Photo: hkhtt hj / Shutterstock

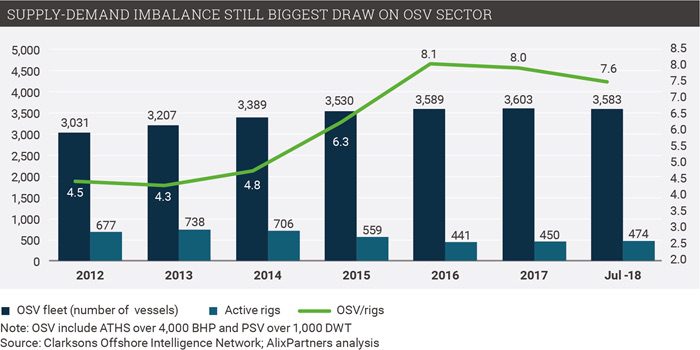

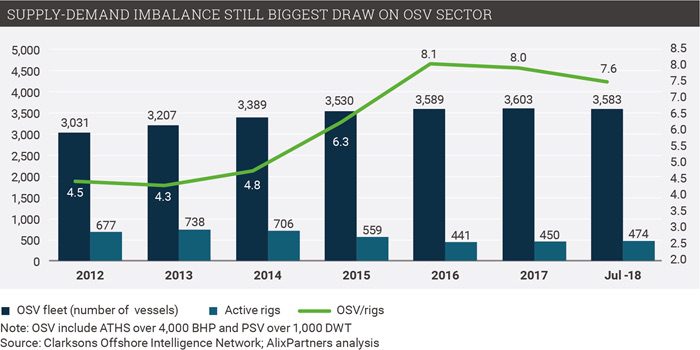

The offshore supply vessel (OSV) sector continues to be in serious trouble despite a rebound in oil prices as too many vessels compete for limited business opportunities, according to a new study from the global consulting firm AlixPartners.

As a result, OSV companies must take quick and decisive action in order to survive in what should be considered the “new normal,” AlixPartners said. In fact, nearly 90% of the OSV companies analyzed by the firm were perceived to be at high risk of bankrupcty.

“Despite the recovery in oil prices, the OSV industry remains in trouble. Charter rates across most asset classes and regions are still running at or close to operating cost levels. There is a continued glut of vessels, caused by over-ordering during the boom in oil prices and easily accessible bank credit, hampering the industry. Companies hoping for a dramatic rebound in OSV vessel demand are playing a dangerous waiting game, as their existing financial resources are likely not enough to sustain them through the current environment,” AlixPartners said in its report on the study.

According to the analysis, 34 of 38 companies had Altman-Z scores of less than 1.8, indicating a high likelihood of bankruptcy in the next 12 months.

“It is abundantly clear that OSV operators need to face the music on the current state of the market and the real probability that we won’t be heading back to sustainable industry dynamics without a structural change to the sector,” said Jeff Drake, Managing Director at AlixPartners. “Companies need to be disciplined about capacity management and do everything they can to reduce costs and increase operational efficiency.”

According to AlixPartners, offshore rig utilization and day rates, the two factors that drive revenue for OSV companies, are still more than 30% below 2014 levels. Other factors such as abundant shale oil supplies and the impact of energy transition on oil demand in the medium-to-long term will are also seen as constraining new offshore wells. &

Based on these factors, AlixPartners estimates that the global OSV market is currently oversupplied by about 1,150 vessels, including about 900 vessels that are 15 years or older, which will likely make it difficult for them to find work.

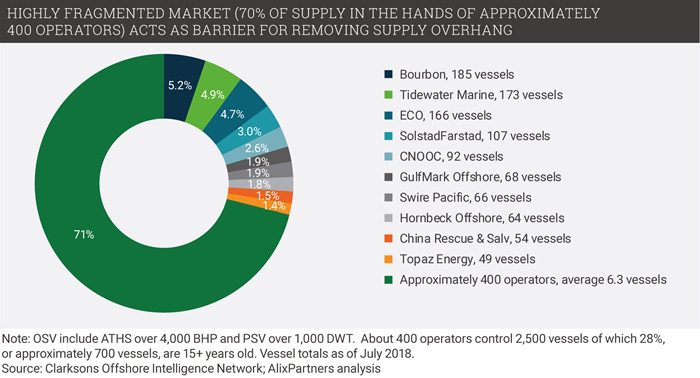

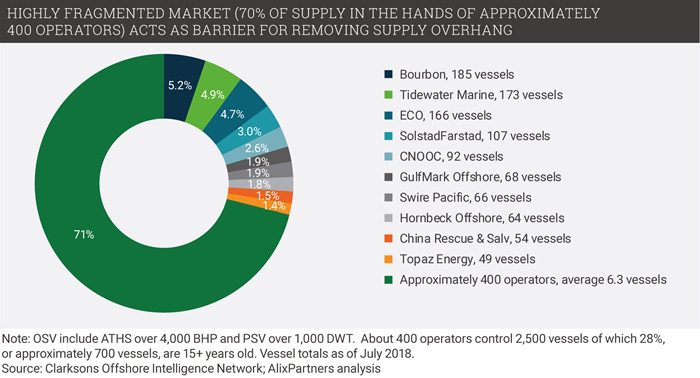

There are issues preventing a reduction in the overall supply of vessels as well.

Chiefly, AlixPartners says, the sector is fragmented, with the largest operators controlling 30% of the fleet and the remaining 70% controlled by 400 smaller operators with fleets of six or fewer vessels. “Small operators have little incentive to retire any of their own fleets and are loathe to take action that would benefit the larger companies or the sector overall,” it said.

Recommendations

Luckily, AlixPartners did make some recommendations on what companies can do to survive the prolonged downturn.

“Presently, operators are price takers in the market at rates at or close to operating expenses. Companies will need to be more ambitious about their cost-cutting plans, by streamlining both operating and selling, general and administrative (SG&A) expenses. Some of which to be driven by employing state-of-the-art technology.

“Consolidation will likely play an increasing role to address some of the apparent supply overhang while realizing cost synergies and in turn improving the sector’s value proposition. On the other hand, debt restructurings seem still off-limits for some creditors. The fact remains, though, that with a debt/EBITDA ratio of 23.9x, the sector is overleveraged, most of that debt is unlikely to be repaid.

“The difficult and painful actions that are required now to become more cost-competitive and restructure balance sheets could create stronger world-class companies that can not only survive this crisis, but even thrive if the sector recovers.”

For additional information, see AlixPartners’ paper, “Too Many Ships, Too Few Rigs: Why Recovery is Still a Distant Dream for the OSV Sector.”

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club