Iranian Ship Linked to Houthi Attacks Heads Home Amid Tensions

(Bloomberg) — An Iranian ship that’s been linked to Houthi attacks in the Red Sea is returning home, removing a prominent asset in the area as the Islamic Republic braces...

(c) Teekay Corporation

Christian Waldegrave, Teekay’s Manager of Research, provides an update of the conventional tanker market since the start of 2014 as well as an outlook for the rest of the year in this latest video:

He notes that due to very low fleet growth over the next few years, mostly from the ordering of new medium-range product tankers, the overall tanker market is due to tighten – particularly on the crude tanker sector.

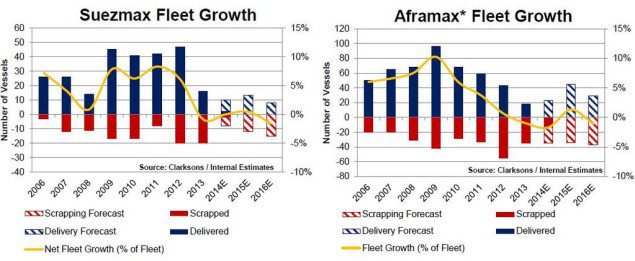

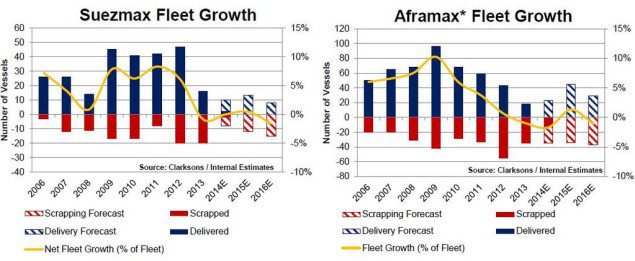

The following graph via Teekay, sourced from Clarksons shows projected fleet growth within the mid-size crude tanker market. The asterisk on the Aframax fleet refers to the fact most major shipyards are full through 2016.

In an emailed statement, Waldegrave provided us with the following, more detailed insight:

The increase in US and Canadian oil production has had a hugely negative impact on the crude tanker market in the past few years. Looking at the US, seaborne crude imports (i.e. total imports minus imports via pipeline from Canada) have fallen from a peak of 8.5 mb/d in 2005 to just 5.2 mb/d in 2013 and are averaging 4.9 mb/d in the first few months of 2014. This reduction in imports has had a negative impact on tanker demand, particularly on trades which were bringing in light sweet crude such as Suezmax movements from West Africa.

However, we believe that the negative impact that rising North American oil production has had on tanker demand is flattening out and in the next year or two we actually believe that we may start to see exports from North America which will be a positive for crude tanker demand.

In the US, the introduction of new pipeline capacity from the Midwest to the US Gulf has shifted the crude supply glut down to the coast and has led to a significant increase in oil inventories. Crude stocks in PADD III (US Gulf) are currently at 215 million barrels, the highest point since the EIA started tracking by PADD in 1990. This represents a build of 49 million barrels since the start of the year (or a 30% increase) as new pipeline capacity has shifted the US crude glut from the US Midwest region around Cushing to the US Gulf. Storage capacity in the US Gulf is estimated to be around 250 million barrels. This means that the US Gulf region is only 35 million barrels away from topping out its storage capacity, at which point oil prices will probably take a big hit due to the structural oversupply. So the US has an incentive to get this oil out of the region.

At the moment the only export route for US crude is to Canada under a special export licence. In 2008 the US exported just 29 kb/d of crude to Canada. By 2013 this figure had reached 119 kb/d but in the first two months of 2014 this figure has jumped to 240 kb/d (so a doubling of exports to Canada). This is the equivalent of an Aframax every three days, and since the trade is considered international It does not fall under Jones Act rules (so international flagged vessels are doing the trade).

In addition to US exports to Canada, the US is starting to grant licenses to re-export foreign (i.e. Canadian) produced crude via US seaports. Repsol recently loaded what is thought to be the first re-export cargo of Canadian crude from a US Gulf sea port when they took a cargo of 500-600,000 barrels from Freeport, Texas to Spain earlier this month. They did so on a Suezmax having first part-loaded a cargo of Maya crude in Mexico, but going forward we think this will be a natural Aframax trade.

According to estimates from Citibank, US crude exports to Canada could double to ~400 kb/d in the next couple of years while the US may also re-export ~200 kb/d of Canadian crude and ~300 kb/d of condensates (if the crude export ban is modified so it doesn’t include condensates). Each 100 kb/d of exports would imply the potential for about 3 Suezmax or 5.5 Aframax cargoes per month. So in the next couple of years we could see a significant amount of crude leaving the US by sea in order to alleviate the glut of crude that is emerging in North America.

We have yet to carry out a full ton-mile analysis to see what the net impact of the above changes might be compared to the loss of barrels from US / Canadian import destruction, but our initial impression is that this could actually be quite a positive factor for Aframax / Suezmax demand in the next couple of years.

Things may be a bit less exciting than they appear however, according to another source in tanker industry who could only speak anonymously.

“Things overall look pretty flat, especially if you take away that spike in tanker rates,” notes our source. “In addition, the tonnage on the market is mostly new ships, meaning as ships are delivered over the next year, you won’t necessarily have another ship to scrap, which will continue to make things more difficult for the crude tanker market.”

“If you look at the historic 12-year shipping market cycle however, we seem to be at or near the bottom with another peak expected in perhaps 6 years,” notes our source.

Teekay Tankers reported today their first quarter earnings from vessel operations increased to $34.7 million from $13.2 million in the same period of the prior year. “The increase was primarily due to higher average realized spot tanker rates from its spot Suezmax, Aframax and MR vessels and an increase in interest income recognized from Teekay Tankers’ investment in two mortgage loans.”

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,983 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,983 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up