Connecticut and Rhode Island attorneys general have escalated their legal fight against the Trump administration’s abrupt halt to the Revolution Wind offshore energy project, filing for a preliminary injunction to immediately block what they describe as a “baseless stop work order” issued last month.

Attorney General William Tong of Connecticut and Attorney General Peter Neronha of Rhode Island initially sued on September 4 in U.S. District Court for the District of Rhode Island, seeking to overturn the administration’s directive. Their recent filing outlines what they characterize as “immediate and irreparable harm” to Connecticut and requests judicial intervention to allow construction to resume while the case proceeds.

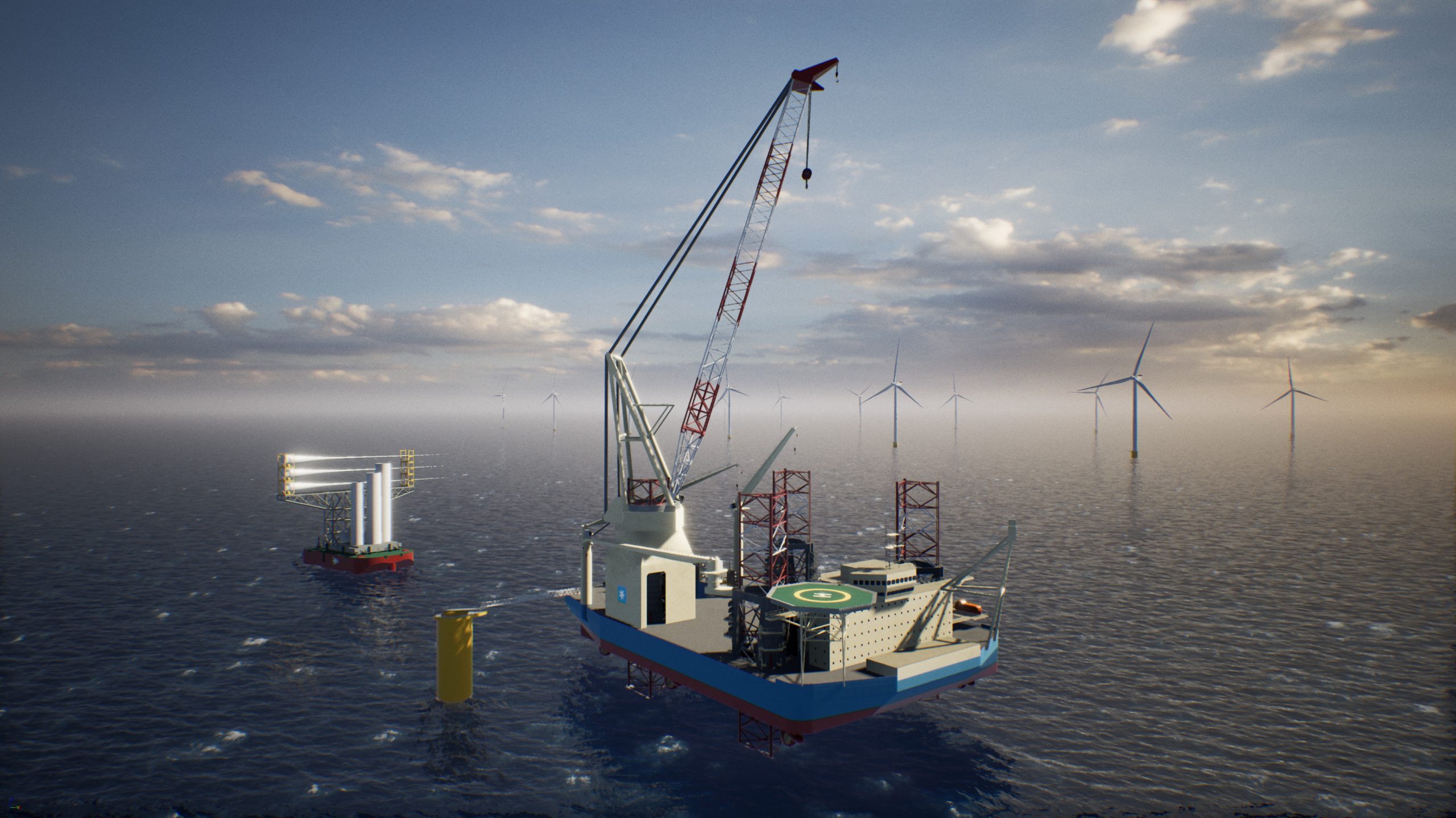

Located fifteen nautical miles off Rhode Island’s coast, Revolution Wind had reached approximately 80% completion with all foundations installed and 45 of 65 planned wind turbines already in place. The project is expected to deliver enough electricity to power 350,000 homes, representing 2.5 percent of New England’s electricity supply beginning in 2026.

“Connecticut families and Connecticut workers need Revolution Wind back on track—today. Every day that Revolution Wind sits mothballed in the ocean is another day of unemployment, another day of unaffordable energy costs, and another day burning fossil fuels when clean, affordable, American-made energy is within our sights,” said Attorney General Tong.

“We have no time to waste in getting Revolution Wind back online, which is why we’re asking the Court to put a stop to this on short order,” added Rhode Island’s Attorney General Neronha. “In the few weeks since the stop work order was issued, without warning or reason, Rhode Islanders have been harmed, facing daily uncertainty.”

On August 22, Bureau of Ocean Energy Management (BOEM) ordered Ørsted’s Revolution Wind project to halt all offshore activities pursuant to a January 2025 presidential memorandum that suspended federal approvals for wind energy projects and ordered a comprehensive review of existing projects. BOEM specifically cited concerns related to “protection of national security interests of the United States and prevention of interference with reasonable uses of the exclusive economic zone, the high seas, and the territorial seas.”

Revolution Wind, a 50/50 joint venture between Ørsted and Global Infrastructure Partner’s Skyborn Renewables, had received full regulatory approvals following a nine-year review process, including its Construction and Operations Plan approval in November 2023. The project secured 20-year power purchase agreements to deliver 400 MW to Rhode Island and 304 MW to Connecticut.

This week, the administration asked a judge to deny Revolution Wind’s request for a preliminary injunction, arguing the company “didn’t include enough detail about the expected breakaway costs or other construction deadlines to justify an ‘extraordinary’ injunction.” The government further stated, “With respect to the $5 billion figure, Revolution Wind has not explained how lack of money already spent would threaten the future viability of its business.”

Ørsted CFO Trond Westlie maintained that restarting the project remains a priority: “Our goal is to get back to work on Revolution Wind as soon as possible. And we work in multiple tracks to make that happen.”

The legal challenges from both the states and Revolution Wind allege that the sudden halt to construction after years of coordination with the government violates constitutional due process rights. This marks the beginning of a significant legal battle over recent orders reflecting what critics describe as the Trump administration’s longstanding opposition to wind power.

This development follows similar action against Equinor’s Empire Wind project earlier this year, which faced a temporary stoppage before being lifted after a month. However, that interruption resulted in significant financial consequences, with Equinor reporting “a significant impairment of $763 million” related to the project.

Ørsted is currently “evaluating the potential financial implications” of the stop work order while proceeding with a heavily discounted $9.4 billion rights offering to shore up its finances after setbacks in the U.S. market.

Join The Club

Join The Club