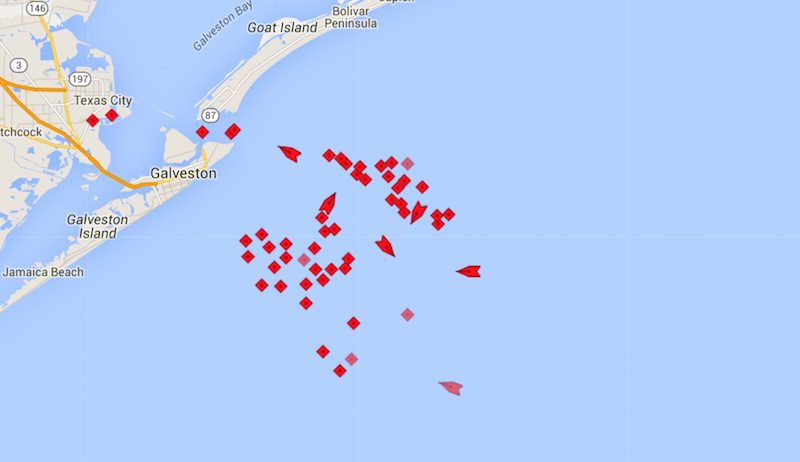

Tankers seen at anchor off the coast of Galveston, Texas, November 10, 2015. Image: MarineTraffic.com

HOUSTON, Nov 10 (Reuters) – A traffic jam of oil tankers has emerged along the U.S. Texas coast this month, a snarl that some traders see as the latest sign of an unyielding global supply glut.

HOUSTON, Nov 10 (Reuters) – A traffic jam of oil tankers has emerged along the U.S. Texas coast this month, a snarl that some traders see as the latest sign of an unyielding global supply glut.

More than 50 commercial vessels were anchored outside ports in the Houston area at the end of last week, of which 41 were tankers, according to the Houston Pilots, an organization that assists in the navigation of larger vessels in and around port areas. Normally there are between 30 to 40 vessels anchored offshore, of which two-thirds are tankers, according to the pilots.

Although the channel has been shut intermittently due to fog or flooding in recent weeks, pilots said those issues were not significant enough to create the backlog.

“It’s not because of a lack of pilots or tug boats,” according to JJ Plunkett, a Port Agent with the Houston Pilots.

As of Nov. 6, more than 20 million barrels of crude were sitting in vessels anchored outside the U.S. Gulf Coast waiting to discharge, double the volume that typically discharges each week, according to Matt Smith, Director of Commodity Research at ClipperData.

“We’re seeing ships idling off the coast of China, Singapore, (the) Arab Gulf, and now the U.S. Gulf. It appears that the glut of supply in the global market is only getting worse,” Smith said.

Oil traders in the U.S. cash market pointed to everything from capacity constraints at Gulf Coast storage tanks to a lack of buyers for the imported barrels.

While U.S. data show Gulf Coast inventories hit a record 251.7 million barrels just over a week ago, major facilities at Corpus Christi, Houston, the Beaumont-Nederland area, and St. James, Louisiana, were still barely two-thirds full at the end of October, according Genscape data.

Several traders said some ships may have arrived without a buyer, which can be hard to find as ample supply and end-of-year taxes push refiners to draw down inventories.

At the same time, the steepening contango structure of the oil futures market – in which prompt barrels are priced at a discount to future contracts – has diminished the urgency to unload vessels.

The spread between first- and sixth-month WTI has fallen by nearly $1 in three days to more than $4, its lowest since August but still not enough to make it profitable to store excess crude on tankers, traders said.

On Monday, the December to January contango for WTI hit its widest level since the end of April, with January trading up to a $1.30 a barrel premium to the prompt contract.

(Reporting by Liz Hampton, with additional reporting by Marianna Parraga in Houston and Catherine Ngai in New York; Editing by Chris Reese)

(c) Copyright Thomson Reuters 2015.

Join The Club

Join The Club