By Jonathan Saul

By Jonathan Saul

LONDON, Oct 9 (Reuters) – War and sanctions are taking an increasing toll on Syria’s vital sea-borne trade, with fewer vessels calling at its cargo ports as ship-owners shy away from the risks associated with a conflict now in its third year.

The slowdown in deliveries of food and other essentials is piling pressure on the government of President Bashar al-Assad, which is struggling to keep commercial supply lines open.

Syria has failed for some time to procure strategic commodities such as wheat, sugar and rice through international tenders due to the civil war and an associated financing crunch. Shipping volumes have been hit despite the country’s ports being open and operational, sources familiar with matter say.

“Assad has support from his allies such as Russia and the regime continues to cling on. At the same time, the conflict is having an effect on supply lines which includes everything from commodities and goods,” said Alan Fraser of security firm AKE.

“They are struggling on the shipping side, which is why they have tried to keep land corridors open.”

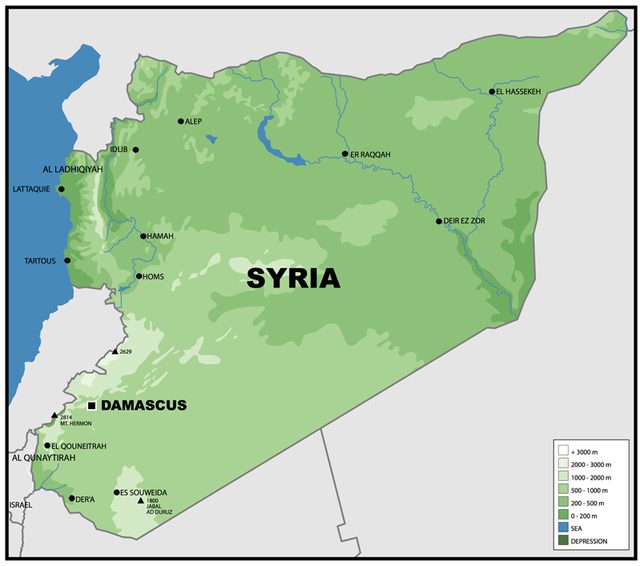

Ship-tracking data from maritime analytics firm Windward shows that the number of ships – dry bulk, container and general cargo vessels – calling at the ports of Tartous and Latakia has fallen since the start of the year.

Port calls made by dry bulk vessels have fallen from a peak of 108 in March to just 20 in September. Similarly, 120 general cargo vessels made port visits in March, falling to 52 in September, the data shows.

“Although sanctions have had an impact on Syrian trade, the dangers to inland transport may also curtail trade into Syrian ports,” a shipping industry source said.

“Ship tracking shows the major ports are receiving only four or five ships a day, nearly all of which are small local general cargo vessels.”

Many of the vessels visiting Syrian ports are among the oldest in the global fleet, averaging 28 years old, the data shows, which sources say reflects the caution bigger lines have about sending more modern ships in.

The threat of Western attacks has faded as Assad has agreed to destroy his chemical arsenal, but “Syria is still not worth the hassle for many owners. You need to factor in potentially high-risk trade,” a European ship owner said.

Earlier this year, Philippines-based International Container Terminal Services pulled out of operating the Tartous container port because of the war.

“As the conflict has intensified, so it has become less viable for freight transport operations,” said Daniel Richards of business intelligence firm Business Monitor International.

“Not only have (Syria’s) ports seen shipping companies shy away from them, but road haulage firms have looked for alternative routes for goods that otherwise would have been transited through the troubled state.”

An official in Latakia said the port was ready to receive ships as normal although business was down.

“In terms of operational problems we don’t have any. There are also no problems with our infrastructure and no damage so we are ready to operate one hundred percent as normal,” the official said. “However, of course because of the situation the volumes of cargo are much less.”

Port officials in Tartous did not respond to requests for comment and official data was not immediately available.

HIGH RISK ZONE

In late 2011, London’s marine insurance market added Syria to a list of areas deemed high risk for merchant vessels, which has also led to higher shipping costs, trade sources say.

“The situation in Syria is such that underwriters really need to be notified if a vessel wishes to go there so they can make their own decision as to whether that risk is bearable at the current terms, or change the terms or conditions for the risks,” said Neil Roberts of the Lloyd’s Market Association, which represents insurance underwriting businesses in the Lloyd’s market.

France’s CMA CGM, the world’s third-biggest container group and part of a consortium that manages the Latakia terminal, said it still called at both Latakia and Tartous.

Others though have scaled back activities, including the world’s number one ship container firm Maersk Line, which offers a weekly feeder service via a sister company after cutting direct calls due to a lack of profitability.

Feeders transport containers which are loaded from bigger ships at other locations or at transshipment hubs such as Egypt or Lebanon.

“We are abiding strictly by the comprehensive sanctions imposed by the international community and this more than anything has reduced the flows into Syria,” said Simon Brown, head of Maersk Line Egypt.

“We continue to accept bookings for any commodities not on the restricted list, for example humanitarian aid, food and medicine. It is our hope that the security situation continues to allow safe passage of vessels and cargo through to Syria.”

Join The Club

Join The Club