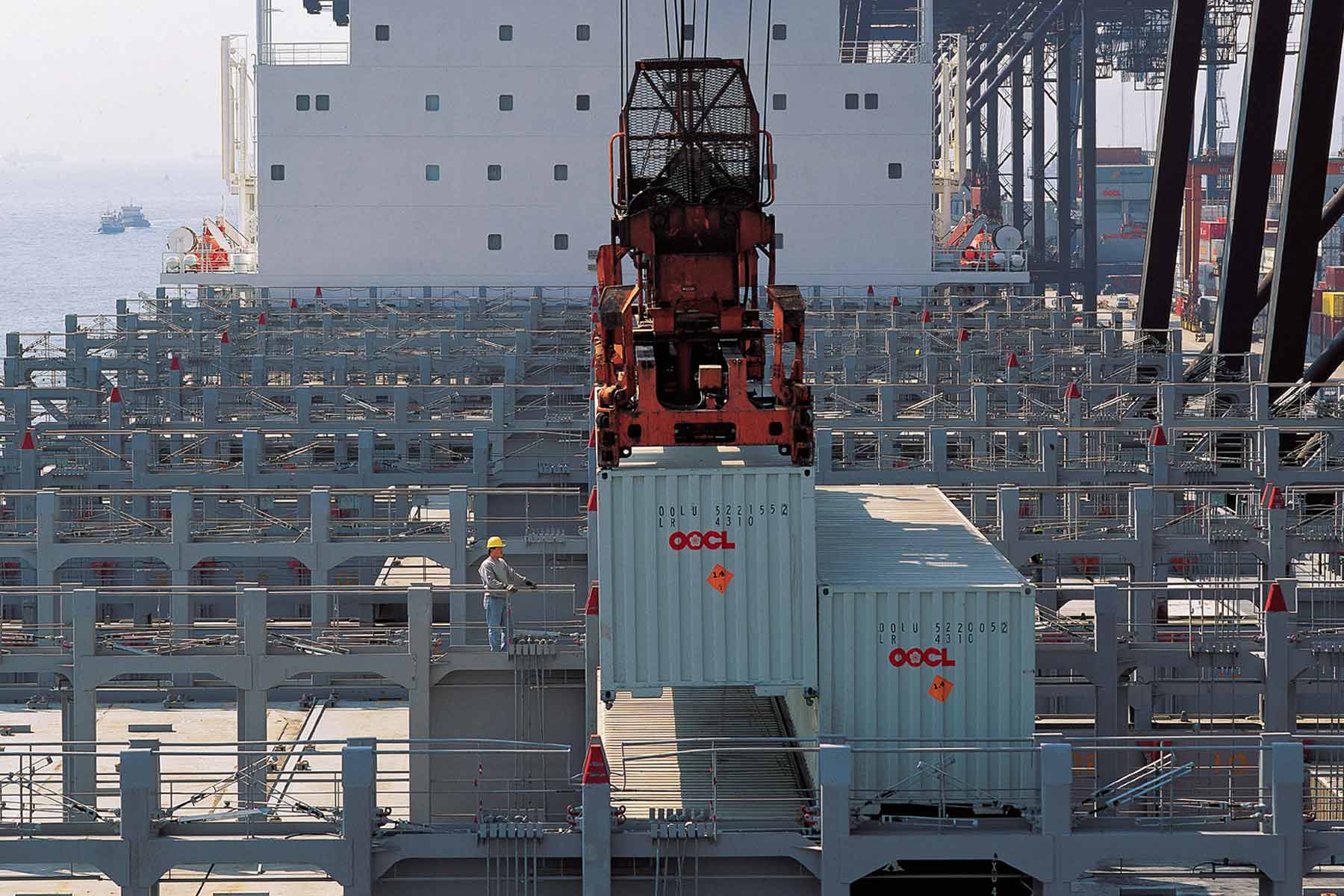

Photo: OOCL

By Gavin van Marle,

Back in June, The Loadstar published a story which quoted a European forwarder who believed that the 1 July general rate increase – generally set at $1,000 per teu – was the carriers’ “last chance” to force rates up.

To which one wit on Twitter replied: “No it isn’t – there’s the August, September, October, November and December GRIs to come as well!”

Well, if many a true word has been said in jest, the only divergence from reality this comment has shown is the relative success – or lack thereof – of those subsequent increases.

The relative strength of this summer’s peak season – after the trough the trade has experienced over the past couple of years, the sight of volumes actually increasing this year represented some sort of a peak – appears to be on the wane, and with it rates are declining.

The Shanghai Containerised Freight Index’s Shanghai-North Europe leg ended last week at $966 per teu, down $107 on the week before, indicating that the era of precipitous freight rate drops is far from over.

Meanwhile, the World Container Index’s Shanghai-Rotterdam leg currently stands at $2.303 per 40ft, a decline of around 8% on the previous week, and well down on the high of $2,881 per 40ft recorded in August.

“The rate momentum has run out of steam as we come to the end of the peak season,” Drewry’s freight rate benchmarking manager, Martin Dixon, told The Loadstar, adding that the prospects for further increases are dim, given that the growth in volumes seen in July and August are not expected to be replicated in the later months of the year.

The momentum Mr Dixon talked of may, perhaps, receive a slight fillip from the China’s Golden Week holiday at the beginning of October. Hapag-Lloyd, for one, has announced a $500 per teu GRI from 23 September.

“That may lift rates a bit but it will be short-term, and after that you are into Golden Week,” Mr Dixon said.

Both the G6 alliance and Maersk have announced a series of void sailings in expectation of hugely reduced volumes during Golden Week, a move that might – as it did previously this year – allow carriers to keep rate levels from dropping further. Both have also cancelled a series of sailings in the week after the holiday.

But accurately managing capacity to keep rates up will prove difficult, as the failed 1 September GRI proved, when the WCI shanghai-Rotterdam rate went up by just $18.

Yet carriers have more than just their year-end figures riding on this, said Mr Dixon. “It is important for carriers because they are coming into the negotiating season for annual contracts on the Asia-Europe trade, which run from January to December. The spot market during October, November and early December has a big influence on the rates that are set for those contracts.”

Join The Club

Join The Club