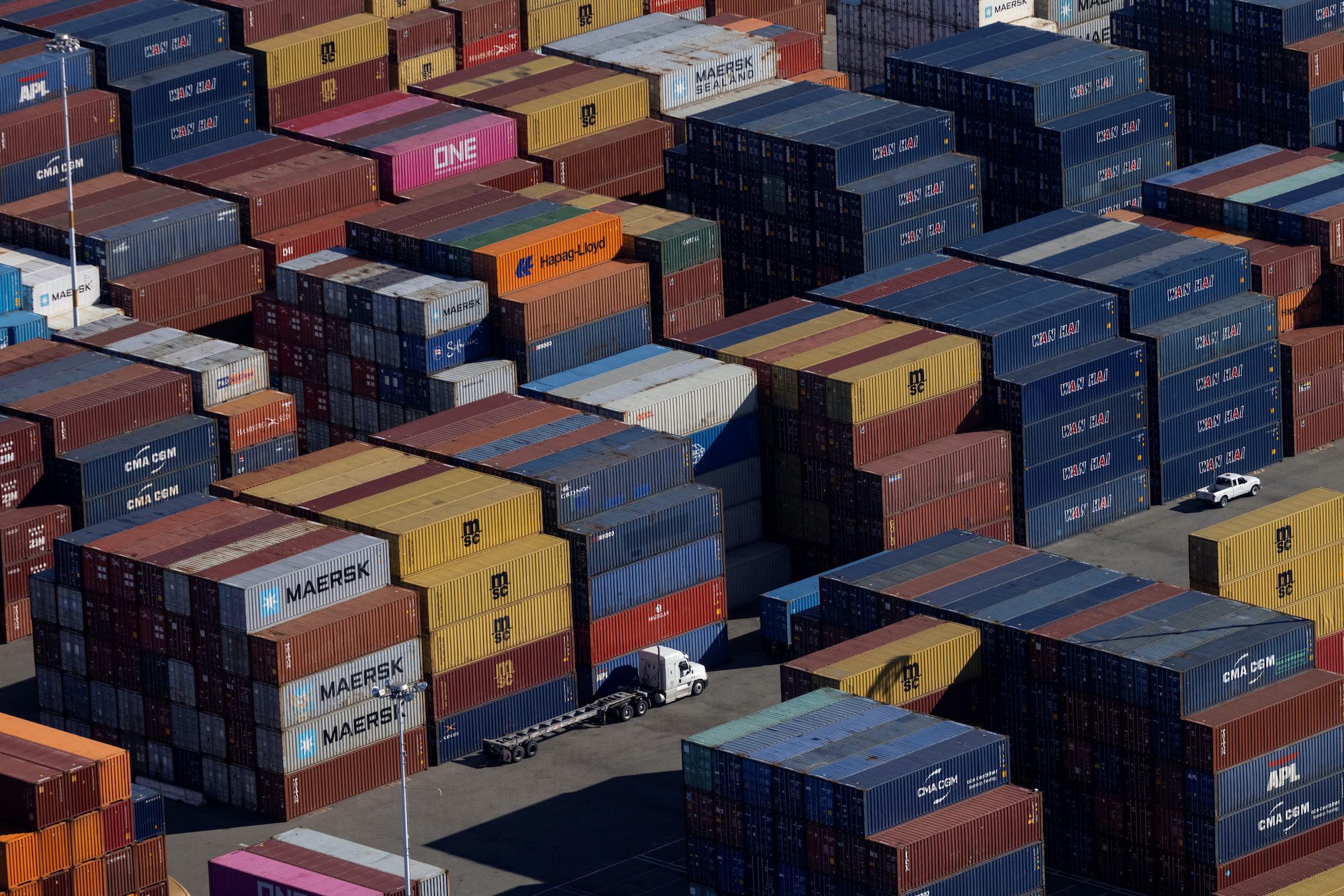

U.S. container import volumes maintained strong momentum in August despite ongoing trade policy turmoil, according to Descartes Systems Group’s latest Global Shipping Report released today. August volumes reached 2,519,722 TEUs, down 3.9% from July but still up 1.6% compared to August 2024.

While overall imports remain elevated, China-origin shipments continued their decline, dropping to 869,523 TEUs in August – down 5.8% from July and 10.8% below August 2024 levels.

“A second consecutive month of elevated container imports continues to call attention to the combined impact of U.S. tariff policy and seasonality on maritime trade, even as volumes from China declined,” said Jackson Wood, Director of Industry Strategy at Descartes.

The August volumes represent the second-highest monthly total this year. Despite these elevated levels, port transit delays increased only modestly at major U.S. ports.

East Asian nations beyond China also saw significant declines, with imports from Japan falling 14.5%, Taiwan down 12.9%, and South Korea dropping 11.8%. Meanwhile, Indonesia and India saw modest gains of 5.3% and 1.7% respectively, highlighting the ongoing diversification of U.S. supply chains.

West Coast ports experienced sharper month-over-month declines than their East Coast counterparts, with Los Angeles down 9.3%, Oakland falling 9.8%, and Tacoma dropping 11.9%. By contrast, Seattle (+14.2%), Savannah (+6.5%), and Norfolk (+6.2%) all posted gains, indicating a continued shift in cargo flows between coasts.

Wood noted that ongoing legal challenges to key tariff measures are now headed to the Supreme Court, “leaving U.S. importers to grapple with continued uncertainty as they weigh supply chain risks and mitigation efforts.”

Join The Club

Join The Club