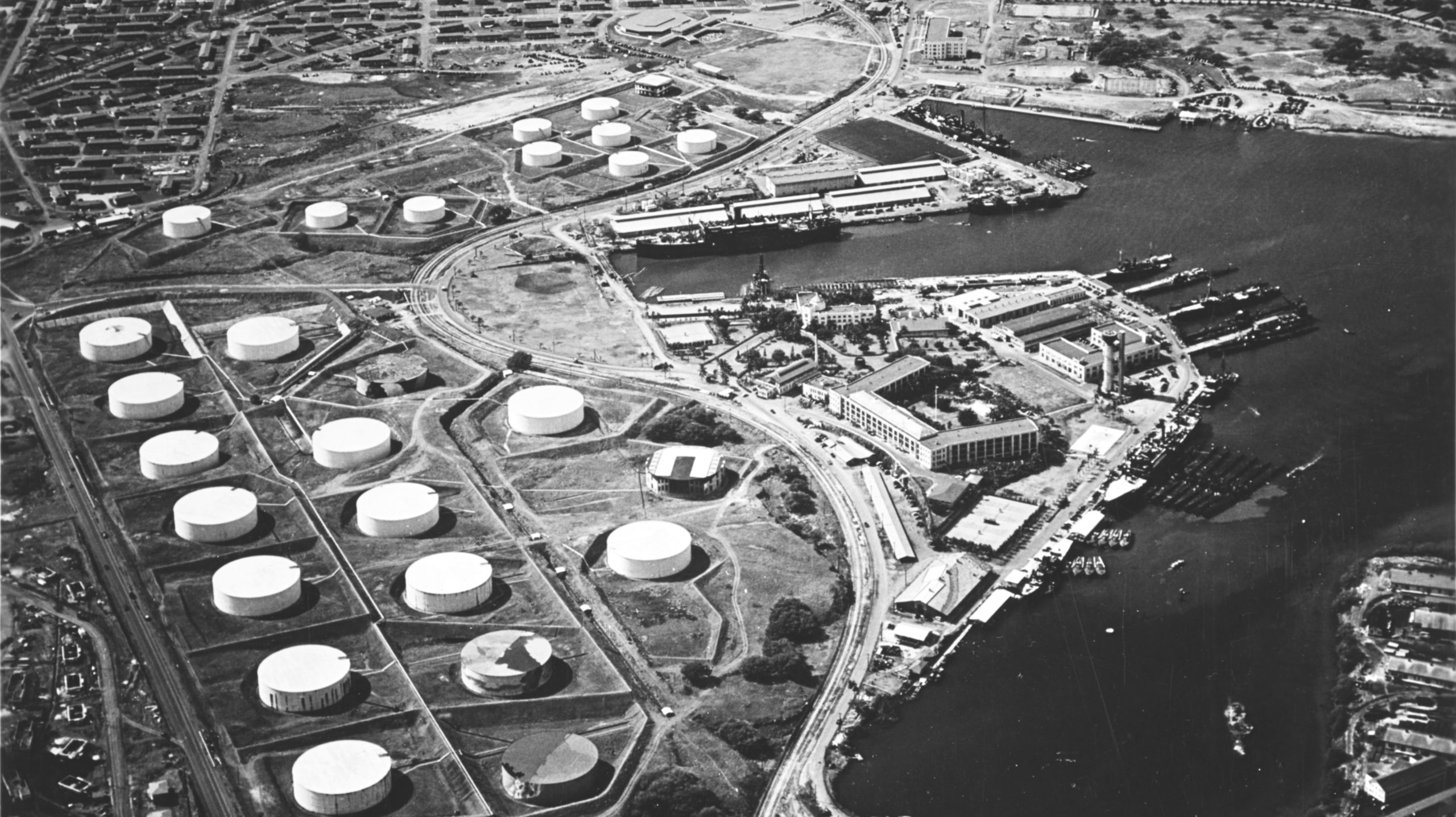

When not hauling rigs for the oil and gas industry, Dockwise’s heavy lift submersible Tern is helping the U.S. Navy deploy its largest mine sweepers to the Persian Gulf. Photo: Dockwise

(Bloomberg) — Dockwise Ltd. shareholders can thank the U.S. Navy for helping return the company to profit as the world’s largest operator of heavy-load vessels hauls mine sweepers to the Persian Gulf.

Dockwise’s carriers are so big they can transport four of the Navy’s 224-foot-long mine hunters in one 42-day voyage across the Pacific Ocean. The extra cargo will help Breda, Netherlands-based Dockwise report a profit in 2012, rebounding from the largest loss in four years in 2011, according to the median of eight analyst estimates compiled by Bloomberg. Shares of the company will rise 43 percent in the next 12 months, the average of eight estimates shows.

The U.S. is deploying more vessels in case Iran retaliates against international sanctions by disrupting shipping through the Strait of Hormuz, the transit point for about 20 percent of the world’s oil. That’s providing Dockwise carriers with work instead of sailing empty after delivering oil rigs from yards in Asia to oil and natural gas fields in the Atlantic. The ships may work at more than 80 percent of capacity next year, the most since 2008, ABN Amro Bank NV estimates.

“There is going to be strong demand for this company as the undisputed market leader,” said Andre Mulder, an analyst at Kepler Capital Markets in Amsterdam whose share recommendations returned 21 percent in the past year. “When the Navy has to transport some ships, that’s adding to the attractiveness.”

Dockwise operates 19 heavy-load vessels capable of hauling everything from 760-foot-long hulls for the Royal Australian Navy’s largest-ever ships to 400-foot-high oil rigs. It acquired four carriers when it bought Fairstar Heavy Transport NV for $90 million in July.

Persian Gulf

The company will report net income of $35.24 million this year, from a $33.49 million loss in 2011, according to the mean of eight analyst estimates compiled by Bloomberg. Its shares rose 16 percent to 13.60 euros ($17.13) in Amsterdam since the start of January and will reach 19.41 euros in 12 months, based on the average of eight predictions.

Tensions in the Persian Gulf are rising after the 27-nation European Union imposed an embargo on Iranian oil in July in response to the country’s nuclear program. The government, also facing sanctions from the U.S. and United Nations, says it is developing nuclear capabilities for civilian purposes.

Iran has threatened to block the strait, which is about 21 miles wide at the narrowest point. The country may have 3,000 naval mines, 10 times more than it would need to close the waterway, according to a 2010 report by the Dubai-based Institute for Near East & Gulf Military Analysis. Admiral Mark Fox, commanding the U.S. 5th Fleet, said in February that laying mines would be interpreted as an act of war.

Crossing Oceans

The Navy vessels, known as mine counter-measure ships, arrived from San Diego on Dockwise’s 600-foot-long Tern. They aren’t designed to cross oceans and would have to refuel too often, said Chris Johnson, a U.S. Naval Sea Systems Command spokesman. The wooden-hulled boats use sonar, video, cable cutters and detonators to find and destroy mines, according to the U.S.Navy.

The four delivered in June doubled the number in the Persian Gulf, said Greg Raelson, a spokesman for the 5th Fleet. They accounted for 10 percent of Dockwise’s business in the second quarter, according to the company’s Aug. 14 presentation.

The Defense Department said in July it would keep two carrier strike groups in the gulf until at least March. Each consists of an aircraft carrier, a guided-missile cruiser, two guided-missile destroyers, an attack submarine and a supply ship. The U.S. and more than 20 allies plan a minesweeping exercise in the region this month, the U.S. Central Command said in July.

Cable Cutters

Dockwise isn’t just delivering military equipment to the Persian Gulf. Its Blue Marlin is carrying part of a so-called Landing Helicopter Dock, a ship with a flight deck the length of two football fields, from Spain for the Royal Australian Navy. Military cargoes typically account for 3 to 5 percent of annual revenue, said Fons van Lith, the company’s investor relations manager.

While the shipments boost earnings, their timing is more difficult to predict than for transporting oil rigs and other equipment for the energy industry, said Jorgen Lande, an analyst at Nordea Markets in Oslo.

Demand for offshore drilling and the need to transport rigs may weaken as economic growth cools. The International Energy Agency, an adviser to 28 nations, cut its forecast for 2012 oil demand on Aug. 10 and predicted slower growth next year for the first time. Consumption will expand by 870,000 barrels a day this year, from January’s estimate of 1.08 million, and 830,000 barrels in 2013, the Paris-based IEA said.

Offshore Drilling

Spending on exploration and production fell 15 percent in 2009 in the global recession, according to data compiled by Bloomberg Industries energy analysts led by Christian O’Neill. Rates for the tallest jack-up rigs slumped 12 percent, according to Rigzone, a Houston-based data provider.

Environmental worries also may hinder offshore exploration. The explosion in April 2010 at BP Plc’s Macondo well in the Gulf of Mexico killed 11 workers and caused the biggest offshore oil spillin U.S. history. London-based BP agreed in March to pay at least $7.8 billion to settle private claims.

Heavy-load ships range from converted oil tankers to purpose-built vessels, some with hull sections removed to allow for wider loads. They submerge partially to move underneath their cargoes and then refloat.

Baker Hughes

Analysts are bullish because the fleet is outnumbered by about 35 to one by oil rigs, which need moving between projects. There are about 98 heavy-load ships, according to data from IHS Inc., an Englewood, Colorado-based research company. That compares with 3,516 rigs, according to Baker Hughes Inc.

Drilling companies have ordered another 147, according to data compiled by Bloomberg. The biggest builders are Keppel Corp. in Singapore and South Korea’s Samsung Heavy Industries Co. and Hyundai Heavy Industries Co. By contrast, 81 percent of all rigs operate in Europe, Africa or the Americas.

The outlook for heavy-load vessels contrasts with a slump across most of the shipping industry, where a glut means owners are failing to cover costs. The Baltic Dry Index, a measure of costs to haul iron ore and coal, plunged 60 percent this year, according to the Baltic Exchange in London. Earnings for the largest oil tankers dropped 77 percent, according to London- based Clarkson Plc, the world’s largest shipbroker.

The Bloomberg Pure Play Dry Bulk Shipping Index of the stocks of 14 shipping companies tumbled 16 percent this year as the six-member Bloomberg Tanker Index of equities retreated 1 percent. The MSCI All-Country World Index of global stocks advanced 7.7 percent and Treasuries returned 2.6 percent, a Bank of America Corp. index shows.

China Cosco

Carrying equipment for the oil and gas industry generates about 70 percent of Dockwise’s revenue, said van Lith. The vessels also haul cranes for unloading containers, mining equipment and yachts. Other operators include China Cosco Holdings Co., Seoul-based STX Pan Ocean Co. and NYK-Hinode Line Ltd., a unit of Tokyo-based Nippon Yusen K.K.

“A lot of large offshore production platforms under construction will be completed and will have to be moved to their production location,” said Michael Roeg, an analyst at KBC Securities in Brussels. “It’s a one-way trip, so for the return trip Dockwise will try to get something, whether a dredging vessel or navy ship or a small rig, just to cover costs and boost utilization.”

-By Isaac Arnsdorf. Copyright 2012 Bloomberg.

Join The Club

Join The Club