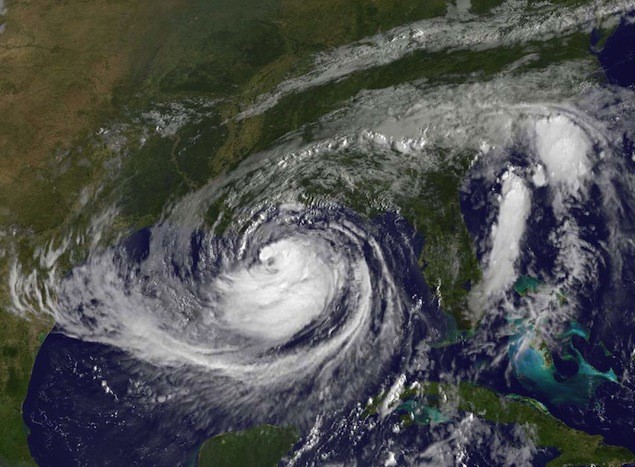

Hurricane Isaac smack dab in the middle of the Gulf of Mexico’s oil production. Credit: NASA GOES Project

(Bloomberg) — The power of hurricanes to drive up oil prices is diminishing as the proportion of U.S. crude coming from the Gulf of Mexico falls to a 14-year low because of the increase in onshore shale production.

Oil prices were little changed in the week ending Aug. 31, even as more than 90 percent of Gulf capacity was shut for five consecutive days with Hurricane Isaac hitting the region. Oil jumped 44 percent in 2008 during Hurricane Ike and 14 percent in 2005 when Katrina devastated the Gulf Coast. Crude inventories rose a week after Isaac made landfall in Louisiana while Katrina cut stockpiles for six straight weeks.

U.S. oil production reached a 13-year high in July as growth in output from shale-rock formations, including the Bakken in North Dakota, bolstered supplies and sent inventories to the highest levels since 1990. Production in the federal waters of the Gulf will account for 21 percent of domestic output this year, the lowest level since 1998 and down from 29 percent in 2009, according to Energy Department data.

“The U.S. supply story is shale production,” Harry Tchilinguirian, BNP Paribas SA’s London-based head of commodity markets strategy, said in a phone interview yesterday. “It’s not so much about the Gulf and the impact of hurricanes is just a temporary shutdown of production that should recover quite rapidly.”

Crude for October delivery gained 38 cents, or 0.4 percent, to $98.69 a barrel at 12:07 p.m. on the New York Mercantile Exchange after climbing to $100.42. Prices rose 0.3 percent in the week ended Aug. 31.

Hurricane Isaac

Isaac, a Category 1 hurricane, made landfall on Aug. 28, shutting in as much as 1.31 million barrels a day of production on Aug. 30, or 95 percent of the region’s capacity, according to the Bureau of Safety and Environmental Enforcement.

Closures remained above 90 percent, or more than 1.2 million barrels a day, in the five days ended Sept. 1. About 36 percent of Gulf output was still shut on Sept. 7.

“Storms aren’t going to cause as much damage as they used to,” Kyle Cooper, director of commodities research at IAF Advisors in Houston, said in a phone interview. “The Gulf is still an important part of the U.S. oil market but its significance has been declining over the past few years.”

There were no storms threatening production in the Gulf of Mexico this week. Tropical Storm Nadine, the 14th named system of the Atlantic season, was 765 miles (1,235 kilometers) east- southeast of Bermuda and posed no threat to land, the National Hurricane Center said today in its latest advisory.

Isaac cut a total of 10.5 million barrels of oil supply from the Gulf, according to LCI Energy Insight, an energy analysis firm in El Paso, Texas.

Lesser Impact

“Obviously the Gulf is producing less oil and storms are not going to have the immediate price impact that we’ve seen in the past,” Luke Larson, vice president at LCI, said by phone yesterday.

Ike and Katrina cut more oil production than Isaac and caused more damage to offshore platforms.

Oil prices surged to $130 a barrel on Sept. 22, 2008, from as low as $90.51 six days earlier after Ike, a Category 2 storm, made landfall on Sept. 13 near Galveston, Texas, less than two weeks after Hurricane Gustav hit the region. Ike cut 21.5 million barrels of oil from Gulf production, according to the Energy Department.

Katrina, which went ashore on Aug. 29, 2005 as a Category 3 storm, curtailed 30.2 million barrels of output. Oil prices jumped to $70.85 a barrel on Aug. 30 from as low as $62.25 on Aug. 18.

More Resilient

The Gulf is better able to withstand storms as oil companies upgraded their facilities after Katrina. Offshore production was also in decline as the moratorium imposed after the BP Plc oil spill slowed the development of deep-water fields.

“A lot of these platforms have been upgraded after the events that we’ve seen in 2005 so they are in a better position to endure adverse weather conditions,” said Tchilinguirian. “If you would have a bearing on the market you need permanent shutdowns.”

Gulf output is forecast to fall to 1.3 million barrels a day this year from 1.56 million in 2009, according to the Energy Department. Output in the lower 48 states excluding the Gulf is forecast to grow to 4.51 million barrels a day, the most since at least 1993.

“If it had not been for that drilling moratorium, Gulf production would have been higher,” said James Williams, an economist at WTRG Economics, an energy-research firm in London, Arkansas. “It’s going to take another two or three years to get Gulf production back to where it was.”

Drilling Ban

The six-month drilling ban in waters deeper than 500 feet (152 meters), imposed after BP’s Macondo well off Louisiana blew out April 20, 2010, was lifted in October of that year.

Shale oil has been boosting U.S. domestic production amid slower drilling in the Gulf. Total production increased to 6.36 million barrels a day in the week ended July 20, the most since February 1999, according to the department. Crude inventories rose to 387.3 million in the week ended June 15, the most since July 1990.

“A lot of the growth that we’re going to be seeing in the domestic oil production is going to be coming from onshore rather than offshore,” Adam Sieminski, the head of the Energy Department’s Energy Information Administration, said during a Bloomberg Government lunch on Aug. 22.

North Dakota

Production in North Dakota jumped to 660,000 barrels a day in June from 386,000 a year earlier, according to the department. Texas, the biggest producing state, increased to 1.9 million barrels a day, up from 1.41 million a year earlier.

“What’s happening in North Dakota is incredible,” John Felmy, chief economist at the industry-funded American Petroleum Institute, said in a phone interview. “There is no question that the industry is still committed to the Gulf.”

Imports from Canada are also reducing reliance on the Gulf. The country, the biggest oil exporter to the U.S., shipped a record of 2.52 million barrels a day to its neighbor in February, according to Energy Department data.

-By Moming Zhou. Copyright 2012 Bloomberg.

Join The Club

Join The Club