Shell to Chevron Move Offshore as Nigerian Risks Mount

July 31 (Bloomberg) — At Royal Dutch Shell Plc’s compound in the Nigerian city of Warri, the gate is locked, the grounds are empty and grass has overgrown since Europe’s biggest oil company closed its operations in March after more than 40 years.

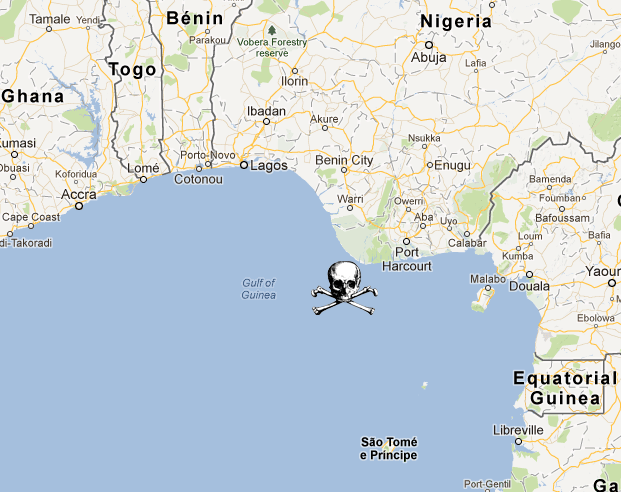

After Warri saw some of the nation’s worst unrest in two decades, Shell has sold land-based fields that pumped about 400,000 barrels a day in the 1990s, valued at $1.2 billion a month at today’s crude prices, and is buying fields offshore.

International oil companies including Shell and Chevron Corp. are shifting their efforts in Africa’s largest producer from land-based operations to offshore fields, where the risk of kidnapping, sabotage and crude theft is lower. The increased security also brings costs that are more than 40 percent higher, according to estimates from Nigeria’s national oil company.

“Due to the increased level of oil theft and disruptions, a number of oil companies have started selling blocks in the troubled areas and moving to deep water offshore blocks,” Rolake Akinkugbe, London-based head of oil and gas at Ecobank Research, said in an e-mailed response to questions. “The move offshore is being viewed as a longer-term solution to the challenges faced onshore and in the shallow waters.”

Business Plan

Deep-water fields that first began production 10 years ago now account for more than half of Nigeria’s production. With output suspended at about 40 land-based fields after armed attacks, Nigeria has compensated for the loss by increasing offshore projects, according to data from the petroleum ministry. Average output fell 110,000 barrels in July to 1.92 million barrels a day, according to a Bloomberg survey. Bonny Light crude, one of the country’s main export grades, rose 0.1 percent to $109.98 as of 5:05 p.m. in London.

Chevron, the Hague-based Shell, Exxon Mobil Corp., France’s Total SA and Eni SpA of Italy run joint ventures with state- owned Nigerian National Petroleum Corp. that pump most of the country’s oil. Shell, the oldest and biggest energy company in Nigeria, sold eight oil leases in three years. San Ramon, California-based Chevron, said last month it wants to sell five fields in shallow waters in the western delta and swamps in the east.

Precious Okolobo, a spokesman for Shell in Nigeria, said he couldn’t comment on the company’s policy regarding onshore and offshore oil fields when contacted. Shell is undertaking “a strategic review” of its Nigerian business and may “exit from the interests it holds in some further onshore leases,” its local unit said in a statement on June 21.

Business Opportunities

Chevron is reviewing its business plan in Nigeria and adopting new approaches to investment due to the current situation, James Craig, a Houston-based spokesman, said July 24 in an e-mailed response to questions.

“The emerging situation brings with it some important challenges to our traditional way of doing business and also provides us some attractive business opportunities,” Craig said without giving further details. “Our commitment to Nigeria remains strong. We have been in Nigeria for over 50 years.”

Total and Eni have also sold interests in some onshore assets they jointly owned with Shell. Charles Ebereonwu, Total’s spokesman in Nigeria, said he couldn’t comment when contacted by phone in Abuja today. An Eni spokesman declined to comment.

As the large oil companies leave, their onshore fields are being bought by mostly smaller, Nigerian companies.

Armed Attacks

Exxon Mobil, whose operations were limited to the shallow and deep offshore waters of the southeastern coast, has recorded the lowest number of output disruptions, with only three attacks in the last decade, compared with 945 recorded by Shell between 2007 and 2012. David Eglinton, an Exxon Mobil spokesman based in Houston, declined to comment for this story.

“The move to deep offshore by these companies frees up the onshore fields for the local companies to increase their production,” Omar Farouk Ibrahim, a spokesman for the state oil company also known as NNPC, said in a phone interview on July 29. “It gives room for those who don’t have the capacity for deep offshore to participate in the industry by operating the onshore and shallow water fields.”

Armed attacks led by the Movement for the Emancipation of the Niger Delta, or MEND, cut Nigeria’s oil output by 28 percent, mainly from the delta’s swamps and shallow waters, according to data compiled by Bloomberg, between 2006 and 2009. They subsided after thousands of fighters accepted a government amnesty offer in 2009 and disarmed.

Renewed Assaults

The former rebels are turning to crime because the government failed to follow up the amnesty by meeting their demands to end poverty and grant the region more benefits from crude production after President Goodluck Jonathan assumed office, according to Anyakwee Nsirimovu, executive director of the Port Harcourt-based Institute of Human Rights and Humanitarian Law.

MEND said last year it has renewed assaults on the oil industry and claimed responsibility for a number of attacks.

A new surge in disruptions through oil theft by criminal gangs tapping the fuel from pipelines for local refining or to sell to vessels waiting offshore saw Nigeria’s output falling to the lowest in four years. The West African nation lost $7 billion in revenue in 2011, about a quarter of this year’s national budget, according to the central bank.

Shell pioneered offshore oil exploration in Nigeria with the discovery of the Bonga field, located 120 kilometers (75 miles) at sea, in 1995. With reserves estimated of about 1 billion barrels, it has capacity for 220,000 barrels daily, producing into a floating production, storage and off-loading vessel moored in the sea.

Reform Bill

Other discoveries quickly followed, confirming the prodigious prospects of the Gulf of Guinea. These include Chevron’s Agbami field estimated at over a billion barrels, Total’s Amenam and Akpo fields and Exxon Mobil’s Erha and Yoho fields. Most of the offshore fields are yet to reach peak production and more discoveries, such as Egina, Bonga North, Bonga Southwest and Aparo, have been added.

While delays in passing a new law to reform the way Nigeria’s oil industry is regulated and funded have discouraged investments in the past four years, Shell and Eni went ahead in 2011 to pay $1.1 billion to acquire a deep water field from Malabu Oil and Gas Ltd. The field is estimated to hold reserves of more than 9 billion barrels.

Energy companies operating in Nigeria say that fiscal terms proposed in the bill will make exploitation of Nigeria’s offshore oil reserves unprofitable. Under its proposals the government will increase its take from hydrocarbons to about 73 percent from 61 percent through higher taxes and royalties. Lawmakers are to vote on the bill in October after receiving committee reports from public hearings held on its proposals, according parliamentary schedule.

Apart from security concerns, energy companies in Nigeria “are refocusing on deep-water production” because of declining onshore reserves, Gbenga Sholotan, an energy analyst at Lagos- based Stanbic IBTC Bank, said in a July 26 e-mailed response to questions. “As such reserve replacement strategy comes into play.”

The approach appears justified by the size of the fields so far discovered in Nigeria’s deep waters, Sholotan said.

Subscribe for Daily Maritime Insights

Sign up for gCaptain’s newsletter and never miss an update

— trusted by our 109,081 members

Get The Industry’s Go-To News

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Join The Club

Join The Club