Hijack Call From Ship Off Iran a False Alarm, Security Firm Ambrey Says

A hijack signal sent from a Panama-flagged petroleum products tanker off Iran was a false alarm, British maritime security firm Ambrey said on Wednesday.

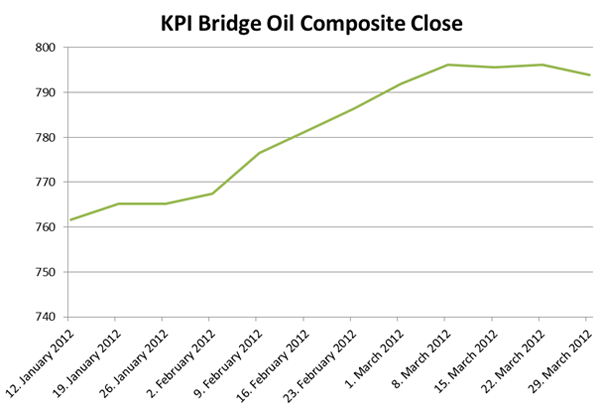

23 March -29 March 2012

We had a very strange and difficult week in the oil markets this week, but ship owners and charterers will be glad to see a decline in the overall market trend. Many of the asset managers world wide were profit taking this week ahead of the quarters end.

What does this mean to the oil markets?

Well it means a short reprieve in extremely elevated prices and for sure more money inflows in the coming weeks pushing prices even higher. We are quickly approaching levels that will harm the economies of the world, but it is very much a slippery-slope. As global monetary policy experts are keeping interest costs low this is in turn devaluing currencies and moving commodities higher. At some point something will have to give, either energy prices become unreasonable or growth accelerates. Only time will tell.

Now with all that being said, currently the potential remains much more likely for higher energy prices than lower. With the constant “saber rattling” between many countries of the world and Iran any conflict there will ignite the oil powder keg and we will see oil prices that have never been seen before. This will happen even though there is more extra oil around than ever before. Supply and demand does not exist in the energy markets any more and it is now driven by headlines and threats.

Bunker prices overall have declined this week and we hope that trend continues. Panama remains tight on availability and large requirements have been difficult to cover in a timely manner. The KPI Bridge Oil Composite was down $2.25 MT.

KPI Bridge Oil Composite

The KPI Bridge Oil Composite is a calculated fuel number based on 14 ports strategically positioned world wide. It is calculated on a weekly basis blending 90% fuel oil prices with 10% distillate prices. The idea behind the number is that it would represent actual fuel costs on a global basis and what vessels would consume on average. This number will not fluctuate as quickly as daily prices and can easily be hedged or used for voyage calculations.

The KPI Bridge Oil Composite is a calculated fuel number based on 14 ports strategically positioned world wide. It is calculated on a weekly basis blending 90% fuel oil prices with 10% distillate prices. The idea behind the number is that it would represent actual fuel costs on a global basis and what vessels would consume on average. This number will not fluctuate as quickly as daily prices and can easily be hedged or used for voyage calculations.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up