Iranian Ship Linked to Houthi Attacks Heads Home Amid Tensions

(Bloomberg) — An Iranian ship that’s been linked to Houthi attacks in the Red Sea is returning home, removing a prominent asset in the area as the Islamic Republic braces...

“‘Realpolitik’ is once again in vogue,” says Henriksen. “Fragmentation and polarization seem more prominent than continued globalization. A territorial and aggressive Russia is met with sanctions from the West, China is converting its economic might into global influence, a war-weary USA is on the retreat, and the EU countries are preoccupied with fixing problems at home.”

With the exception of the United States which has been buoyed by the shale boom, “there is little drive in the major growth economies, and down-side risk dominates the outlook,” says Henriksen.

“In Greece, two-thirds of young people are without work, in Spain over half. Apathy and hopelessness, together with falling tax incomes and higher public fees, are the inevitable consequences.

Adding to this is the large and growing gap in income and wealth.

Wages have stagnated or are declining in many countries. In the US, new jobs pay, on average, 23 percent less than those lost during the financial crisis. Today, the richest one percent of the world population controls half of all global assets and the gap continues to widen.”

Mediterranean and eastern European countries are meanwhile facing the largest displacement of people since World War II, largely from the dozen or so countries that were destabilized during the Arab Spring uprisings that began at the end of 2010.

For the commercial shipping sector, this enormous humanitarian crisis has landed directly on the deck plates of their ships. In 2014, some 42,000 migrants were rescued by merchant vessels, 5,000 of which were by Norwegian-owned vessels.

Amidst all of this, a few sectors are moving forward, namely the tanker industry which has been supported by low oil prices which have fueled the growth in shipments to and from refineries and oil storage facilities around the world.

Hidden behind today’s strong tanker market is the underlying issue of Iraq. In the IEA’s World Energy Outlook (WEO) 2014, oil production from Iraq and the rest of the Middle East is predicted to account for most of the expected 14 million barrel per day increase in global oil demand up to 2040. Meanwhile, Iraq is currently the second most violent country in the world behind Syria.

“Iraq is set to play a critical role in the global oil markets, a country which is going through very difficult times today,” commented Fatih Birol, IEA’s chief economist, during the WEO 2014 presentation in Oslo this past November.

Looking ahead, global oil demand is expected to rise from 90 million barrels per day to 104 million by 2040, according to the IEA, while gas demand grows by more than half.

While low oil prices support one sector, they are devastating the offshore sector. The NSA reports that more than three out of four offshore services ship owners and half of offshore contractors anticipate weaker operating results in 2015 due to slashed capital expenditures by energy majors.

“This situation is unlikely to prevail,” says the NSA.

The outlook for both the Norwegian and global rig market is bleak, and situation will get worse as we move towards 2016. The supply is greatly outstripping demand, a situation that is aggravated with the delivery of several new AoC-units to the Norwegian continental shelf. As a consequence, day rates for rigs are expected to decrease further.

This situation will intensify in 2016, when a larger proportion of the fleet will go off contract compared to 2015.

The number of mobile offshore units that will be stacked in 2015 is expected to more than double from 6 to 13 units, the NSA says.

The finance sector, a.k.a. the throttle that fuels brilliant or perhaps reckless moves by ship owners, is becoming a far more challenging place these days. The following is a survey by the NSA detailing the situation.

Despite all the negativity, there is actually more it seems.

The NSA notes the world’s free market is being hindered by protectionist policies that have become a trend as a result of the fallout of the current geopolitical crisis. In particular, The Association of Southeast Asian Nations (ASEAN) is supporting the establishment of the RCEP (Regional Comprehensive Economic Partnership) which includes the ten ASEAN member states and its Free Trade Agreement Partners (Australia, China, India, Japan, the Republic of Korea and New Zealand). On the other side of the coin is the Trans-Pacific Partnership (TPP) between 12 Pacific Rim countries and the Trans-Atlantic Trade and Investment Partnership (TTIP) between the EU and US – neither of which include China.

Collectively, the TPP and TTIP affect 70 percent of world trade in goods and services according to the WEF Global Agenda Council on Trade & Foreign Direct Investment, but they also exclude some 160 countries and 80 percent of the global population

Wang Yong, director for the Centre of Economic Policy Research at Peking University in China “The launch of mega-regional FTA [Free Trade Agreements], especially the TPP and TTIP, has caused wide concerns, said Wang. – Developing countries are worried that they will be left outside the mainstream of the global economy. As some analysts argue, the global economy may be fragmented and break into two separate blocs.

Two out of three Norwegian shipowners polled by the NSA believe that increased protectionism and stricter sanctions against Russia are the biggest barriers to growth.

Not all governments are crawling into a protectionist shell however.

CNN’s Fareed Zakaria was interviewed by the the FT’s Valeria Criscione on behalf of the NSA and he notes,

“Two of the three largest Asian countries – India and Indonesia – have elected governments pushing for reform; Japan’s pro-growth Prime Minister wants to break with 20 years of stagnation; and Africa is much more economically vibrant,” he says.

Policy forms one of the key pillars for growth and growth comes in the form of more domestic ship owners and seafarers.

“Shipping companies and their owners, in their never-ending quest for better and more efficient solutions, are the engine that drives Norway’s maritime industry,” the NSA says. “Seafarers are the central conveyers of experience and knowledge from sea to land, and between companies on the mainland.”

“Without Norwegian shipowners, the maritime industry would lack its most important drivers of innovation and development.”

Implementation in 1996 of a competitive special tax system for shipping companies, the tonnage tax regime, proved critical in achieving strong fleet growth. The regime was adjusted in 2007, and the past years have seen the number of ships in the regime grow by nearly 80 percent, now numbering more than 1,450 vessels. In this respect, the tonnage tax regime has not only been a success, but has become necessary in order to sustain Norway’s attractiveness as a host country for shipowners and other maritime business. Maintaining the competitiveness of the Norwegian tonnage tax regime is therefore critical to keeping Norway attractive as a host country for maritime activities.

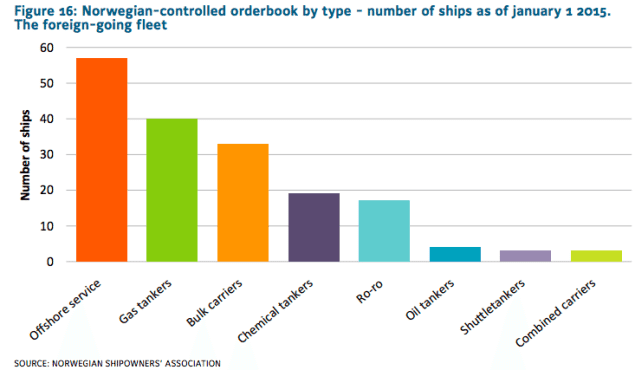

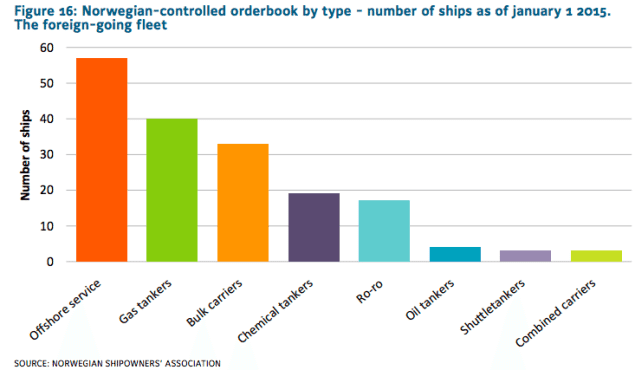

Norway’s political attention to the maritime sector has certainly paid off as it boasts the world’s 6th largest shipping fleet measured in market value and its 110,000 employees contribute to a value creation of NOK 175 billion annually. In addition, 176 new ships are currently on order by Norwegian ship owners, the majority of which are not destined for the offshore sector.

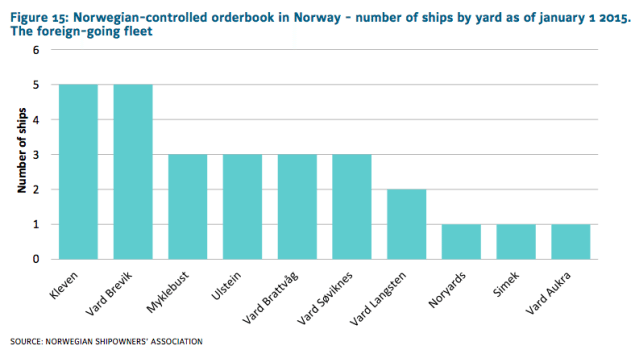

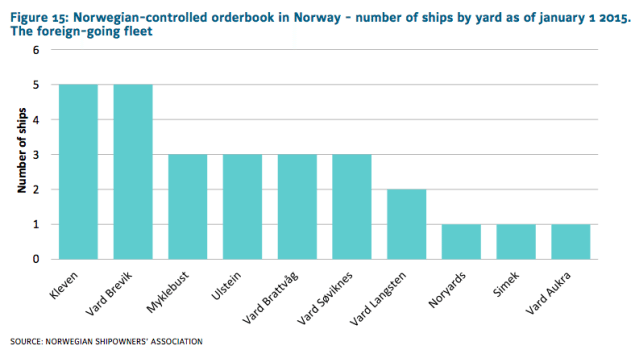

Not all policies are perfect however, as only 15 percent of the new ships on order will be built by Norwegian yards. Chinese yards have won the most orders at 32 percent followed by South Korea at 24 percent. The NSA also notes the country’s current ownership tax is not competitive and that it undermines private ownership and competitiveness of Norwegian shipping. 92 percent of Norwegian shipowners state that reduced rates in equity taxes are more important than larger rebates.

The NSA’s research into their own sector and macro overview of the geopolitics that have directly impacted the maritime industry provides an insightful look at the global economic picture, however whether it be the external geopolitical forces between countries that shape world trade, or the internal forces that enable the growth of a domestic maritime industry, the central hub around which everything pivots appears to be policy.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,944 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,944 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up