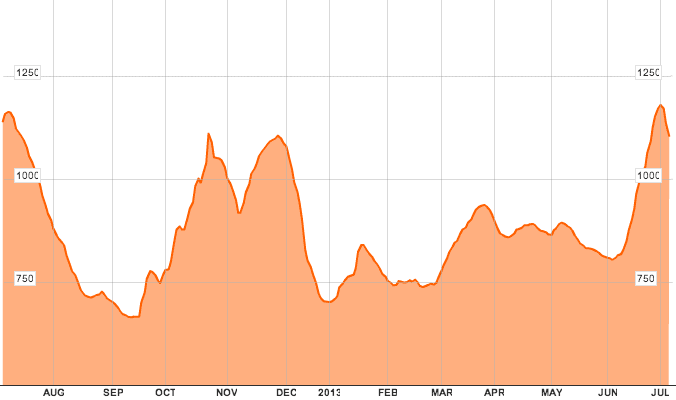

Baltic Dry Index, past 12 months as of 5 July 2013, via Bloomberg

(Bloomberg) — The Baltic Dry Index, a measure of commodity-shipping costs, fell for a fourth day, capping the biggest weekly decline since December, as rates declined for all four vessel types the gauge tracks.

The index slid 0.4 percent to 1,099 today, for a 6.1 percent drop this week, figures from the London-based Baltic Exchange today showed.

Rates for Capesizes, the largest dry bulk vessels tracked by the index that typically haul cargoes of iron ore and coal, fell 15 percent this week to $12,737 a day. The supply of vessels increased and the number of cargoes shrank, especially from Brazil, according to Fearnley Securities AS.

“Some port congestion in Australia has slowed down the fixing activity,” Fearnley said in an e-mailed report today. “The Baltic Dry Index was further down to 1103 yesterday, again driven by a significant drop in Capesize rates, where spot vessels appear more frequently and cargoes are limited, especially from Brazil.”

Daily returns for Panamaxes, the biggest ships that can navigate the Panama Canal, dropped 0.5 percent to $8,013 a day, according to the exchange. Supramax rates slipped 0.8 percent to $9,664. Handysizes, the smallest ships in the gauge, fell 0.1 percent to $8,324, exchange data show.

– Rob Sheridan, Copyright 2013 Bloomberg.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club