The ARA Libertad is nice, but only a fraction of the $1.6 billion that the Argentine government owes Singer’s Elliot Management Corp.

BUENOS AIRES–Argentina’s government pledged on Friday to exhaust all legal measures to free a navy training ship detained in Ghana at the request of creditors seeking to collect on defaulted Argentine bonds.

“Argentina is keeping all of its options open in the area of international law. If necessary it will go the United Nations. Negotiating with vulture funds isn’t nor will it be one of those options,” Foreign Minister Hector Timerman said in a televised address.

Mr. Timerman said the detention of the cadet-training ship was an “illegal act” because as a warship it enjoys immunity under Ghanaian law and international treaties.

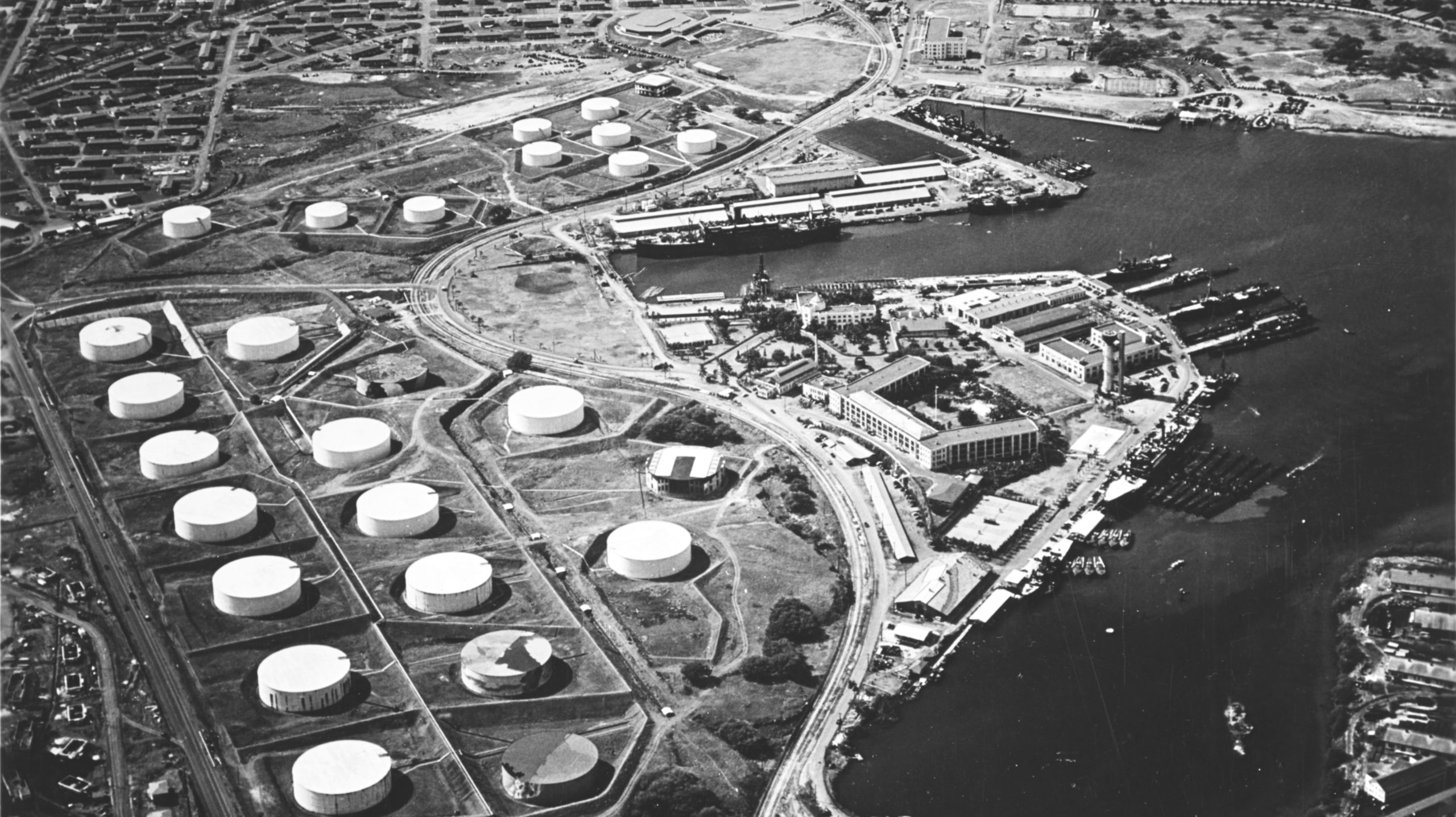

A Ghanaian judge on Oct.2 ordered the 130-meter-long sailing ship, ARA Libertad, held at the port of Tema until Argentina honors U.S. judicial rulings that awarded about $1.6 billion to Elliott Management Corp.’s NML Capital Ltd.

NML has said it wouldn’t oppose the ship leaving Ghana if Argentina first deposits $20 million with the court.

It has also offered to fly any ARA Libertad sailor to his or her home country at its expense, according to a letter sent to Argentina’s lawyer by NML’s lawyers in Ghana and viewed by Dow Jones Newswires.

The incident has proven deeply embarrassing to the government of President Cristina Kirchner.

Last week, the Navy’s top admiral, Carlos Alberto Paz, resigned and two senior officers were suspended pending an investigation into why the ship was put at risk by stopping at Ghana earlier this month.

The ship left Argentina in June on a training cruise that included stops at ports in the South Atlantic, Caribbean, Europe and Africa. ARA Libertad was scheduled to return to Argentina on Dec. 8.

Argentina’s dispute with investment funds stems from its $100 billion sovereign default in 2001. The South American nation managed to restructure about 93% of its defaulted bonds in debt exchanges in 2005 and 2010, offering investors about 33 cents on the dollar.

Some $4.5 billion of defaulted bonds are in the hands of so-called holdouts like Kenneth Dart’s EM Ltd. and NML Capital Ltd. funds.

Meanwhile, ARA Libertad’s crew of 320 men and women, including 15 Chilean sailors and a handful of Uruguayans, are whiling away the time at port, waiting for news on whether they will be able to set sail.

-By Ken Parks. (c) 2012 Dow Jones & Company, Inc.

Join The Club

Join The Club