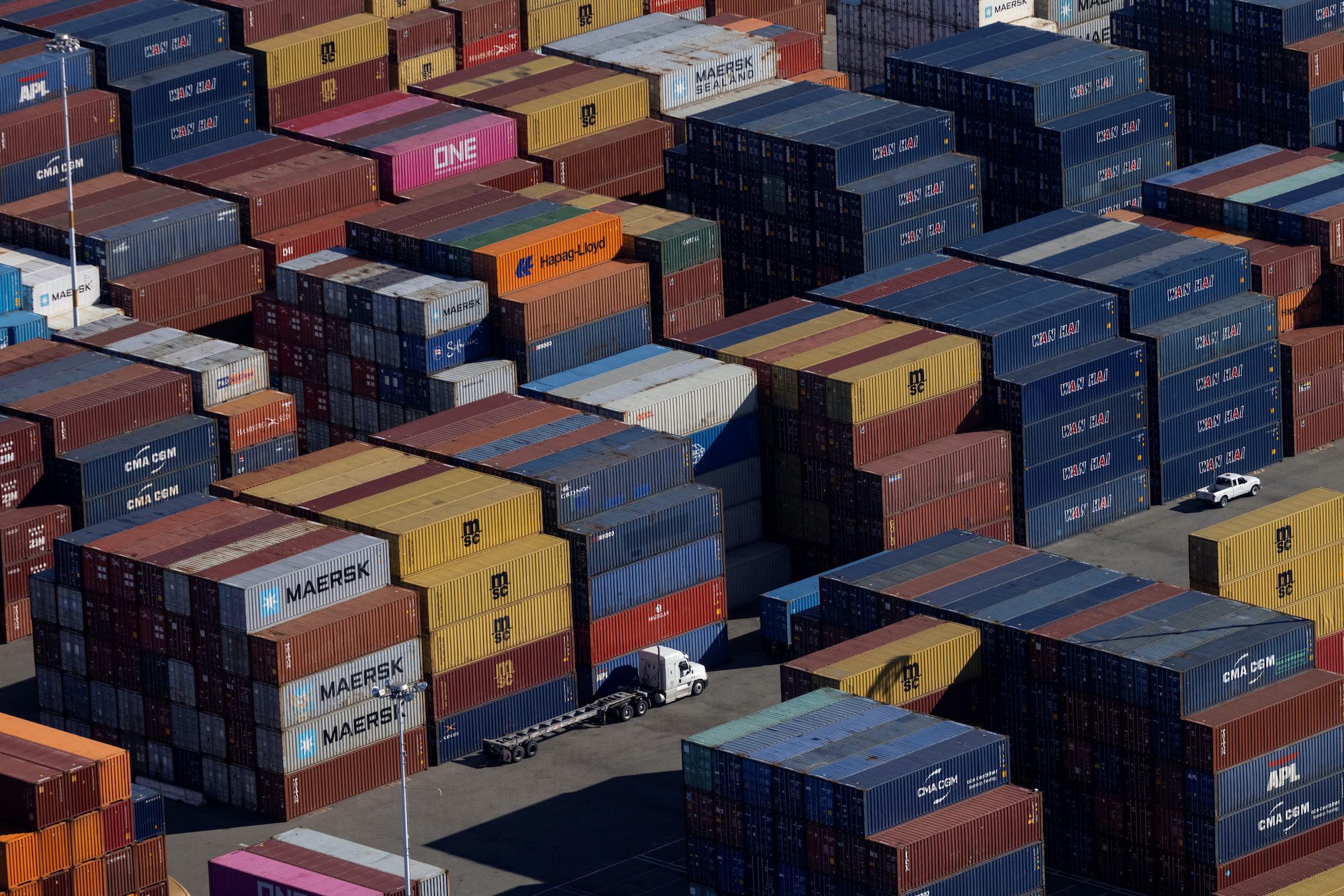

Imports into the top 10 U.S. container ports fell 5.5% in September driven by a steep drop on the West Coast, industry veteran John McCown said in his latest monthly report.

September saw the biggest decline in inbound container volume in 27 months, marking an acceleration of the 0.6% decline in August and the 0.3% decline in July.

West Coast ports saw inbound container volumes fall a dramatic 17% for the biggest drop in years amid ongoing concerns over port labor negotiations, which resulted in more cargo shifting eastward to East and Gulf coast ports. In fact, the East-West gap widened even further in September, continuing a trend that we have seen play out this year. While West Coast ports saw a sharp decline in volumes last month, East and Gulf coast ports saw a 6.6% increase in volume.

Once again, New York was the top destination for imports by far with 418,770 TEUs in September, compared to Los Angeles’ 343,462 TEUs and Long Beach’s 342,671 TEUs, according to McCown’s tally.

The lower number of inbound containers helped the congestion situation, with 24% less containerships waiting for berths last month than in August—99 ships in September vs. 130 ships in August. The Southern California backup, in particular, has continued to improve markedly, with East (in Savannah and New York) and Gulf coast (Houston) backups to a lesser extent.

A portion of McCown’s report that I’d like to highlight is his observations on “the perilous impact of container pricing on inflation,” which he notes is not on the same curve as improving congestion or is likely to go away anytime soon.

In his report, McCown writes:

“The wide range of pricing and lack of transparency on historical pricing levels and trends exacerbate the direct and indirect effects of inflation related to container shipping. The situation is compounded by information that is less precise than it should be.”

While some indices, like the Federal Reserve Bank of New York, include a pricing index for container shipping based on spot rates (which, by the way, have crashed this year), a more accurate measure of container shipping’s contribution to inflation “can only be measured by an aggregate index that takes into account all loads,” according to McCown.

“Container shipping is too important a part of the U.S. economy not to have more credible actual pricing indices. The [U.S. Energy Information Administration] is an entire federal agency that came into being to provide factual and transparent pricing related to energy because it was too important to be left to anecdotal reporting. In my view,” McCown writes, “a smaller version of that focused on historical container shipping pricing would play a constructive for the U.S. economy.”

“Opacity played a key role in what has occurred in container shipping during the pandemic and it is best inoculated with transparency,” he concludes.

You can read the full report on LinkedIn here.

Join The Club

Join The Club