Updated: April 12, 2023 (Originally published October 7, 2013)

The World Bank lowered its economic growth forecasts for 2013 and 2014 for China and most of developing East Asia. It cited slower growth in the world’s most populous country as well as weaker commodity prices that have hurt exports and investments in countries such as Indonesia. “Developing East Asia is expanding at a slower pace as China shifts from an export-oriented economy and focuses on domestic demand,” the World Bank said in its latest East Asia Pacific Economic Update report. The report issued by the World Bank is consistent with other projections forecasting lower GDP growth estimates for 2013 and 2014.

The Washington-based development bank now expects developing East Asia to expand by 7.1% in 2013 and by 7.2% in 2014, down from its April estimate of 7.8% and 7.6%, respectively.

The World Bank now expects the Chinese economy to expand by 7.5% in 2013, down from its April forecast of 8.3% and below the International Monetary Fund’s most recent forecast of 7.75%. China’s 2014 GDP growth is estimated at 7.7%, down 0.3 percentage point from the previous forecast.

On China, the World Bank said the massive, investment-heavy stimulus program supported by credit expansion, the latest initiated in July/early August was an “unofficial economic stimulus” program had run its course, and policymakers must focus on containing the rapid growth of credit and tighten financial supervision.

Read: China: Economic Stimulus / Short-Term Dry Bulk Shipping Impact

It added local government debt was a concern, given the complexity and opacity of municipal finances, and said they should be reformed “with clear rules on borrowing, on allowed sources of borrowing, on debt resolution, and on the disclosure of comprehensive financial accounts by local governments,” Furthermore the World Bank believes, “the rapid expansion of shadow banking poses serious challenges, since shadow banking is closely linked to the banking system, is less regulated, and operates with implicit guarantees from banks and local governments,”

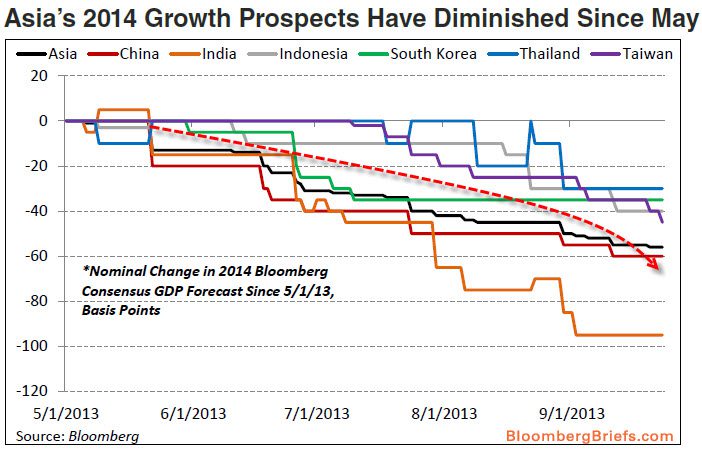

This economic forecast for China and developing Asia and the upcoming IMF forecast challenge analyst forecasts and investor expectations for dry bulk shipping as well as those predictions for the container (liner) and tanker markets. We have seen recent economic forecasts for Asia deteriorate, yet expectations that shipping will strongly rebound remains high. This is in spite of a strong orderbook in dry bulk and containers and reluctance on the part of shipowners to scrap ships.

Slower economic growth is not supportive of a strong shipping market in 2014.

The lower forecasts will also have the impact of reducing returns on projected investment returns over the next few years. Without additional economic stimulus programs initiated by central banks, “unofficial” or “official,” shipping markets will remain challenged in 2014 and the expected recovery by analysts and investors will be further pushed into the future.

Jay Goodgal can be reached via email at [email protected]

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club