(Bloomberg) — Oil-tanker rates have jumped for vessels hauling refined fuel cargoes from the Caribbean and Europe on strengthening export volumes from the U.S. Gulf, according to investment bank Dahlman Rose & Co.

Earnings for tankers jumped to $25,000 a day compared with an average this year so far of $10,000, Omar Nokta, a New York- based analyst, said in an e-mailed report today.

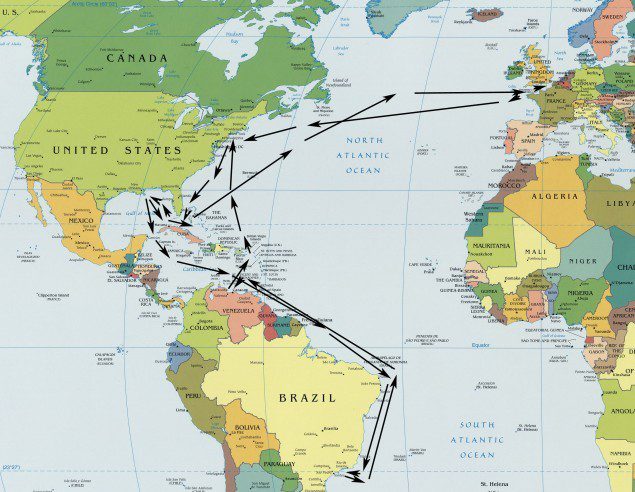

A ship can transport gasoline from the U.S. Gulf to Brazil, and after unloading, it can sail to Venezuela, and collect another cargo of the road fuel bound for the U.S. Atlantic Coast. After unloading the shipment, the vessel is then able to return to the gulf and load a diesel cargo for Europe. It can then return carrying gasoline to the U.S. Atlantic Coast. This trading pattern, known as triangulation, increases a ship’s utilization rate and boosts earnings, Nokta said.

“Strength across the various routes globally is likely to keep vessel supply in check, leading to higher highs and higher lows,” for spot or single-journey rates, Nokta said in the report. “Considering peak winter season trading activity is on the horizon, and rates are at a high base already, it seems likely that the next 3-4 months will be quite beneficial to product tanker owners.”

– Rob Sheridan, Copyright 2012 Bloomberg

Join The Club

Join The Club