Iranian Ship Linked to Houthi Attacks Heads Home Amid Tensions

(Bloomberg) — An Iranian ship that’s been linked to Houthi attacks in the Red Sea is returning home, removing a prominent asset in the area as the Islamic Republic braces...

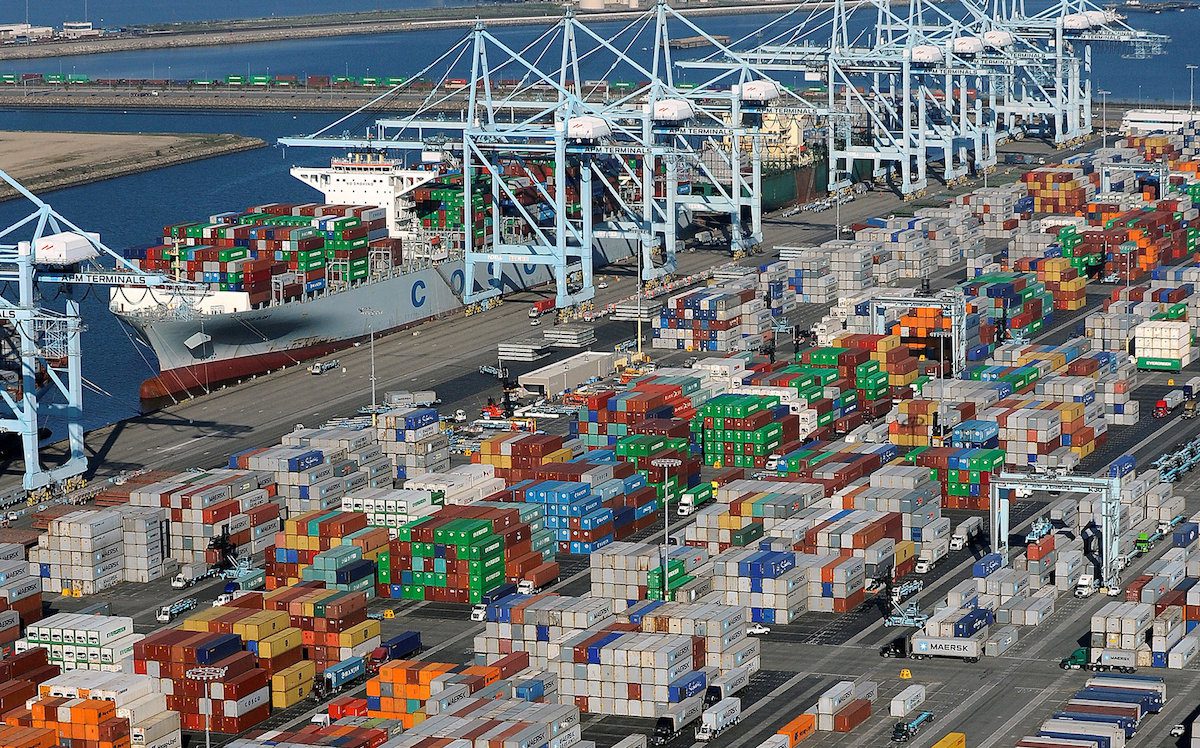

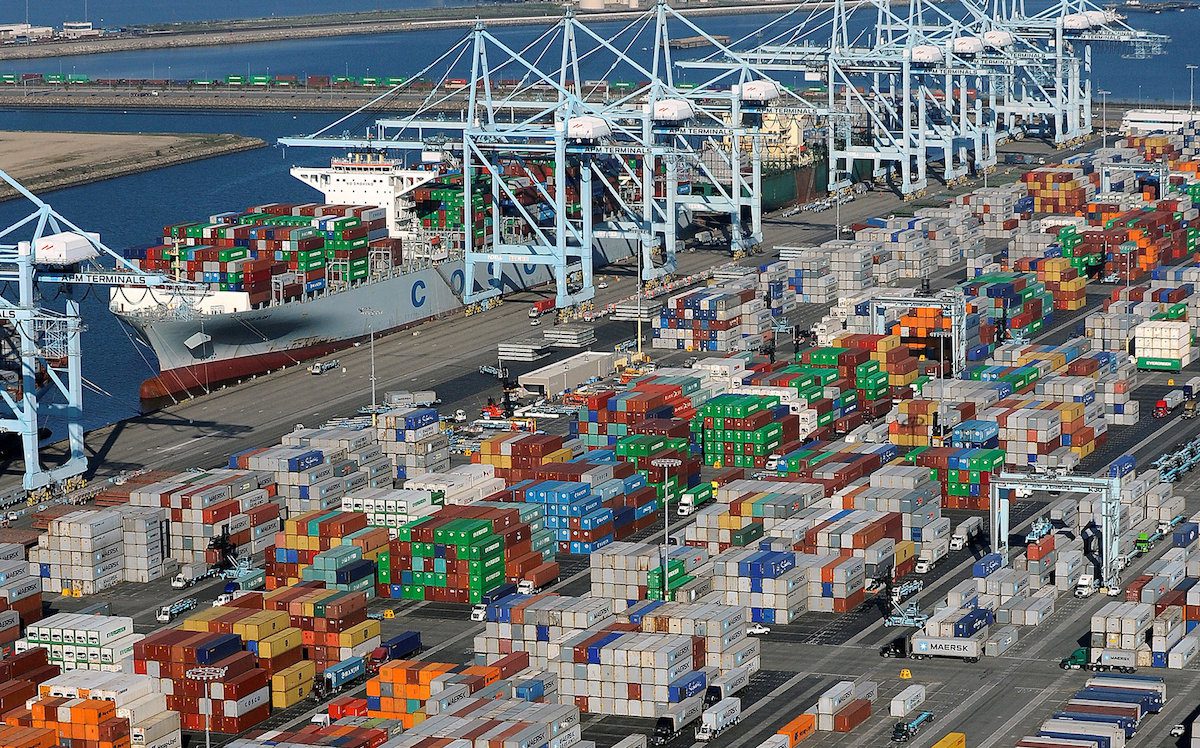

FILE PHOTO: Shipping containers sit at the ports of Los Angeles and Long Beach, California, U.S. on February 6, 2015. REUTERS/Bob Riha, Jr./File Photo

The shipping industry should be able to manage the U.S.-China tariffs tit-for-tat, but risks an all-out trade war, which would be bad for shipping, are rising, Fitch Ratings said Wednesday.

The container sector and, to some extent, the dry bulk sector would probably be the shipping segments most affected by the recently announced US and China tariffs, according to Fitch Ratings. However, the degree of impact will depend on the final terms of the tariffs, and the potential flexibility of shipping companies to divert some volumes to other destinations and the ultimate tonne-mile demand, Fitch said.

For shipping companies, the direct impact of the tariffs and an escalating trade war will also depend on their exposure to the trans-Pacific trade, Fitch said.

The US recently announced potential tariffs on steel and aluminium imports. Subsequently, it proposed an additional duty of 25% on certain products imported from China, including medicaments, machinery and chemicals, with a total value of about USD50 billion. In response, China proposed a 25% tariff on a range of imported products from the US including soybeans, chemicals and selected aircraft.

“The immediate impact of potential tariffs may be manageable for both container and dry-bulk shipping,” Fitch said in a statement. “Some of the goods under the proposed tariffs are likely to continue to be imported by the US or China due to the limited substitutes. Some of the volumes could be diverted to other countries, potentially affecting distances travelled and putting tonne-mile demand in focus. The proposed value of about USD50 billion of goods subject to tariffs accounts for only about 10% of US imports from China and slightly over 2% of China’s total merchandise exports. In addition, soybeans and steel represent a limited share of the dry-bulk shipping market.”

Fitch Ratings’ statement added:

“The direct impact on the companies will also depend on their exposure to trans-Pacific trades. Container shipping companies are global and tend to be diversified by trading lanes. The top five companies, including Maersk Line, Hapag-Lloyd and COSCO, have manageable exposure to US-Asia trades. However, smaller ones, mostly Asian container shipping companies, including Yang Ming, Evergreen and OOIL, have large exposure to trans-Pacific trades of around 40%.

“The key risk to shipping is if protectionist measures escalate into a trade war damaging the prospects for global trade and GDP growth. Global trade growth is an important stimulator of demand in container shipping, while China remains the key driver for dry-bulk commodity imports and trade.

“We believe the supply side is key to achieving the supply-demand balance and a long-term sustainable recovery in the sector, but further slowdown in volume growth in the short term may put further pressure on freight rates. Volume growth has moderated for both container and dry-bulk shipping in recent years. This again emphasises the necessity of prudent capacity management in the sector, which has been plagued by overcapacity.”

The IMF expects global trade growth to reach 4.6% in 2018, which should support container transport volumes growth of over 4.5% in 2018, according to Fitch.

“However, supply growth has increased since 2016 and is likely to accelerate to over 5.5% in 2018, again exceeding demand growth,” Fitch added. “We expect supply-demand fundamentals to be better in dry bulk, with a moderate expected increase in dry-bulk volumes of 2.7% in 2018 coupled with low vessel supply growth at 1.2%, which should provide support for dry bulk freight rates,” it said.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,982 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,982 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up