Ships Fleeing The Red Sea Now Face Perilous African Weather

By Alex Longley and Paul Burkhardt (Bloomberg) –Ships sailing around the southern tip of Africa are wrestling with a bout of bad weather that has already run one vessel aground and...

Port of Los Angeles. File Photo: ackats / Shutterstock.com

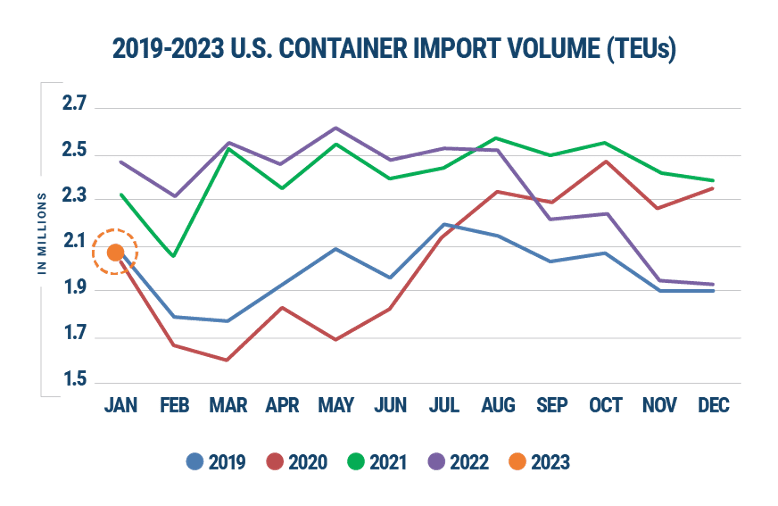

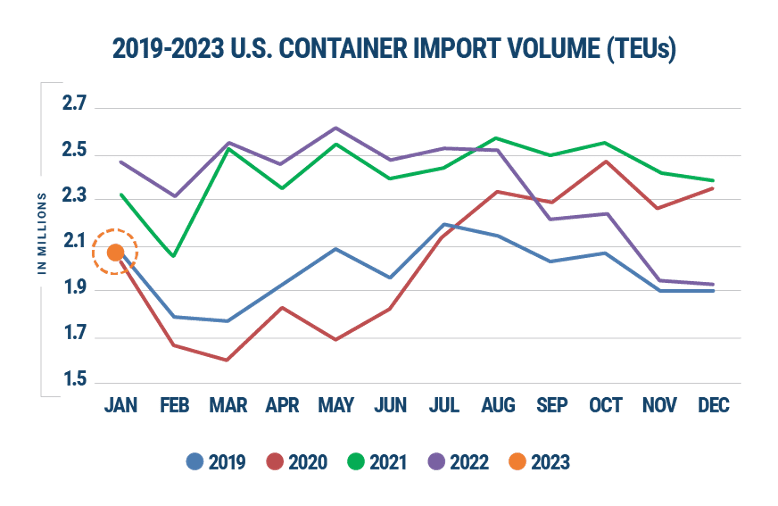

U.S. container imports dipped below pre-pandemic levels in January, but a rebound in Chinese imports and consecutive monthly gains points to a stronger than anticipated economic activity, according to Descartes Systems Group (Nasdaq: DSGX) (TSX:DSG).

Containerized imports last month totaled just over 2 million TEUs, marking a 16.1% drop compared to January 2022. However, looking at consecutive months, January’s container imports increased 7.2% versus December to more tightly align with January 2019 levels. But imports last month actually came in 0.3% below January 2019, marking the first month to underperform pre-pandemic 2019 levels since July 2020.

Imports from China also reversed a downward trend last month, rebounding even stronger with 11% growth over December 2022. Granted, Chinese imports are still down 24% from the 2022 high in August.

Descartes believes these key indicators point to stronger than anticipated economic activity, but challenges remain. “This could impact future container import volumes but, combined with COVID, the Russia/Ukraine conflict and the West Coast labor situation, continue to highlight potential disruptions that could make for challenging global supply chain performance in 2023,” Descartes said.

Port delays continued to improve in January with East Coast ports picking up the most gains. Most notably, the Port of Seattle grew by 3.6 days to 9.0 days versus December 2022.

Descartes’ report also shows west coast ports making some headway on regaining market share lost to East and Gulf Coast ports over this past year. Imports in the East and Gulf Coast ports declined 0.3% versus December 2022 to hold a 45.2% market share, while West Coast ports increased to 38.6% in January, up 0.5% versus December 2022.

“Comparing January 2023 import volume to growth of the previous five years, the 7.2% increase can be considered significant and Chinese imports rebounded with even stronger growth,” said Chris Jones, EVP Industry & Services at Descartes. “The January U.S. container import data shows some stability, but a number of issues continue to point to challenging global supply chain performance in 2023.”

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 107,191 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 107,191 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up