Jan. 12 (Bloomberg) — Indonesia pushed ahead with a watered-down ban on mineral ore exports that will cut global nickel supplies and allow Freeport-McMoRan Copper & Gold Inc. to keep exporting copper concentrates.

Indonesia’s President Susilo Bambang Yudhoyono signed a regulation for the ore ban, Energy and Mineral Resources Minister Jero Wacik told reporters, after an 11th-hour meeting of government ministers in Cikeas, West Java, yesterday. The rule, which goes into effect today, permits exports of minerals that are processed or refined in the country.

The decision will ease concerns about disruptions to copper shipments and may push up nickel prices. Indonesia accounts for 3 percent of global copper supply, 18 percent to 20 percent of nickel and 9 percent to 10 percent of aluminum from bauxite, according to Goldman Sachs Group Inc. estimates.

“The law should clearly be bullish for nickel, as we should expect to see significant lower volumes of ore flow from Indonesia to China,” David Wilson, an analyst at Citigroup Inc. in London, said yesterday after the decision.

Nickel futures prices in London rose 3.3 percent on Jan. 10 to close at $13,860 a ton ahead of the expected ban by the world’s biggest mined nickel producer. Chinese ore stocks will become more valuable and many producers will not be able to use lower-grade ore from the Philippines as an alternative, Wilson said.

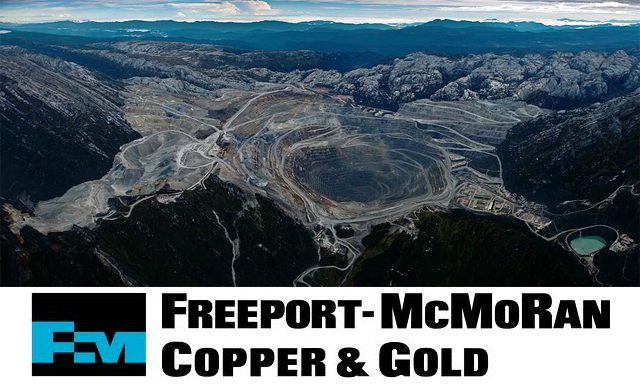

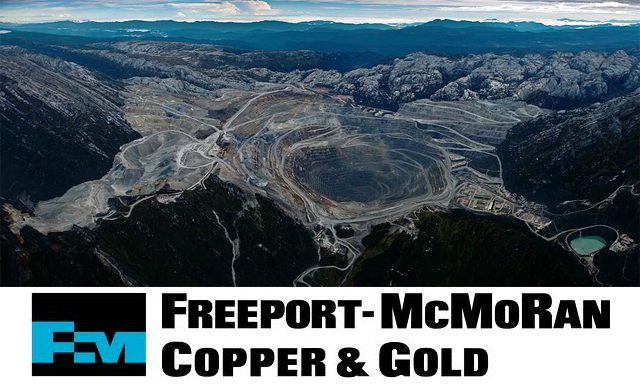

Newmont Mining Corp. and Freeport, which runs the world’s second-largest copper mine in eastern Indonesia, can keep exporting concentrates, Wacik said. More than 60 companies that are planning to process ore domestically will also be allowed exports, Wacik said, without giving the purity levels that need to be met. Details will be published later, Wacik said.

Diluted Curbs

The Energy and Mineral Resources Ministry proposed Jan. 8 that companies be allowed to continue shipping mineral concentrates for three years. The minimum level of copper in the concentrates may be set at 15 percent, according to Rozik B. Soetjipto, president director of Freeport’s Indonesian unit. That’s less than the percentage produced by Freeport and Newmont in Indonesia.

“Indonesia appears to be willing to allow miners who do some degree of processing or have definite plans for smelters in place to keep exporting but is still acting tough with the little guys,” Keith Loveard, a risk analyst at Jakarta-based Concord Consulting, said today, pointing to around 4,000 companies with mining business licenses.

Aluminum Corp. of China Ltd., the nation’s biggest producer of the metal, said Jan. 10 that it stockpiled bauxite before the ban on exports even as it expected the Indonesian curbs to be diluted because of the potential economic consequences. Indonesia will reopen exports as it has such a big impact, according to Li Haiming, president of the Hong Kong unit.

Ore Stockpiles

Indonesia’s nickel-ore exports are mostly in the form of laterite with 1 percent to 2 percent nickel, according to RBC Capital Markets. In China, the ore is processed into so-called nickel pig iron, an alternative to the refined metal.

Chinese stockpiles of nickel ore are large enough to sustain the output of nickel pig iron through until at least the final quarter of this year, RBC Capital Markets said on Dec. 19, citing an estimate from researcher Wood Mackenzie. Indonesia’s Industry Minister M. S. Hidayat told reporters in Jakarta on Jan. 8 that China has 20 million tons of nickel ore in reserves ahead of the ban.

Nickel may average $15,500 this year, according to an ABN Amro Bank NV report on Jan. 3 that cited the curbs in Indonesia and improved demand spurred by a global economic recovery. Last year’s average was $15,081 a ton as prices touched a low of $13,205 on July 9. Refined nickel prices fell 19 percent on the London Metal Exchange in 2013, dropping for a third year amid a global glut to post the worst performance among major base metals.

Export Revenue

The ban in Southeast Asia’s largest economy is intended to promote local processing, lure investment and spur the output of higher-value metal products.

“The essence of the government regulation is to uphold the 2009 Mining Law that means starting midnight on Jan. 12, exports of mineral ore will be banned,” said Hatta Rajasa, the Coordinating Minister for the Economy. “That means all must be processed or refined.”

The curbs could worsen Indonesia’s 2014 current-account position by as much as 0.3 percent of gross domestic product, Citigroup Inc. said last month, while Nomura Holdings Inc. said it will cost at least $5 billion in export revenue. Nickel and bauxite account for about 48 percent of total mineral exports, said David Sumual, economist at PT Bank Central Asia in Jakarta.

Election Year

If the ore ban had been implemented in full, the current- account deficit would increase by about 0.6 percent of GDP, Sumual said. Persistent trade and current-account deficits last year made the rupiah Asia’s worst-performing currency in 2013.

“I think the rupiah has priced in for the total ban, meaning 0.6 percent of GDP, while the impact of the ore ban on the current-account deficit should only be 0.25 percent of GDP,” Sumual said.

The final decision reduced the impact of the rule on the country’s mining industry and economy ahead of national elections this year. Yudhoyono cannot stand for a third-term and has no clear successor, with Rajasa, the Trade Minister Gita Wirjawan and State-Owned Enterprises Minister Dahlan Iskan all possible presidential candidates.

As many as 800,000 jobs may be at risk from the ban on shipments, the Indonesian Chamber of Commerce and Industry said on Dec. 16. It remains to be seen whether the government will be prepared to deal with the domestic fall-out and there is a potential for legal challenges in the courts, Loveard said.

“We want to avoid mass layoffs,” Wacik said. “We also want to keep companies that are already or planning to process ore to continue their operations.”

– Yoga Rusmana and Neil Chatterjee, Copyright 2014 Bloomberg.

Join The Club

Join The Club