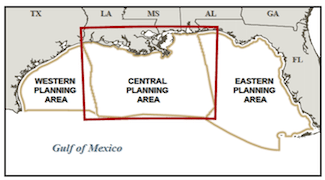

Lease Sale 216/222 focused on the central planning area of the U.S. Gulf of Mexico. Image: BOEM

HOUSTON–U.S. Interior Secretary Ken Salazar said Wednesday that the first lease sale in the central U.S. Gulf of Mexico since the Deepwater Horizon oil spill drew $1.7 billion in winning bids from energy companies.

The central area of the Gulf is considered the most promising by the oil and gas industry, and has yielded a huge bounty of oil in the past two decades. It is also where in 2010, a well blow-out destroyed the Deepwater Horizon rig, killed 11 and unleashed the largest offshore spill in U.S. history.

The high demand for drilling leases in the central region underscores both its potential and the eagerness of oil and gas companies to ramp up activities in the area after months of acrimonious exchanges with U.S. authorities over tough revisions of drilling regulations.

The sum of winning bids is the fourth largest raised in a lease sale for the central Gulf, which includes waters off the coast of Louisiana, Mississippi and western Alabama. It is also the largest amount in bids in a sale held after the Deepwater Horizon incident. In December, a lease sale in the less developed western part of the Gulf raised $337 million.

Mr. Salazar, who called the sale “record-breaking,” said the interest is “proof positive” that the oil and gas industry is confident it can meet new drilling rules put in place following the 2010 accident.

“The Gulf of Mexico is a crown jewel for oil production,” Mr. Salazar said, adding that the total bids indicate that “this is the right place to be.”

Norway’s Statoil ASA (STO) offered the highest single bid, $157 million, for a block in the Mississippi Canyon area, Salazar said. Anglo-Dutch oil giant Royal Dutch Shell Plc (RDSA) submitted the highest total value of bids, $406.5 million.

If fully developed, the U.S. government estimates that the leases for sale could result in the production of up to 1 billion barrels of oil and 4 trillion cubic feet of natural gas.

At Wednesday’s lease sale, 56 companies made 593 bids on 454 blocks. There were 7,250 blocks up for lease, comprising 39 million acres.

Several environmental groups filed suit in federal court seeking to block Wednesday’s sale, including Oceana, the Center for Biological Diversity, Defenders of Wildlife and the Southern Environmental Law Center.

“It’s premature to increase drilling in the Gulf before we know how much damage has already been done to the ecosystem,” said Jacqueline Savitz, vice president for North America at Oceana. “The big question remains–can endangered species like sea turtles, and commercially important ones like Bluefin tuna, handle more drilling?”

Since 1954, the U.S. government has conducted 112 offshore lease sales, including Wednesday’s sale.

The record bid for a U.S. Gulf of Mexico lease came in 1973 when a consortium of Mobil Oil Corp, Champlin Petroleum Co. and Exxon Corp. bid $212 million for a block off the Alabama coast. But entering the winning bid hardly guarantees a big payout for companies. That particular block, known as Destin Dome 162, came up with seven dry holes drilled by the companies.

In another instance, in the 1960s, Texaco Inc. spent more than $280 million on acreage that turned out to be light on oil but heavy with natural gas, which at the time was less desirable to exploration and production companies.

Another firm, Pennzoil Co., was unable to develop all of the acres it successfully bid on in the early 1970s, leading the company to sell the leases or bring in partners to develop them.

Copyright © 2012 Dow Jones & Company, Inc.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club