TORM to Acquire Eight MR Vessels in $340 Million Deal

Product tanker operator TORM has agreed to acquire agreed to acquire eight second-hand Medium Range (MR) tankers for $340 million. Delivery of these vessels is expected in Q3 and Q4...

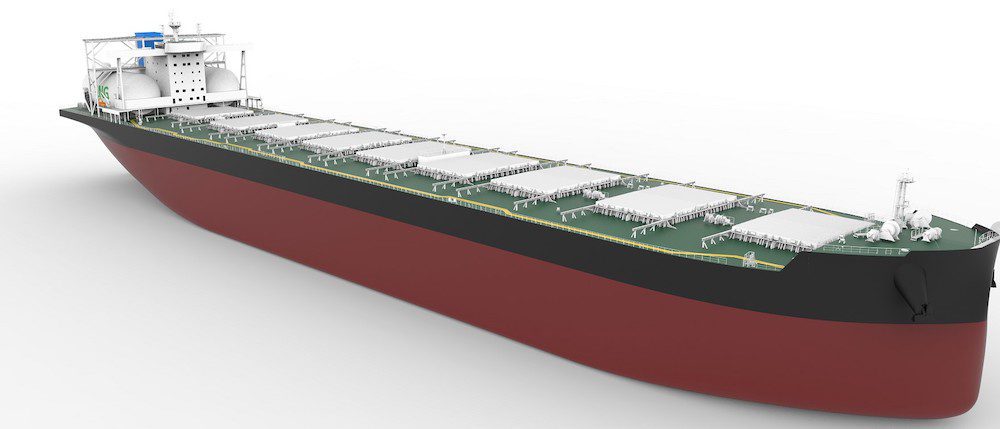

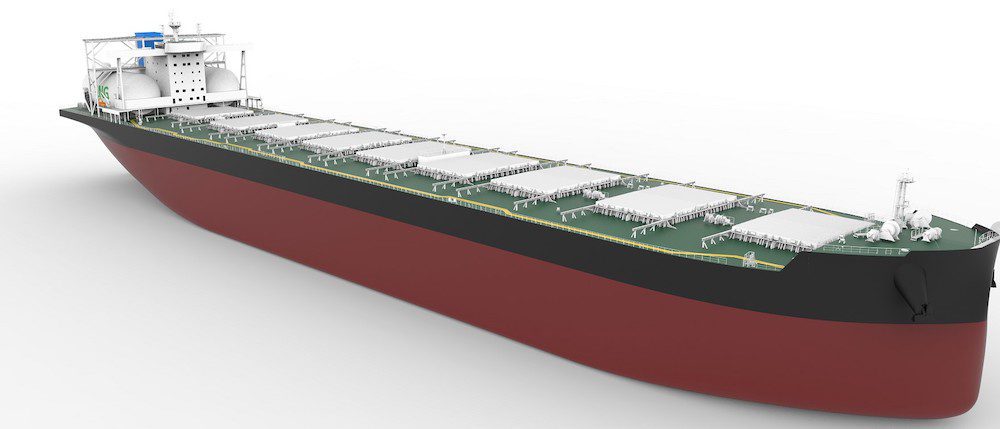

An illustration of Himalaya Shipping's Newcastlemax bulk carriers.

Himalaya Shipping Ltd., an independent bulk carrier company, announced today its plan to launch an initial public offering (IPO) of $45,000,000 of its common shares on the New York Stock Exchange.

The company operates two newbuild LNG dual-fueled, scrubber-fitted Newcastlemax vessels and has 10 more under construction at New Times Shipyard in China. The company says it intends to use the proceeds for general corporate purposes, including funding vessel acquisitions, maintaining liquidity, repaying indebtedness, and supporting working capital needs.

Himalaya Shipping was incorporated in Bermuda on March 17, 2021 with the intention of owning dual-fuel LNG Newcastlemax bulk carriers in the range of 210,000 DWT. Its shares have been listed on the Euronext Expand market since April 2022 under the ticker “HSHIP”.

The company expects the delivery of another vessel by mid-April, plus three more by the end of the year and the remaining six by July 2024.

The company intends to list 7.72 million common shares, according to an SEC filing. The IPO price will be determined through a book building process and is expected to align with the closing price of the company’s shares on the Euronext Expand in Norway on the most recent trading day before the IPO pricing date, which has not been announced.

In addition, underwriters will be granted a 30-day option to purchase up to an additional $6,750,000 of common shares to cover over-allotments, if any, at the initial public offering price, less underwriting discounts and commissions.

The company has applied to list its common shares on the New York Stock Exchange (NYSE) under the ticker symbol “HSHP.” Post-IPO, Himalaya Shipping will remain listed on the Euronext Expand in Norway under the same ticker.

Himalaya Shipping fleet of 12 newbuild bulk carriers are expected to be fully delivered by August 2024.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 107,181 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 107,181 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up