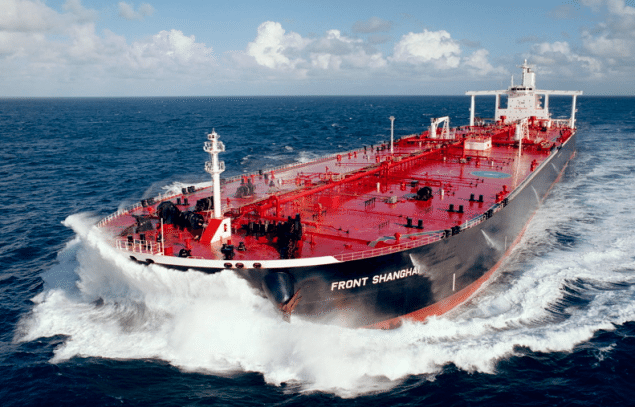

Front Shanghai. Image (c) Frontline

Jan. 9 (Bloomberg) — The recovery propelling shipping markets is poised to leave crude-oil tankers behind, unless the U.S. changes its 39-year-old ban on most unrefined exports.

Sea shipments of refined fuels are set to expand the fastest since 2010 and demand to transport dry-bulk commodities such as iron ore and coal will rise more than capacity for the first time in seven years, according to Clarkson Plc, the world’s largest shipbroker. Demand for crude carriers will advance the least since 2009, as the U.S. produces the most domestic supply in a quarter century and cuts imports for the fourth straight year, Clarkson estimates.

Profits will increase for companies including product- tanker owner Scorpio Tankers Inc. and Star Bulk Carriers Corp., whose ships carry dry-bulk commodities, analyst estimates compiled by Bloomberg show. Allowing more U.S. crude exports would be a “positive surprise” for tankers, according to RS Platou Markets AS. Senator Lisa Murkowski of Alaska backed lifting the export ban in a Jan. 7 speech, joining calls from producers such as Exxon Mobil Corp.

Read: Top U.S. Senator Urges End to Crude Oil Export Ban

“The demand is not there” for crude tankers, said Fotis Giannakoulis, an analyst at Morgan Stanley. “The only wild card that can really help the market would be U.S. crude exports.”

Market Overbuilt

The ClarkSea Index, a measure of industrywide earnings, jumped 79 percent last year to $17,141 a day, the highest since June 2010. The gauge’s 2012 average of $9,586 was the lowest in data beginning in 1990 because owners ordered too many ships before the global recession.

While increasing trade is finally shrinking the excess capacity for most types of vessels, the glut of crude tankers persists. Demand will rise 0.2 percent, less than the 0.6 percent last year and will be the smallest advance since a contraction in 2009, Clarkson estimates. Fleet growth of 1.8 percent will outpace demand, the shipbroker says.

Supertanker rates retreated 19 percent from a more than three-year high of $50,801 a day reached Nov. 22, Clarkson data show. Earnings for very large crude carriers will average about $21,000 this year, according to the median of 11 analyst estimates compiled by Bloomberg. While that would be up from $16,350 in 2013, it’s still 6.3 percent less than Frontline Ltd., the operator led by billionaire John Fredriksen, says its vessels need to break even.

Frontline Loss

Frontline’s net loss will narrow to $89.9 million this year from $168.4 million in 2013, according to the averages of 23 analyst estimates compiled by Bloomberg. Shares that rallied 28 percent last year will drop 73 percent to 8.69 kroner in 12 months, the average of 13 estimates shows. The Hamilton, Bermuda-based company expects a sustained market recovery “may take some time” depending on global growth and demolition of existing tankers to curb the glut, it said in a Nov. 27 report.

The U.S. is importing less crude as domestic fields produce the most since 1988 and the country meets the highest share of its own energy needs since 1986, Energy Department data show. Incoming shipments will fall another 7 percent to 4.9 million barrels a day in 2014, compared with the 2005 peak of 8.5 million, Clarkson estimates.

China, set to overtake the U.S. as the largest seaborne crude importer this year, isn’t adding as much as the U.S. is cutting, with shipments rising 4 percent to 5.4 million barrels a day this year, according to Clarkson.

Because a 1975 law bans most crude-oil exports, the surging output isn’t leaving U.S. shores, and American refineries are benefiting from the cheaper feed-stocks.

Net Exporter

That’s helped the U.S. become a net exporter of petroleum products since June 2011, shipping a record 3.58 million barrels a day for the past three weeks, Energy Department data show. Exports of products such as diesel and gasoline to South America from the U.S. Gulf Coast jumped 31 percent in 2013 and will rise another 17 percent this year, Clarkson estimates. Daily earnings for medium-range tankers will increase 12 percent to $16,625, the highest since 2008, the median of eight analyst estimates shows.

Scorpio runs the largest fleet of product tankers, with 48 on the water and 58 more on order, according to the Monaco-based company’s website. Its shares rose 66 percent to $11.79 last year and will reach $13.61 in 12 months, according to the average of 11 analyst estimates.

The outlook may shift if the U.S. changes its export policy. Crude tankers would benefit as smaller Suezmaxes and Aframaxes carry U.S. cargoes to Europe or to a pipeline across Panama, where VLCCs at the other end would take the crude to Asia, Court Smith, an analyst at Poten & Partners Inc., a New York-based shipbroker and consultant, said by phone Dec. 18.

Rules Outdated

The effect on product tankers depends on U.S. prices and refinery margins, according to Poten. Demand for the ships would be unaffected because importing countries in Africa and South America don’t have enough refineries and would still buy U.S. cargoes, Robert Bugbee, Scorpio’s president, said by phone Dec. 30.

Crude export restrictions may be outdated and Congress should review them, Energy Secretary Ernest Moniz said at a conference in New York last month. Exxon, the world’s biggest energy company by market value, favors lifting the export limits as U.S. production will soon overwhelm the capacity of domestic refineries, the Irving, Texas-based company said Dec. 12.

Congress Debates

“We need to act before the crude oil export ban causes problems in the U.S. oil production, which will raise prices and therefore hurt American jobs,” Murkowski, the top Republican on the Senate Energy and Natural Resources Committee, said Jan. 7 in remarks at the Brookings Institution in Washington.

The oil industry’s push for crude exports will face resistance from some members of Congress concerned that gasoline prices would rise. Senator Robert Menendez, a Democrat from New Jersey, said in a Dec. 16 letter to President Barack Obama that domestic crude should be used to lower prices at home. Senator Ron Wyden, an Oregon Democrat who chairs the Energy and Natural Resources Committee, is open to the discussion and wants to make sure consumers wouldn’t be adversely affected, spokesman Keith Chu said in a Jan. 7 phone interview.

Rules probably won’t change until at least 2015, according to Chris Neumiller, senior energy and shipping adviser at McQuilling Services LLC, a marine consulting company in Garden City, New York. If exports are allowed, they will probably be limited and would have a small effect on tanker demand, he said.

The Commerce Department can issue licenses to export crude. Shipments rose 45 percent to 105,000 barrels a day in the first 10 months of 2013 compared with a year earlier, and all but one cargo went to Canada, according to the Energy Department.

Recovery Prospects

The crude tanker market may improve without the help of U.S. exports. The vessels have the best recovery prospects in the shipping industry, Omar Nokta, an analyst at Global Hunter Securities LLC in New York, said in a Jan. 6 report. Platou, an Oslo-based investment bank, expects to raise its earnings estimates as fleet growth slows. Euronav NV, the Antwerp, Belgium-based owner of 35 crude tankers, said Jan. 5 it will buy 15 VLCCs from Maersk Tankers Singapore Pte. for $980 million citing an improved outlook and rising demand.

Expanding crude exports would take cargoes away from tankers shuttling between domestic ports, which have to be U.S.- built, owned and crewed under a 1920 federal law called the Jones Act. A qualifying tanker available to trade crude commands a record $110,000 a day for a six- to 12-month charter or $75,000 a day for a four- to five-year lease, and crude will account for about a third of the market this year, according to broker MJLF & Associates.

Jones Act

“It’s bad for the Jones Act if we’re allowing crude exports — the fact that the U.S. crude market is isolated is immensely benefiting,” said Donald Bogden, an analyst at MJLF in Stamford, Connecticut. The effect probably wouldn’t be “cataclysmic” because crude exports would be limited and wouldn’t happen until a glut of domestic crude may cause prices to collapse in 2016 or 2017. “We’ll export barrels to countries on a one-off basis rather than a complete lifting of the ban,” Bogden said.

Tankers hauling liquefied petroleum gases such as propane and butane are poised to profit in 2014 whether or not the U.S. exports crude. Supply of the fuels, used for cooking and heating, is surging as a byproduct of oil and gas drilling, and average daily rates for the largest carriers will rise 22 percent to $45,000 this year as U.S. exports expand enough to absorb all the new ships under construction, Oslo-based analysts at DNB Markets said in a December report.

Dorian IPO

Dorian LPG Ltd., a Stamford-based owner, bought 11 contracts for new gas carriers from Scorpio in exchange for a 30 percent stake, with an initial public offering planned for 2014, the company said in October. BW LPG Ltd., the largest owner of very large gas carriers, raised about 3.1 billion kroner ($500 million) from selling shares in Oslo in November.

Navigator Holdings Ltd., an owner of smaller LPG carriers whose largest shareholder is a fund led by billionaire Wilbur Ross, raised $228 million by selling shares in November.

Ross, the founder of WL Ross & Co., has also raised $100 million to buy ships hauling coal, iron ore and grains, betting that accelerating growth in emerging markets will boost trade. Demand for dry-bulk commodities will surpass fleet growth for the first time since 2008, Morgan Stanley said last month, upgrading its view on the industry to “in-line” from “cautious” and recommending shares of Safe Bulkers Inc., Diana Shipping Inc., Knightsbridge Tankers Ltd. and Star Bulk Carriers.

LNG Tankers

After record rates in 2011 and 2012, tankers hauling liquefied natural gas will extend losses in 2014 as new ships join the fleet before export facilities finish construction. Earnings will fall 25 percent to $74,000 a day as the fleet expands 6.9 percent while demand grows 3.6 percent, according to Platou.

The tankers will benefit as U.S. LNG export capacity reaches 71 million metric tons by 2020, according to Morgan Stanley. Cheniere Energy Inc.’s LNG export terminal at Sabine Pass, Louisiana, will be the first in the continental U.S. when it opens in 2015. The Energy Department approved three other projects so far.

“The U.S. shale oil and gas story will continue to change the landscape for shipping in 2014,” said Erik Nikolai Stavseth, an Oslo-based analyst at Arctic Securities ASA whose recommendations on the shares of shipping companies returned 24 percent in the past year. “If the U.S. starts exporting crude it would leave the entire market in disarray and likely turn investors’ bets upside-down.”

– Isaac Arnsdorf, Copyright 2014 Bloomberg.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club