U.S. Customs Revenue Tops $100 Billion for First Time Amid Tariff Surge

US revenue from customs duties this fiscal year surpassed $100 billion for the first time, reflecting higher tariffs imposed by the Trump administration.

The drybulk market, described a few weeks ago as “overheated” or “on fire”, has been inching back to a calmer and cooler situation. Interestingly, more versatile smaller sized bulk carriers (which transport a wide array of cargoes, including agricultural products that had previously, but not now, filled up containers in “backhaul” moves) are seeing stronger daily hires than larger Capesize vessels (taking iron ore and coal), going forward.

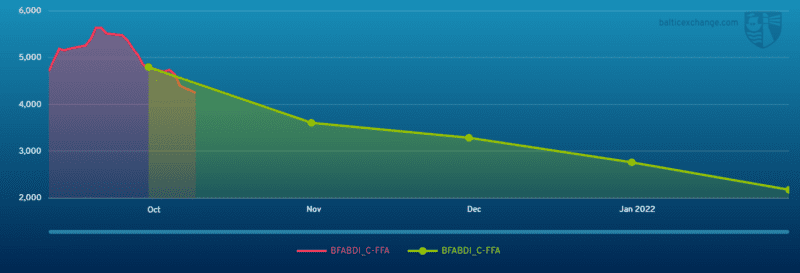

Veteran traders were already seeing a possible “top” several weeks ago. In early October, the spot market’s barometer Baltic Dry Index (BDI, representing a composite of daily hires for different sized drybulk carriers) had reached a high of 5,694 points (based on underlying composites, which assess different vessel size classes, in $/day). By around mid October, the index was pushing downwards, seeing a 10% decline as it descended below the 5,000 mark (again, this is points, not $/day), on its way to late month levels just above 4,000 points.

Yes, the market is still strong (compared to troughs seen as recently as mid 2020)- owners fixing their vessels at the present levels will see free cash going to the bottom line, after expenses. For public companies, where shares are traded on the NYSE, NASDAQ and elsewhere, some of that cash can flow to shareholders in the form of dividends. But the bloom is off the rose.

Breakwave Advisors, a Commodity Trading Advisor which manages an NYSE-listed Exchange Traded Fund (ETF) based on the BDI, said in a late October market report “….both the Pacific and the Atlantic markets have experienced a significant deterioration in demand, especially for iron ore transportation. This is not a surprising development, as the recent rally was driven by factors that, in our view, were not fundamental in nature.”

Savvy traders can read the tea-leaves, going beyond the oft-uttered tropes about “…a slowdown in China for drybulk moves…” Clearly, that’s the sentiment, but data available from the Baltic Exchange, based in London, UK, can add a great deal of color to an analysis. One important clue about the likely course of time charter hires came from looking at the forward markets, which give insights into how traders are viewing the prospects for the various underlying vessel sizes, expressed in $/day actual hires out in the future.

In mid October, as the BDI was in full descent, consider the “abnormal” situation where forward hire expectations for smaller vessels actually exceeded those for the larger “Capes”. Based on freight futures prices for the February, 2022 timeframe, Panamax vessels were expected to be worth around $30,000/day, compared to just under $23,000 for the much larger Capes, in contrast to the nearby pricing where Capes exceeded those of Panamaxes.

Traders see strength continuing in smaller and medium size bulkers- but not in the Capesizes. By late October, the overall BDI (remember, it reflects multiple vessel sizes) had moved downward to under 4,100 points. At the beginning of October’s final week, the composite of Capesize hires (in its settlement phase) stood at approximately $65,000/day (down from its earlier high of nearly $80,000/day). Looking out to Feb. 2022, traders were looking for $18,400/day (down from the $23,000/day less than two weeks earlier) for these big vessels. Showing either perceived Capesize weakness (or potential strength in smaller vessels), the Dec. 2021 Capes were worth around $31,000/day (on the trajectory downward towards Feb’s $18,400/day), compared to Handies (38,000 ton bulkers) worth $34,250/day.

The indexes, used to price physical freight, are also the settlement mechanism for freight futures trades. These are compiled by The Baltic Exchange, which creates assessments for ship scrapping prices, for hires on LNG cargoes, and for the costs of transporting containers. These days, nearly all the drybulk and tanker trades, executed through the intermediation of brokers, are financially “cleared” via an exchange such as the Singapore Exchange Limited (SGX) or the European Energy Exchange (EEX).

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up