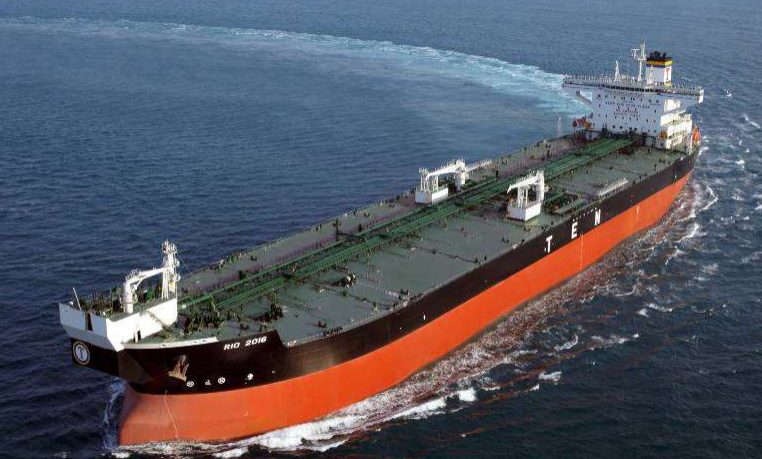

On May 18, TEN’s shuttle tanker Rio 2016 arrived in Brazil and commenced its 15-year charter which is expected to generate approximately $255.0 million in gross revenues. Second shuttle tanker Brasil 2014 is en route to Brazil for delivery to charterers and commencement of similar, in terms of duration and rate. Image: TEN

“We do believe that both product and crude markets have turned the corner,” noted Nikolas P. Tsakos, President & Chief Executive Officer of Tsakos Energy Navigation commented in his company’s 1st quarter report today.

Over the past year, Tsakos has witnessed a near ten-fold increase in his company’s net operating income and a 30.0% increase in EBITDA to $34.1 million as compared to Q1 2012.

“TEN’s return to profitability, is a result of our modern fleet composition, our flexible long-term employment strategy, our cost containment policy and our ability to maintain and build relationships with high quality charterers around the world,” notes Tsakos. “Our fleet is well positioned to take advantage of current and expected market improvements. Also, our exposure in the high-end LNG and shuttle tanker markets provides further growth to our bottom line.”

TEN’s fleet consists of 28 product tankers, 19 crude carriers (1 VLCC, 10 Suezmax, 8 Aframax) and two LNG carriers, which over the past 3 months has seen a 98 percent utilization rate. Since 1 January, nine of their product tankers have been placed on charter with future minimum gross revenues of $117 million over their respective fixtures. Total minimum contracted coverage exceeds $1 billion with average duration 3.2 years.

Time charter equivalent rates have risen to $18,176 per day as compared to $17,129 in the first quarter 2012, while daily operating expenses have been reduced from $7,692 per day to $8,308 over the same period.

Mr. Tsakos further comments that asset growth of his company will come from the “accretive expansion” of LNG and shuttle tankers in the future, while maintaining a “dominant presence in product and crude carriers.”

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club