IMF Sees Slow and Steady Growth of Global Economy

By David Lawder WASHINGTON, April 16 (Reuters) – The global economy is set for another year of slow but steady growth, the International Monetary Fund said on Tuesday, with U.S. strength pushing...

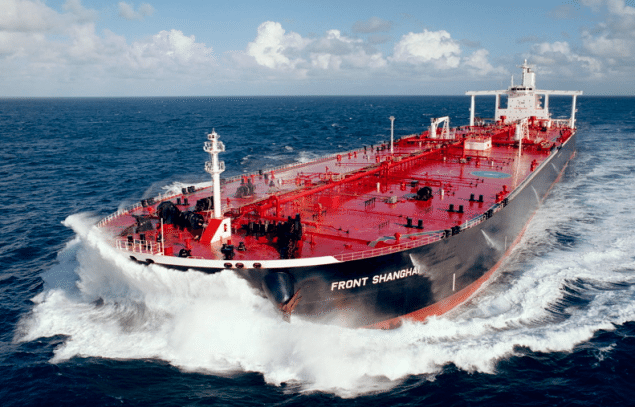

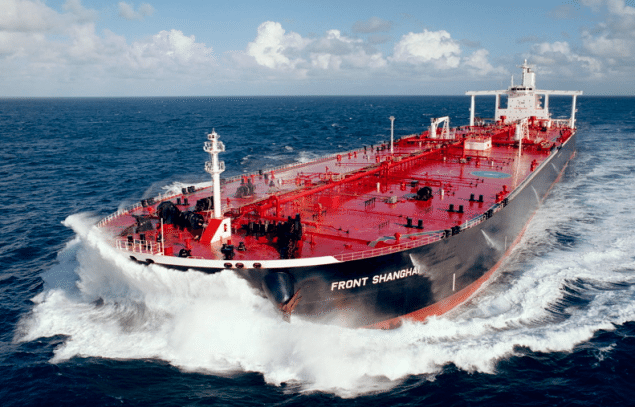

John Fredriksen, the world’s biggest tanker owner.

By Rob Sheridan

(Bloomberg) — Frontline 2012 Ltd., the shipping company led by billionaire John Fredriksen, almost doubled the number of vessels it’s building at a time when the maritime industry is contending with record low earnings and a glut.

Orders for new ships increased to 53, from 28 at the end of last year, the Hamilton, Bermuda-based owner said in a statement today. While the market is “massively oversupplied” in some cases, Frontline 2012 placed orders for fuel-efficient carriers after construction prices slumped, it said.

Read: John Fredriksen: The Man, the Myth, the Legend

The ClarkSea shipping index, a measure of vessel earnings across the industry, averaged $8,284 a day in February, its lowest on record, according to Clarkson Plc, the world’s largest shipbroker. Rates will start to recover in three years and Frontline 2012 is ordering vessels to carry crude, refined products, liquefied petroleum gas, coal and iron ore, it said.

“It is the shipping company you want to own as we move through the trough of the shipping cycle,” Erik Nikolai Stavseth, an analyst at Arctic Securities ASA, said in an e- mailed note today. The owner will place more orders, he said.

Frontline climbed 2.6 percent to 39 kroner as of 1:24 p.m. in Oslo trading. Frontline 2012 will list in New York in 10 to 16 months, according to the statement.

“The company is currently in the process of concluding one of the most aggressive newbuilding programs ever executed,” Frontline 2012 said. Most of the new carriers will be profitable at rates where “existing tonnage barely covers operating costs,” it said.

Supertanker Surplus

An oversupply of supertankers competing for 2 million- barrel cargoes of Persian Gulf oil is poised to decline over the next 30 days, according to a Bloomberg News survey today.

There will be 17.5 percent more very large crude carriers available in the Persian Gulf over the next 30 days than there will be probable cargoes, the median estimate of six owners and shipbrokers showed. That’s 2.5 percentage points fewer than last week and the smallest excess since Jan. 8.

The surplus of tankers expanded to the biggest since 2011 during the first week of March. Bookings had plunged following the longest series of production cuts in four years by the Organization of the Petroleum Exporting Countries, which supplies about 40 percent of the world’s oil.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,912 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,912 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up