Image (c) CMA CGM

Containership owners such as Maersk Line, CMA CGM, Seaspan, SinOceanic, Costamare, Ignazio Messina, Capital Shipmanagement, CIMC and others are all moving forward with plans to expand their fleets amid a market that can only be described as oversupplied.

The irony of the situation is that containership (liner) companies are being driven to order these large ships in part because they believe that freight rates will remain subdued for some considerable time. However, by contracting even more 12,000+ twenty-foot equivalent unit (teu) tonnage, they are postponing any form of freight rate recovery even further.

The combination of overcapacity and the efficiency of the cascade means that long haul freight rates more or less across the board are taking a pummeling. Assuming 2010 average as a benchmark, freight rates from China to South Africa and East Coast South America are down by nearly 50%.

Containership asset values are in a worse position when compared with the other leading shipping sectors.

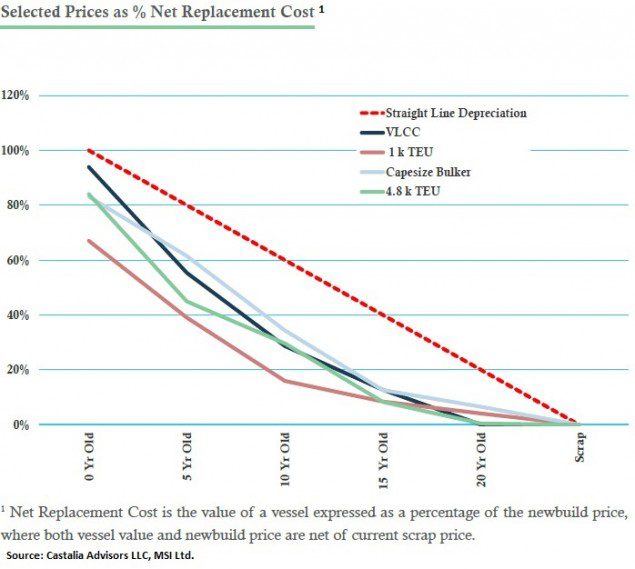

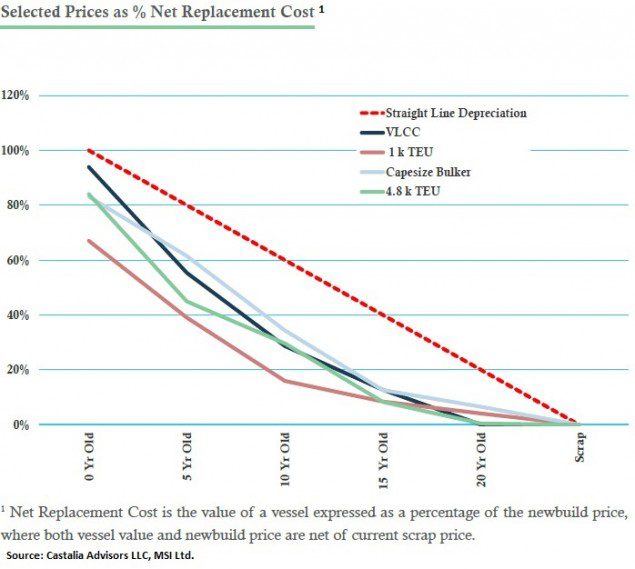

When current asset prices are restated in terms of its net replacement cost¹, the sub 5,000 teu containerships are clearly in a very depressed state. A 10 year old, 1,000 teu ship, for example, is worth barely 20% of its net replacement cost. To put that in context, under straight line deprecation that would be the expected value of a vessel twice its age.

For any vessel over 10 years old, there is only a marginal difference in value and the downside from buying such a ship is almost zero, assuming scrap prices do not collapse.

While the relative valuation of a 4,800 teu vessel is significantly better, it should be noted that it is still worse than that of a VLCC, which is currently the most visible yardstick of a busted shipping sector, and it is even less attractive than a Capesize bulker, where newbuilding deliveries continue to flow into a dry bulk shipping sector which can only be described as a mess.

Even if one assumes values for vessels sub 5,000 teu will bottom in the near-term, the more relevant issue for shipowners is whether vessels will continue to operate at or below break-even operating costs.

Will shipowners scrap vessels early? Given the history of shipowners not scrapping vessels early, one can expect continual pressure on rates as deliveries of 12,000+ teu. ships hit the water [Note: The orderbook for 12,000+ teu. vessels is huge].

In spite of the container business being an ugly business, shipowners keep ordering ships and investors continue to invest capital that generates suboptimal returns.

Join The Club

Join The Club