U.S. Customs Revenue Tops $100 Billion for First Time Amid Tariff Surge

US revenue from customs duties this fiscal year surpassed $100 billion for the first time, reflecting higher tariffs imposed by the Trump administration.

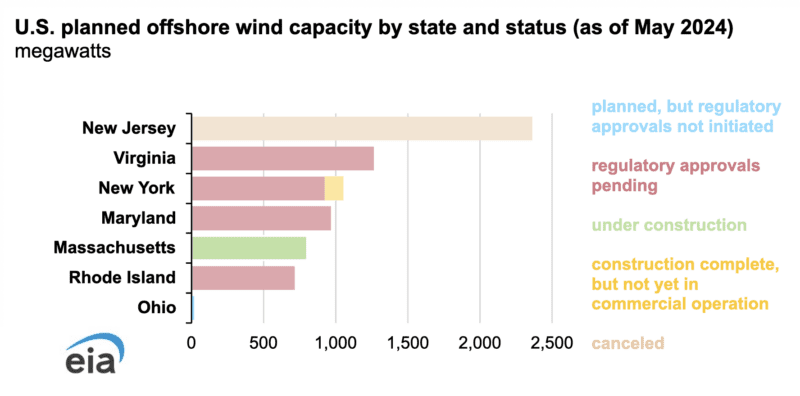

The landscape of offshore wind generating capacity in the United States is undergoing significant changes following the cancellation of two major projects in New Jersey last year, putting the total capacity under construction or planned in flux.

As of May, there were a reported 7,200 megawatts (MW) of offshore wind capacity, according to the U.S. Energy Information Administration’s (EIA) latest Preliminary Monthly Electric Generator Inventory. However, 2,400 MW worth of projects have been canceled since December, while 4,800 MW remain active and are in various stages of development.

In late 2023, developer Orsted canceled its 2,400-MW Ocean Wind 1 and 2 projects in New Jersey, attributing the decision to rising interest rates, high inflation, and supply chain delays.

Currently, one offshore wind project is under construction, and another is awaiting commercial operation, both expected to begin operations in 2024. The 130-MW South Fork Wind project, located off the coast of Long Island, New York, began generating electricity in March but has not yet reached commercial operation. Meanwhile, the 800-MW Vineyard Wind 1 project near Martha’s Vineyard, Massachusetts, is partially built, with 10 of its planned 62 turbines in place as of February.

Several other projects are also in various stages of planning and development. For instance, the 704-MW Revolution Wind project off Rhode Island and the 2,600-MW Coastal Virginia Offshore Wind (CVOW) Commercial Project have begun building foundations. Revolution Wind is expected to be operational by fall 2025, while CVOW, which has received all local, state and federal approvals, is slated to start in early 2027.

Additionally, the 924-MW Sunrise Wind project, one of two active projects awarded by New York State in February, is expected to come online in 2026. The other project, Equinor’s 810-MW Empire Wind 1, has yet to be reported to the EIA as a planned project.

However, some projects in Maryland and Ohio have faced setbacks. In January, Orsted withdrew from commitments to build the 966-MW Skipjack 1 and 2 projects in Maryland but continues advanced development and permitting. Similarly, the 20-MW Icebreaker Wind project on the Ohio coast of Lake Erie was halted late last year due to rising costs and loss of funding.

Meanwhile, the a new report from the American Clean Power Association (ACP) projects $65 billion in investments and 56,000 jobs in U.S. offshore wind by 2030. The Biden Administration has set a target of deploying 30 GW of offshore wind energy capacity by 2030, but market analysts forecast that only 14 GW of offshore wind will be deployed by 2030, with 30 GW by 2033, and 40 GW by 2035. However, former President Donald Trump, the presumptive Republican nominee, has vowed to issue an executive order targeting offshore wind development on “day one” if he wins a second term.

As the U.S. offshore wind sector navigates these challenges, the future of wind energy projects remains uncertain and changing, leaving the novel industry in flux.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up