Geopolitics, High Bids, and U.S. Pressure Cloud COSCO’s Global Port Ambitions

COSCO Shipping Ports is facing "challenges" with its international investments amid pressures from the U.S. trade war, its managing director said in Hong Kong on Thursday.

Photo: By VanderWolf Images / Shutterstock

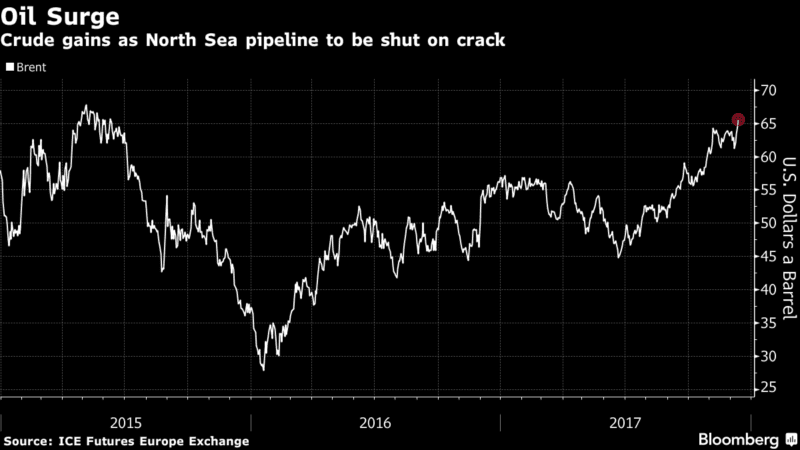

By Grant Smith (Bloomberg) — Global benchmark Brent crude jumped above $65 a barrel for the first time in 2 1/2 years after one of the most important pipelines in the world was shut because of a crack.

Futures rose as much as 1.8 percent in London, set for the highest close since June 2015, after advancing 2 percent Monday. It will take about two weeks to repair the small hairline crack after it was discovered on the North Sea Forties Pipeline System during a routine inspection, according to operator Ineos. In the U.S., crude stockpiles are forecast to drop a fourth week, a Bloomberg survey showed before government data Wednesday.

Oil is heading for a second yearly gain as the Organization of Petroleum Exporting Countries and its allies including Russia extend supply cuts through to the end of 2018. A strategy to exit the deal can be drafted in June if the market is no longer oversupplied by then, according to United Arab Emirates Energy Minister Suhail Al Mazrouei.

“The extra tick-up in the price is a result of what’s happened in the North Sea, because it just starts to say the market is a little more tight,” Daniel Yergin, vice chairman of consultants IHS Markit Ltd., said in a Bloomberg television interview.

Brent for February settlement rose as much as $1.14 to $65.83 a barrel on the London-based ICE Futures Europe exchange, and was at $65.68 at 1:11 p.m. London time. Prices gained $1.29 to $64.69 on Monday. The benchmark traded at a premium of as much as $7.35 to February West Texas Intermediate, the most since May 2015.

WTI for January delivery climbed as much as 57 cents, or 1 percent, to $58.56 a barrel on the New York Mercantile Exchange after rising 1.1 percent Monday. Total volume traded was about 15 percent above the 100-day average.

The supplies that flow through the Forties Pipeline System are the single largest constituent part of so-called Dated Brent crude that helps to settle more than half of the world’s physical oil prices. The shutdown forced Apache Corp. to suspend operations at its nearby Forties field.

“Yesterday’s closure of the Forties pipeline system for weeks is one of the most significant unplanned crude oil shortages we have seen this year,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London.

Oil-market news:

U.S. crude stockpiles probably dropped by 2.89 million barrels last week, according to the Bloomberg survey before an Energy Information Administration report Wednesday. Protesters in Nigeria’s southern Niger River delta stopped work at three oil wells operated by Eni SpA’s Nigerian unit, their representatives said.

© 2017 Bloomberg L.P

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up