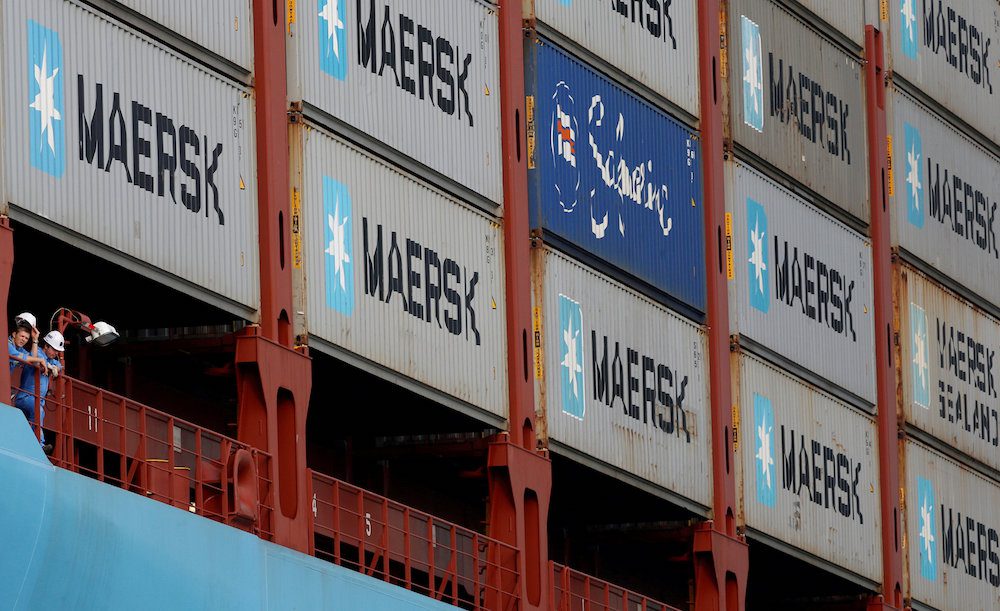

REUTERS/Edgar Su/File Photo

By Jacob Gronholt-Pedersen COPENHAGEN, Aug 22 (Reuters) – A.P. Moller-Maersk has been fortified by the $7.5 billion sale of its oil and gas business to France’s Total, but the company’s main sea freight business faces the threat of a new price war in a consolidating industry.

By Jacob Gronholt-Pedersen COPENHAGEN, Aug 22 (Reuters) – A.P. Moller-Maersk has been fortified by the $7.5 billion sale of its oil and gas business to France’s Total, but the company’s main sea freight business faces the threat of a new price war in a consolidating industry.

Maersk, the world’s biggest container shipping company, has shifted its focus this year from preserving market share to higher margins, a strategy that was helped by a recovery in freight rates.

Chief Executive Soren Skou told Reuters that the company’s second quarter results last week “were driven by higher freight rates alone” and that underlying industry fundamentals were their best since 2010.

But competitors including Ocean Alliance — a newly-created partnership between France’s CMA CGM, China’s Cosco, Hong Kong’s OOCL and Taiwan’s Evergreen — will this year launch a string of ultra-large vessels and will have little choice but to chase a bigger slice of the market.

“This could force Maersk to become defensive and defend its market share,” said Lars Jensen, director at Copenhagen-based consultancy SeaIntelligence.

“If you don’t want to enter a price war, you have to accept losing market share.”

The industry last year emerged from a fierce price war over market share that saw freight rates drop, hurting container line profitability as too many ships chased too little business.

But there are already signs of price skirmishes on the trans-Pacific route, which could spread to other regions.

Maersk’s focus on margins comes after splashing out $4 billion in December to buy smaller German rival Hamburg Sud, strengthening its presence in global trade and Latin America and increasing global market share to 18.6 percent from 15.7 percent.

Although the sale of the oil and gas business has allowed Maersk to shed any conglomerate discount in the way investors value its shares, it also means it can no longer use oil as a hedge against a downturn in the container market.

This strategy had already prompted rating agencies to downgrade the company, although analysts still say it will retain its investment grade – a key metric for the management.

“Overall, (the oil sale) is a credit negative event but we doubt it will have much impact on the short end of the curve due to Maersk’s significant liquidity,” Danske Bank credit analyst Brian Borsting said.

Maersk management is very keen on staying financially robust, indicating it wants to be ready for another price war and for new takeovers.

The company has given itself another year to spin off the remaining energy assets, which includes 24 offshore drilling rigs, 158 oil tankers and a supply service operation.

Nordea estimates a valuation for the drilling fleet around $3.9 billion, while Jefferies expect Maersk to fetch around $7.5 billion from those assets. (Reporting by Jacob Gronholt-Pedersen; Editing by Keith Weir)

(c) Copyright Thomson Reuters 2017.

Join The Club

Join The Club