European Ports Spearhead Movement for Greater LNG Bunkering Infrastructure

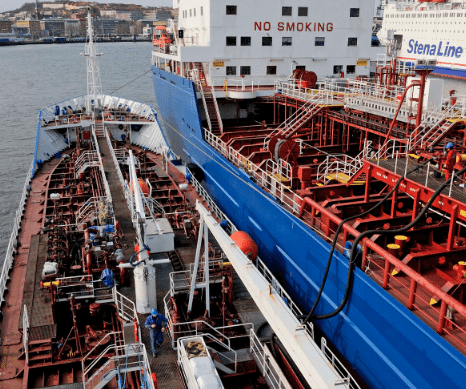

Bunkering at Port of Gothemburg. Via Port of Gothenburg

By Henning Gloystein and Jonathan Saul

LONDON, March 5 (Reuters) – North European ports are leading a switch to natural gas as a cleaner way to power ships than burning oil-based bunker fuel, while regulation and cost benefits are likely to convince other sectors to follow in coming years.

Gas has been used so far mostly for power generation and heating, while oil products have dominated the transport sector.

The outlook for cheaper gas in the wake of the shale gas boom in North America as well as toughening environmental regulation in Europe have driven up investment in gas as a transport fuel.

Ports in northern Europe, pushed by regulation to clean up a major source of pollution, are now at the forefront with the planned installation of liquefied natural gas (LNG) fuel stations for ships, known as bunkering, before the end of the decade.

“At present there are around 20 vessels in operation using LNG as a marine fuel; almost all are in Scandinavia. Many more are on order, and even more will be likely to be ordered,” said Andrew Clifton, general manager of the Society of International Gas Tanker and Terminal Operators.

The shift in ship engines will follow.

“It will be at least two years before major deep-sea shipping companies order LNG-powered engines once financing becomes more available,” said Arthur Barret, director of LNG bunkering at French group Gaztransport & Technigaz.

“By then, hopefully, there will also be more infrastructure to load LNG as a ship fuel,” he added.

An European Union draft law has set a goal to cut greenhouse gas emissions from the shipping sector by at least 40 percent by 2050 from 2005 levels. The European Commission is pushing for regulation that will oblige all major ports in the EU to provide LNG refuelling facilities by 2020.

“There seems to be a very strong economic argument in favour of supporting LNG in shipping,” a European Commission working document published in January said.

Swedish infrastructure company Swedegas and Dutch oil and gas storage company Vopak are jointly investing around 1 billion Swedish crowns ($155.3 million) in an LNG terminal at the port of Gothenburg, Sweden’s biggest. Swedegas said it was also looking to fit other Swedish ports with LNG stations.

“We can start bunkering in Gothenburg in 2015, and activity will be expanded by 2017,” a spokeswoman for Swedegas said.

The Belgian port of Antwerp, one of Europe’s biggest, is chairing an international working group with other leading ports, including Amsterdam, Bremerhaven, Brunsbuttel, Gothenburg, Hamburg, Le Havre, Los Angeles, Long Beach, Rotterdam, Stockholm and Zeebrugge, to develop guidelines on safe procedures for LNG bunkering operations.

Rotterdam and Singapore, both major transport hubs, have already announced plans to invest in facilities that would allow ships to take LNG as a marine fuel, and Norway has already developed a state-driven national LNG marine transport fuel storage network.

BIG CHANGE AHEAD

Ports in North America, also affected by new industry standards to reduce pollution from ships within so-called Emission Control Areas, are beginning to follow suit.

Anglo-Dutch energy major Royal Dutch Shell said on Tuesday it would build two small-scale gas liquefaction units in Louisiana and Ontario, with plans to become operational by 2016, in order to unlock value in the use of LNG as a transport fuel.

“Populated coastal areas have emissions standards that prohibit the use of heavy fuel oil, so ‘cleaner’ options should become increasingly popular in coming years,” Urs Dur, managing director of Clarksons Capital Markets, said in a report.

Even so, the shift will take time and start in big commercial markets because of the need for massive investment in global infrastructure to transport and distribute gas, starting with LNG import and export terminals at ports.

Shell has said gas will ultimately overtake oil as the world’s most used energy source, driven largely by growth in the transport sector.

“In the 2030s, natural gas becomes the largest global primary energy source, ending a 70-year reign for oil,” the company said in a report published in February.

Shell did not see an end to the primacy of oil in the road transport market before 2040, however. In the auto market, gas-powered vehicles also will face stiff competition from electric cars, it added.

China and the United States are both making attempts to replace more oil-powered vehicles with cleaner gas.

“The high energy density of the fuel increases the driving range; this makes LNG an interesting option for the heavy-goods transport sector,” said Rolande LNG, a Dutch road gas transportation company, adding that it was already relatively well developed for use in trucks in the United States.

In China, the government has targeted the country’s vast transport sector as a preferred user of natural gas.

(c) 2013 Thomson Reuters, Click For Restrictions

Subscribe for Daily Maritime Insights

Sign up for gCaptain’s newsletter and never miss an update

— trusted by our 109,088 members

Get The Industry’s Go-To News

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Join The Club

Join The Club