Yemen’s Houthis Target MSC Ship in Gulf of Aden

DUBAI, April 25 (Reuters) – Yemen’s Houthis said they targeted the MSC Darwin ship in the Gulf of Aden on Thursday, as the Iran-aligned group resumed attacks on commercial ships in the Red Sea...

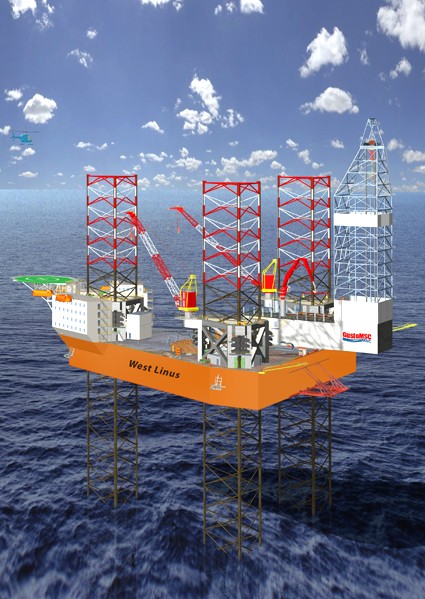

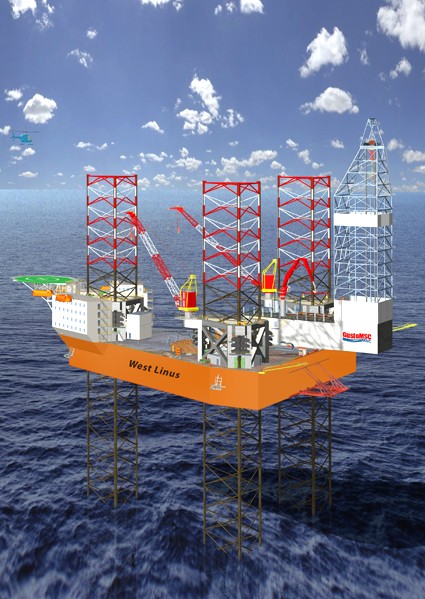

The total acquisition cost will be $600 million and the drilling rig will be chartered back to NADL on a bareboat contract for a period in excess of 15 years. NADL has been granted four purchase options, first time after five years and the last at the end of the charter period. Ship Finance will also have an option to sell the rig back to NADL at the end of the charter period. NADL has sub-chartered the rig to ConocoPhillips Skandinavia AS (“ConocoPhillips”) for a period of five years with two extension options of two years each. Expected delivery to ConocoPhillips is April 2014 and the rig will be at a mobilization rate from the delivery from the shipyard until commencement of the sub-charter.

$195 million of the purchase price was paid in June 2013, and the remaining $405 million will be paid on delivery from the shipyard in December 2013. The financing package will be $475 million in total, of which $70 million has been funded now, and $405 million will be funded at delivery from the shipyard. The $125 million equity investment has been funded from the Company’s recent equity offering.

The bareboat charter rate over the first five years (excluding the four-month mobilization period) will be approximately US$220,000 per day and the average rate for the remaining 10-year lease period will be approximately US$115,000 per day. The transaction will add more than $800 million to our the charter backlog, and the average yearly net cash flow, after interest and loan amortization, is estimated to be approximately $19 million, or $0.20 per share, during the first five years.

NADL is an offshore harsh environment drilling company with focus on the North Atlantic basin. The company has nine drilling units in the fleet, including five semi-submersible, a drillship, and three jack-up rigs. Seadrill Limited currently owns 74% of the outstanding shares and the company is listed on the Oslo OTC exchange with a market capitalization of approximately $2 billion.

The bareboat charter includes an interest compensation clause whereby NADL will compensate us for volatility in the interest rate environment, and due to the frontloaded nature of the contract, we will be able to repay the loan amounts quickly. We expect the rig-owning subsidiary to be accounted for as ‘Investment in associate’ under US GAAP, similar to our three deepwater drilling rigs on charter to Seadrill.

Ole B. Hjertaker, CEO of Ship Finance Management AS, said in a comment: “Ship Finance has in the recent months invested nearly $1 billion in new assets which is a firm commitment to our continued growth strategy. We are very pleased to increase our exposure to the strong offshore industry with a state-of-the-art harsh environment jack-up drilling rig which will be employed on a long-term drilling contract to ConocoPhillips. Our charter backlog and long-term distribution capacity is building in an accretive manner, and there is still good capacity for more investments.”

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,881 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,881 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up