Firms in Fed’s Beige Book Fret Over Any Lengthy Baltimore Port Closure

(Bloomberg) — The closure of one of the East Coast’s busiest ports after the collapse of Baltimore’s Francis Scott Key Bridge has so far not led to broad price increases,...

Situational awareness requires that people know their surroundings and the risks inherent therein. In a crowded theater, one should always make sure to know the way out.

The phrase: “In case of emergency, proceed to the exits in an orderly fashion” comes to mind.

Many sectors of the shipping industry are presently facing an oversupply of tonnage. How we got here can be debated. The current imbalance of supply and demand cannot. This imbalance is creating a freight rate prospect many would term an emergency. Proceeding to the exits in an orderly fashion may be the best alternative.

In this note we look at the economic impact of accelerated scrapping in the tanker industry. For several years now, there has been a growing sentiment that acceptability of tonnage by the major charterers was shifting to newer vessels. Fifteen years was discussed as the emerging limit for consideration of tonnage by the top tier players. Now the idea of reducing the trading inventory to bring tonnage supply in line with vessel demand is gaining traction.

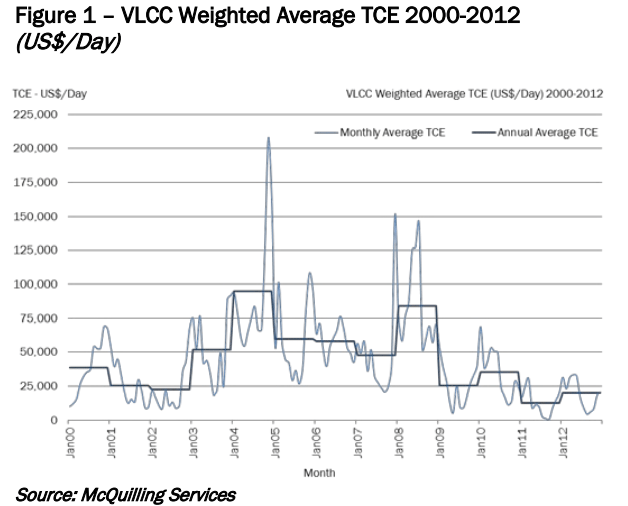

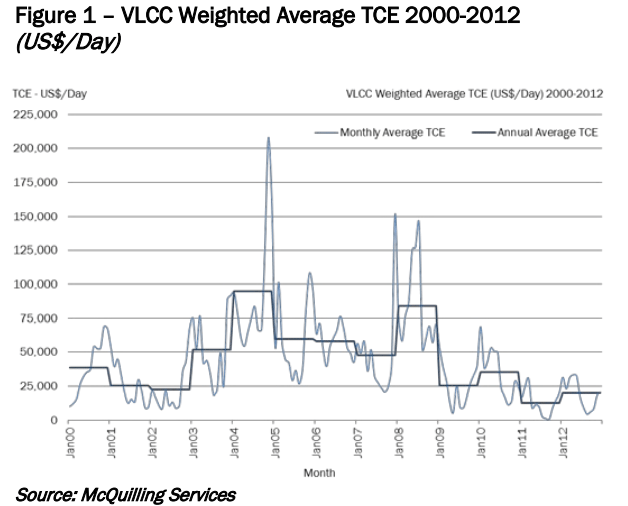

To understand the impact of an accelerated exit profile, we first focused on the VLCC sector where we analyzed historical TCE revenues over the period 2000 through 2012. As illustrated in Figure 1, this timeframe contained a fair amount of volatility in freight rates.

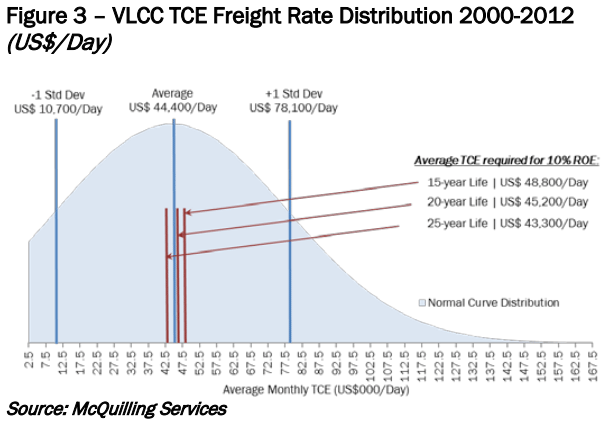

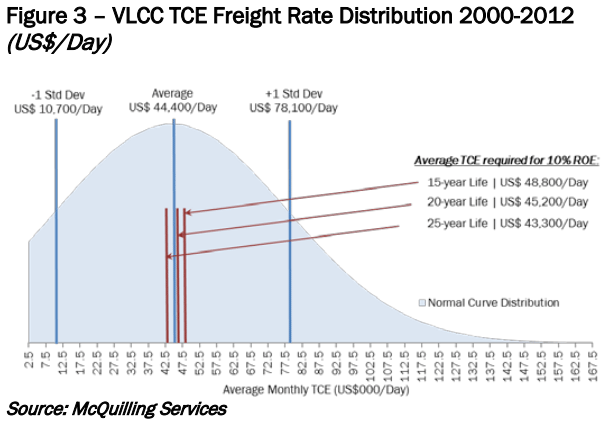

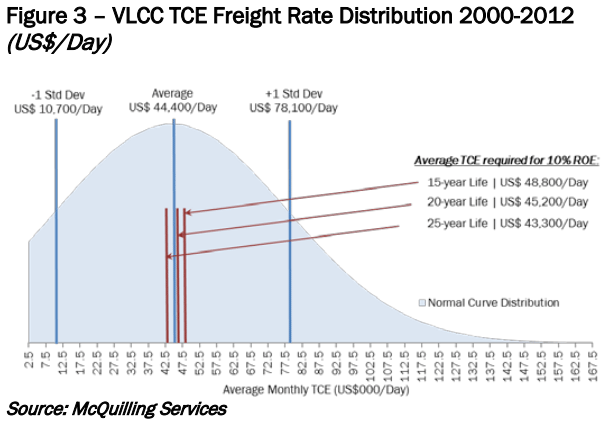

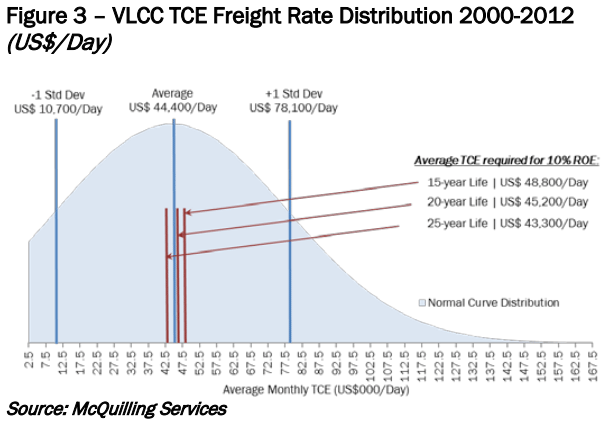

Under the assumption that VLCC freight rate behavior during 2000-2012, while volatile, was reasonably well behaved, we fit the data into a normal distribution, which yielded an average TCE for the period 2000 through 2012 of US $44,400/day and a standard deviation of US $33,700/day. This is shown in Figure 2 where the dark blue bars display the frequency of occurrence in number of months of an average TCE level and the light blue area is the mathematical normal or bell curve corresponding to this frequency distribution.

We speculated that, on average, and barring extraordinary events, future behavior of the VLCC freight market might also be described by this normal distribution.

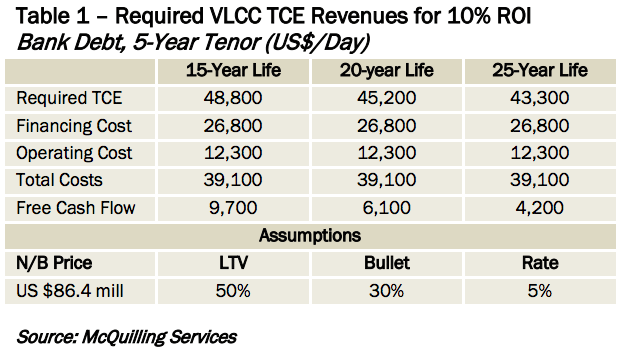

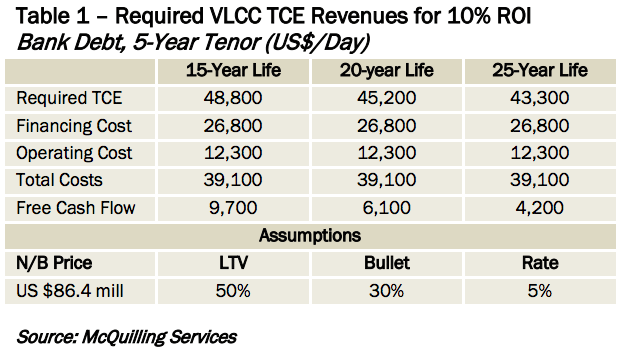

Then, we looked at the life cycle economics of a newbuilding vessel ordered at today’s prices with today’s financing terms (simple bank loan, 5-year tenor), and traded for 15 years, 20 years and 25 years before being sold for scrap in each case at today’s scrap prices. From this information we calculated the average time charter equivalent (TCE) revenues required in each case to return 10% on an owner’s investment (Table 1).

Figure 3 is interesting from a number of different perspectives. First, the light blue shaded area reveals the wide range of values that could be estimated based on the 2000-2012 dataset. This range translates statistically into a relatively large standard deviation which can loosely be interpreted to mean that we are unable to place much utility in the average TCE of US $44,400/day being representative for the period in question.

If indeed the distribution may also reflect future VLCC behavior (certainly not a guarantee), we would expect to see a large variation around the average value going forward as well.

Given this expectation of observing a large variation of TCEs in the marketplace, the relative difference in required TCEs for the various VLCC lifespan assumptions appears quite small in comparison. The US $5,500/day difference between the required TCE of a VLCC traded for 15 years and one traded for 25 years is immaterial as compared to the expected variation that will be observed in the marketplace over the life of the vessel. The explanation for this lies in the effect of discounting the cash flows over time. The cash flows in the later years of the project make far less contribution that those in the early years. As a result, the economic impact of shortening the vessel’s life is not as severe as might be expected yet the potential for substantially different TCEs than required during these years is high.

On this basis, once could argue that an early scrapping strategy widely employed could substantially improve market fundamentals at little expected cost to the owners.

Of course, the above comparison is theoretical.

In practice, owners are looking at today’s (and tomorrow’s) market and trying to maximize their free cash flows from operations to generate returns on their investments. Each voyage on an existing vessel with positive cash flow contributes beneficially to the bottom line. Additional years of trading, especially on paid-off vessels, can be quite lucrative in healthy markets.

The problem at present however, is that the markets are not healthy, and in fact, many participants see this as a kind of emergency situation. Perhaps a justification to follow instincts and head for the exit deserves closer scrutiny.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,953 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,953 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up