Iranian Ship Linked to Houthi Attacks Heads Home Amid Tensions

(Bloomberg) — An Iranian ship that’s been linked to Houthi attacks in the Red Sea is returning home, removing a prominent asset in the area as the Islamic Republic braces...

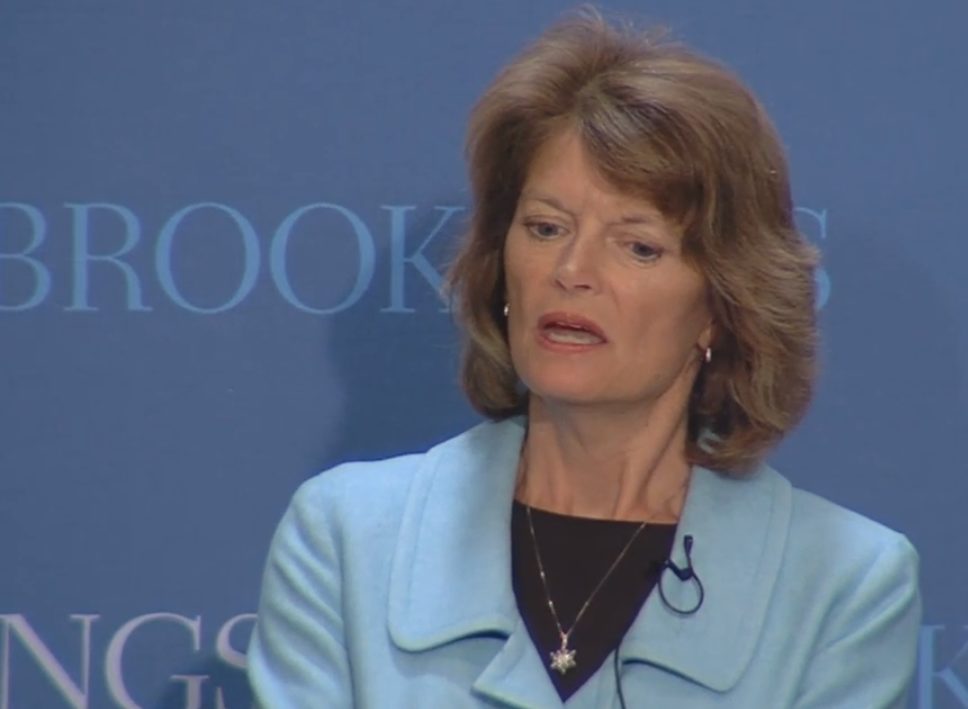

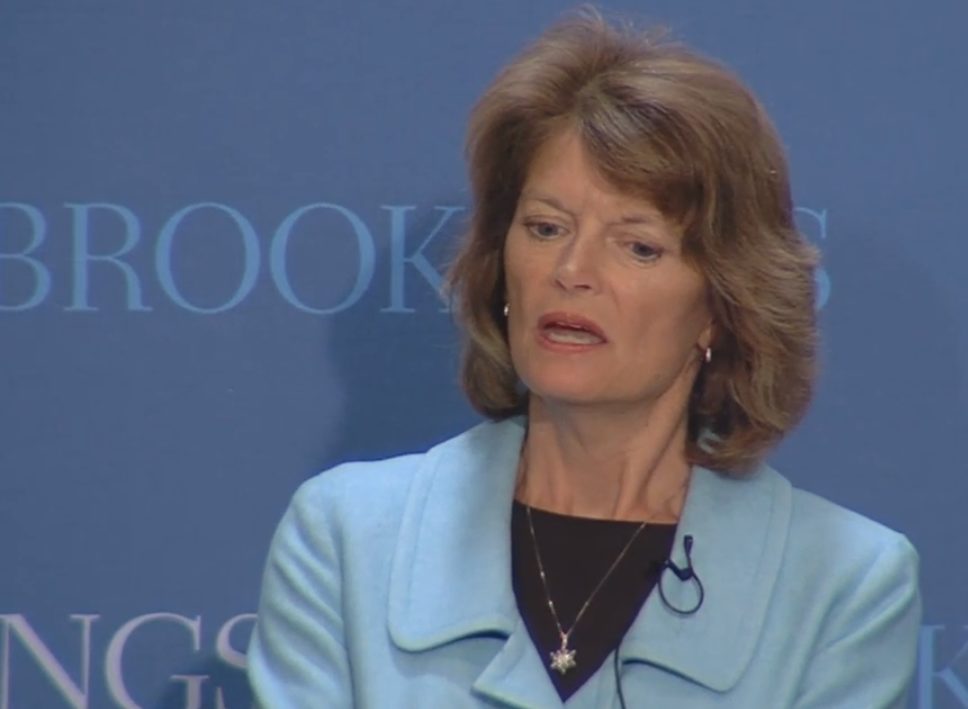

Senator Lisa Murkowski supported U.S. crude exports during a speech at the Brookings Institute on 7 January, screen shot via YouTube live feed

Jan. 28 (Bloomberg) — ExxonMobil Corp.’s push to export U.S. oil overseas is facing a new obstacle: falling gasoline prices.

A flood of new oil from Texas to the Great Plains has swamped refineries, driving down prices at the pump 10 percent since March, while global oil prices have hovered at about $107 a barrel. That suggests the world crude market is having waning influence on U.S. gasoline, which instead is beginning to track lower-priced domestic oil.

U.S. supplies are having a greater impact because they’re making up a bigger part of the gasoline market, supplying about 53 percent today, compared with 34 percent less than three years ago.

As cheaper oil translates to cheaper gasoline, Exxon and ConocoPhillips will have a tougher time convincing legislators that ending export restrictions that date back to 1970s oil shortages would benefit the nation, said Sandy Fielden, director of energy analytics at consultant RBN Energy LLC.

If more exports are allowed, “The most obvious thing that’s going to happen is that crude prices will go up and so will gasoline,” Fielden said.

Investors are betting the trend will continue, and that West Texas Intermediate, the U.S. benchmark for oil, will drop about 17 percent by December 2016. A contract for delivery in that month trades at about $80 a barrel, compared with about $97 today.

Export Benefits

Lifting strict export limits would halt the decline in U.S. crude prices while costing motorists as much as $10 billion a year in higher fuel prices, according to Barclays Plc. Gasoline prices reached a three-year low last year and should continue to drop through 2015, according to the U.S. Energy Information Administration.

Senator Lisa Murkowski, the top Republican on the Senate Energy and Natural Resources Committee, has joined Exxon, the American Petroleum Institute and the U.S. Chamber of Commerce in calling for an end to crude export restrictions that were put in place after the Arab oil embargo in 1973 triggered gasoline shortages in the U.S.

“The reality is the market has moved from an era of scarcity to an era of abundance — but we’re still saddled with statutes and regulations stuck in a mindset of scarcity,” said Kenneth Cohen, the vice president who oversees Exxon’s lobbying efforts, in a December interview.

The debate over exports is splitting the energy industry. Oil producers such as billionaire Harold Hamm’s Continental Resources Inc. want leeway to send their crude abroad for higher prices. Some refiners want U.S. oil to remain landlocked, offering them a cheaper feedstock for their plants.

Favoring Refiners

In a strategic sense, the U.S. is not alone in how its policies prioritize refining over exports. Countries from Saudi Arabia to Brazil are seeking to boost their refining capacity, spending billions to create manufacturing jobs or reduce imports, said Charles Kemp, a senior consultant at Baker & O’Brien Inc.

Advocates of more oil exports have warned that unless the limits are lifted, the production boom that has boosted U.S. oil output to the highest level in 25 years will slow. Opening the spigot of U.S. crude to the world will lower the trade deficit and boost employment, replacing outdated regulations that now allow exports of refined products such as gasoline and diesel but limit crude, Murkowski said in a Jan. 7 speech.

A central argument for opening exports, made by Murkowski and ConocoPhillips Chairman and Chief Executive Officer Ryan Lance, hinges on the contention that shipping American oil abroad would bring down world prices, and thus reduce gasoline prices. That’s because imports of crude from abroad have historically tied U.S. gasoline markets more closely to the global Brent benchmark price for crude.

Crude Discounts

Falling gasoline prices, even with export restrictions remaining in place, are eroding that argument. New supplies of oil from North Dakota and Texas have outstripped processing capacity in some refineries, resulting in U.S. crude selling for about $11 a barrel less than global varieties.

Refiners who benefit from the lower costs of crude are passing about $3 a barrel of that discount on to consumers, which translates into annual savings of more than $9.5 billion last year and an expected $9.6 billion this year, Barclays analyst Paul Cheng said in a Jan. 22 note to investors. The ultimate benefit is even greater as the savings ripple through the U.S. economy in a multiplier effect, Cheng said.

Energy Security

“Moving U.S. oil away from the mainland will raise the price at the pump for consumers,” said Jamie Court, president of Consumer Watchdog, a California-based advocacy organization that has faulted oil companies for high gasoline prices in the past. “This is exactly the wrong time to change the formula by which Americans maintain their energy security. We don’t want to go back to where we were in terms of scarcity.”

The U.S. retail price for regular gasoline fell to $3.279 a gallon yesterday, according to Heathrow, Florida-based AAA, the nation’s largest motoring company. The countrywide average rose to within a cent and a half of $4 in April 2011.

Prices at the pump in the U.S. have typically tracked closely with the global Brent oil benchmark in the U.K.’s North Sea as East Coast refiners used foreign oil priced against Brent because they couldn’t access domestic crude. European plants also sent gasoline to New York as U.S. oil production slumped after peaking in 1970.

As oil output began rising in 2009, spurred by horizontal drilling and hydraulic fracturing that unlocked new resources in dense shale rock, the imports that helped set U.S. prices began to slow. The U.S. imported an average of 576,000 barrels of gasoline a day in 2013, the lowest since 2000, EIA data show.

Price Correlations

For most of January, gasoline prices tracked more closely with cheaper domestic oil than with the Brent price. This correlation means that gasoline prices have fallen in step with domestic West Texas Intermediate oil as crude production boosted supplies, according to data compiled by Bloomberg.

The lighter weight oil from shale fields, which has fewer impurities, tends to yield more gasoline, a factor that could further boost supply and potentially decrease prices if oil export restrictions remain in place, John Auers, a senior vice president at industry consultant Turner Mason & Co.

“From a long term fundamental standpoint, gasoline prices are going to be pretty attractive,” Auers said. “We’ve seen those high, $5-a-gallon prices and we’re not going back to those for any length of time.”

– Bradley Olson and Dan Murtaugh, Copyright 2014 Bloomberg.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,954 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,954 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up