U.S. Customs Revenue Tops $100 Billion for First Time Amid Tariff Surge

US revenue from customs duties this fiscal year surpassed $100 billion for the first time, reflecting higher tariffs imposed by the Trump administration.

The numbers are in…

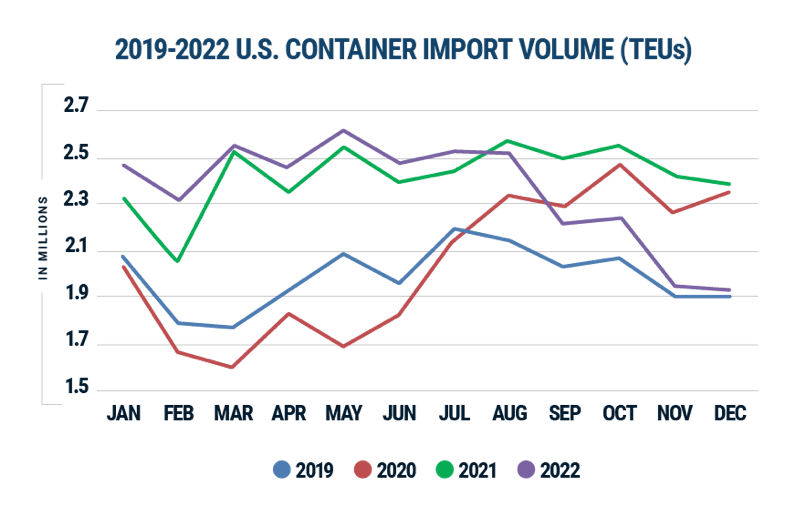

U.S. container imports in December reveal an alignment with pre-pandemic levels, with U.S. East and Gulf Coast ports seeing the greatest reduction while West Coast ports started to regain market share, according to Descartes Systems Group’s (Nasdaq: DSGX) latest global shipping report.

The report shows that U.S. container import volumes in December declined slightly from November, down 1.3% month over month to 1.9 million TEUs. The year over year reduction, however, is much more stark, with December 2022 volumes coming in 19.3% below December 2021. Interestingly, the 1.9 million TEUs imported last month is only 1.3% higher than December 2019, showing an alignment with pre-pandemic levels.

This return to pre-pandemic levels is a continuation from November’s volumes, which came in 2.8% higher than pre-pandemic in November 2019, and October volumes which were 7.2% higher than pre-pandemic levels in 2019.

The good news is that the imports lull is continuing to ease supply chain pressure and improve port delays. According to Descartes, East Coast ports saw the greatest decrease in wait times with none in the double digits, while West Coast wait times are down to less than 10 days. Descartes said these improvements can be attributed to the continued decrease in volume, though schedule reliability is still low compared to pre-pandemic numbers.

“Comparing fall imports in 2022 to the previous six years, the slight decline in December 2022 volume versus November 2022 was consistent at -1.3%. Imports from China also declined, but even more slowly at -0.5%,” said Chris Jones, EVP Industry & Services at Descartes. “The December U.S. container import data points to less pressure on supply chains and logistics operations, but there are still a number of issues that may cause further disruptions in 2023.”

Another interesting takeaway from the report is that West Coast ports have started regain market share that they lost over the last year to East and Gulf Coast ports as importers shifted cargo east to avoid potential disruptions from West Coast port labor negotiations. Of the total import container volume, West Coast ports grew their market share to 38.1% in December, up 1.2% versus November, while East and Gulf Coast ports’ market share declined to 45.5%, down 1.7% versus November—at least when comparing the top five West Coast ports to the top five East and Gulf Coast ports in December 2022 vs. November 2022

Looking ahead, key economic indicators continue to paint a conflicting picture about their impact on future import volumes and, combined with COVID, the Russia/Ukraine conflict and the West Coast labor situation, continue to point to further disruptions and challenging global supply chain performance in 2023, according to Descartes.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up