By Josh Saul (Bloomberg) —

The head of Danish energy giant Orsted A/S says the US is an attractive place to build new offshore wind farms even after inflationary shocks devastated the sector over the past year. The reason: the newest deals to sell electricity include crucial provisions that increase the price of power if inflation goes up.

“When US states choose to offer inflation protection, that increases the attractiveness of the US,” Orsted A/S Chief Executive Officer Mads Nipper said in an interview Wednesday.

It’s a different approach after pandemic-era inflation spikes and supply-chain disruptions rendered many US offshore wind projects unprofitable, which roiled the industry. Now states including New York and New Jersey are negotiating electricity contracts that stipulate prices rising alongside the consumer price index and other inflation indices, he said.

Nipper said such provisions would also protect developers if a Republican president managed to slow down the permitting process. Without such protections, developers would just add any potential price increases into their bids; that’s why such protections are the best way to make sure consumers only pay for inflation if it actually happens, he said.

Last year Orsted canceled two wind projects off the coast of New Jersey, taking a $4 billion writedown. Earlier this month the company said it would suspend dividend payments until at least 2025, slash plans to build new projects this decade by at least 24% and eliminate as many as 800 jobs.

“It’s a company that took a blow to the jaw in 2023,” Nipper said. “Our focus is to take action now.”

Orsted is among many companies in the US offshore-wind industry that have struggled with high inflation, supply-chain bottlenecks and difficulties securing financing. BP Plc and Equinor ASA also took big writedowns on projects this year.

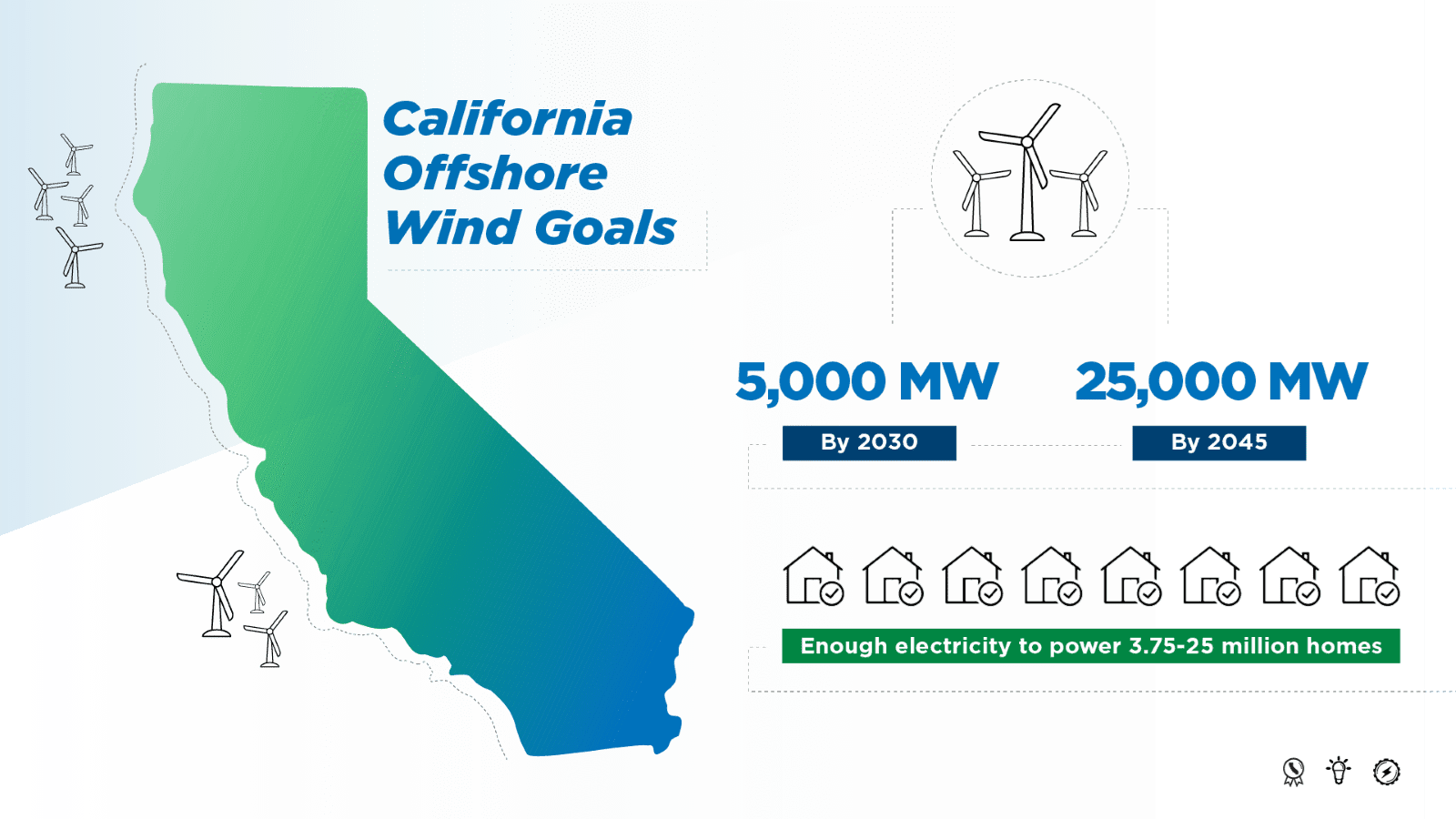

Many of the power agreements signed for the electricity produced by planned offshore developments have been canceled or are in dispute. President Joe Biden laid out a target in 2021 of deploying 30 gigawatts of offshore wind capacity by 2030, part of his goal to decarbonize the US electric grid and slow climate change. But a cascading series of setbacks have some analysts projecting the US will reach little more than half that amount by the end of the decade.

One project that has largely steered clear of stumbling blocks is Dominion Energy Inc.’s $9.8 billion Coastal Virginia Offshore Wind project, which will have 176 turbines and stand in water about 27 miles (43 kilometers) off Virginia Beach. Dominion said Thursday that it sold a 50% non-controlling stake in that project to infrastructure-focused private equity fund Stonepeak for $3 billion.

© 2024 Bloomberg L.P.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club