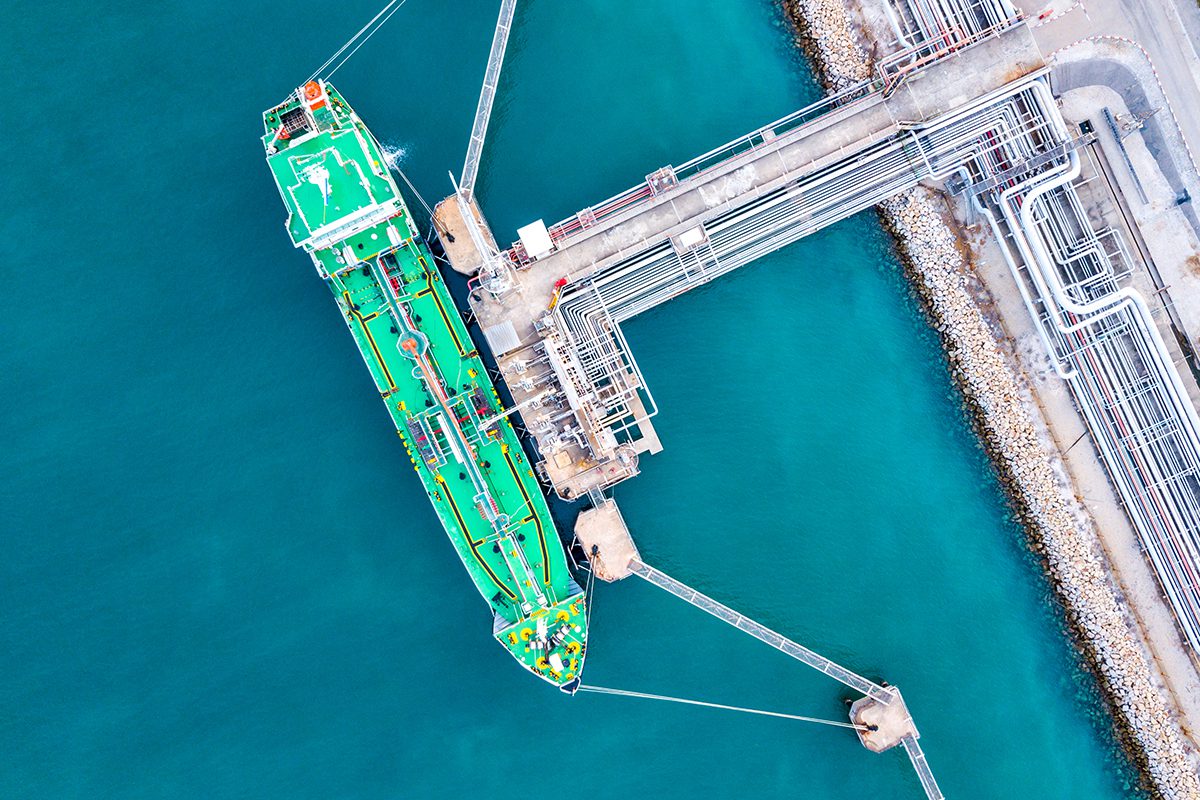

Image: Aker Philadelphia Shipyard

Aker ASA controlled Converto Capital Fund is looking at ways to restructure or possibly merge American Shipping Company ASA and Aker Philadelphia Shipyard as it looks to capitalize on booming U.S. shale production and a strong Jones Act market.

Converto is the principle shareholder in both AMSC and Aker Philadelphia, and is 99.8% owned by Aker ASA.

Aker said in a statement Monday that after mulling an exit from American Shipping Company, Converto has confirmed the future potential of AMSC and AKPS and has decided that potential strategic alternatives would likely create more value than an exit.

Converto has been a major shareholder in AMSC and AKPS since 2009. In recent years, the North American shale oil revolution has created a structural change in the demand for oil transportation and refining in the United States, resulting in the creation of numerous jobs and significant tailwinds for the Jones Act market, of which AMSC and AKPS are uniquely positioned to benefit from.

Aker says that Converto will be working with management and the Board of Directors of AMSC and AKPS to evaluate and execute potential strategic initiatives in order to maximize shareholder value. Aker added that this could include M&A and financial restructuring in AMSC and AKPS, as well as potential joint strategic alternatives for the two companies.

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club